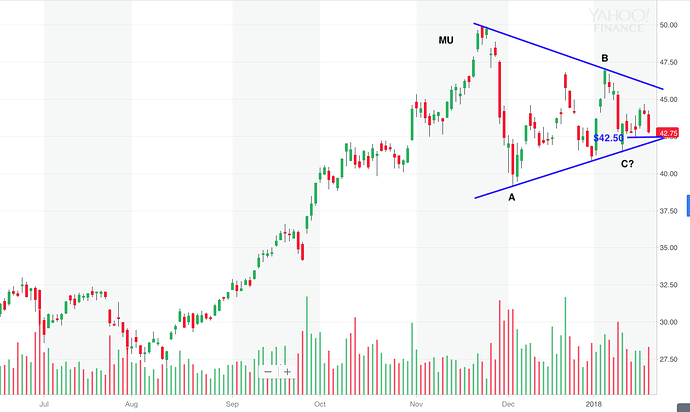

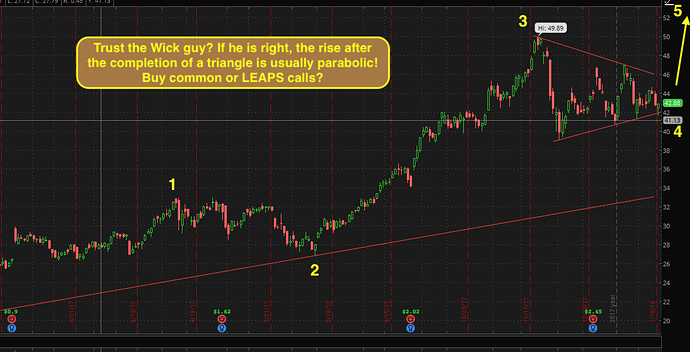

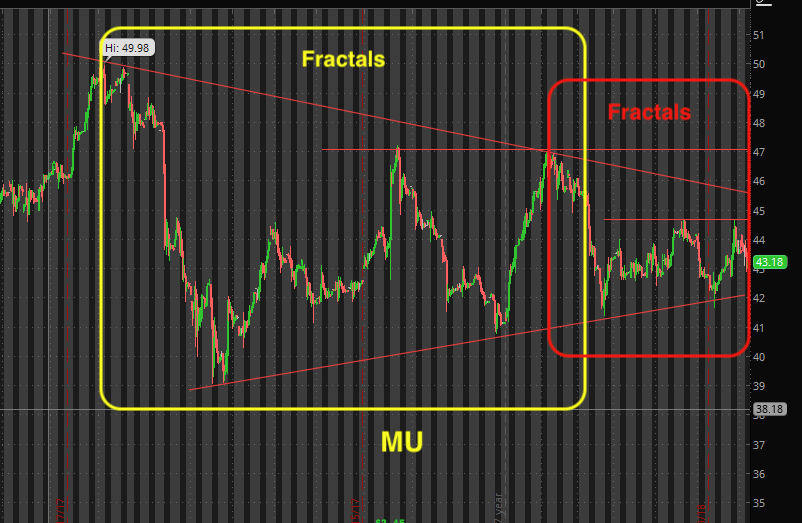

Can easily draw it as a triangle ![]()

Amazon nailed it. In the .com days, the mantra was “get the eyeballs, and the money will follow”. Google and Facebook won, with the bulk of eyeballs going to facebook/google a few times a day. The next phase is “get the voice, and the money will follow”. Who will win?

Honestly I have never heard of him. But what he said is almost word for word the same as Eddie Tam.

This Eddie Tam?

https://som.yale.edu/news/news/alumni-profile-eddie-tam-93-ceo-central-asset-investments

Right.

“If you are really good at what you’re doing, you will come to an intersection point whereby you have enough capital to launch your own venture,” he said.

Tam is a good market timer.

Central asset investments is a 3 person company. How much is their asset under management? With his track record, why don’t you guys move some of your networth for him to manage?

Since its inception, Tam said Central Asset Investments has averaged over 32% annualized return.

Inception in 2005, no idea which month of 2005. Did he manage similar return from 2011 to 2018?

From Jan 23 2005 to Jan 22 2018,

Annualized return of:

AAPL 32.01% (exclude dividends)

AMZN 30.27%

NVDA 30.77%

GOOG 21.14%

NFLX 46.02%

He can help you avoid negative returns during recession, which is huge.

Also he almost matches AAPL return with a diversified portfolio.

And lastly he pays no capital gains tax in HongKong, so he can trade freely for you.

Btw, since Singapore charges no capital gains tax, if you trade stocks in a Singapore account, do you need to pay US capital gains tax for each trade? If yes, you can go to Tam and his fund’s trading won’t progpagate to you. That’s the same as 401k tax deferral, right?

Intel had a blowout quarter, while my Lam and Xilinx got slaughtered.

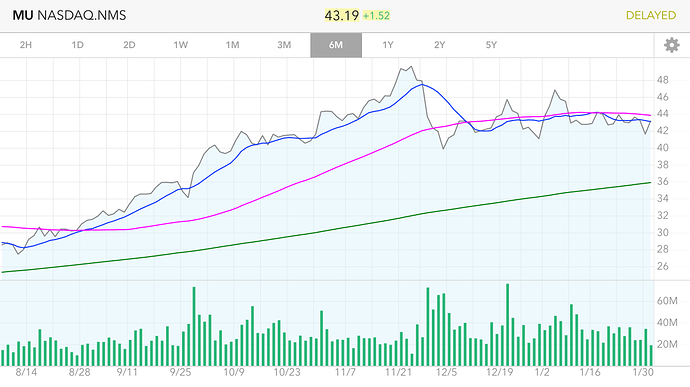

Micron is one of the leading worldwide providers of semiconductor memory solutions. The company’s memory solutions are marketed towards customers in a variety of industries, including computer manufacturing, consumer electronics, and telecommunications. Shares of Micron are up over 85% within the past year, and the stock is one of Wall Street’s most talked about.

This is owed directly to the company’s incredible growth rates on the top and bottom lines. In fact, our current consensus estimates are calling for triple-digit EPS growth and 60% sales growth this quarter. Meanwhile, estimates for the full fiscal year, which ends in August, are calling for EPS growth of 98% and revenue growth of 37%.

Micron’s earnings are expected to improve at an annualized rate of 10% over the next three to five years, but the stock currently has a Zacks Rank #1 (Strong Buy), so investors might want to buy into that growth right now.

MU needs to prove to people the old cycles don’t apply anymore. If and when they do, their stock will get rerated and multiple expanded. I feel that the bearish sentiments have more or less reflected in the price already.

MU started to run?

FOMO purchased 5 calls.

Was selling puts, aka earning peanuts instead of eating bacons.

MU is consolidating.

Was. Still is?

What do you think?