OMG, my bad memory…it is lulu. Too old…for all those now…hi hi hi hi…

Too fast for my verticals and calendars to make much money… yes, manch, I don’t follow my own advice. If I have bought as naked calls, 150-200% in just under 2 days. Luckily I do have 10 Jul calls that have more than 200% gain.

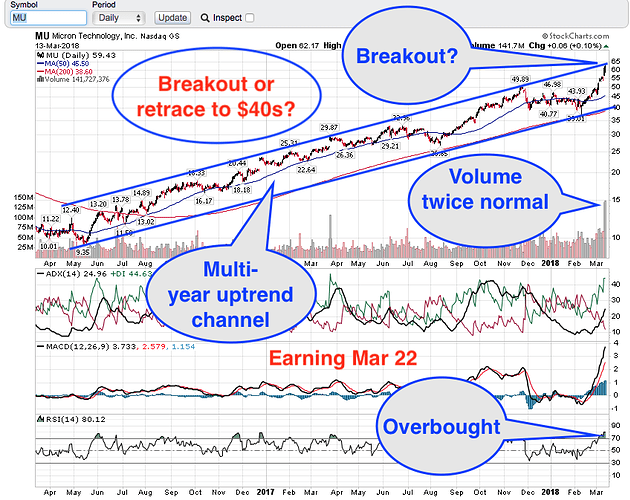

I like that chart. Definitely says buy from a technical perspective.

Excitement building towards earnings on Mar 22.

Position too small.

Position too small.

How big do you want me to gamble?

Make $5000 per week = $260k per year… higher than a fresh grad working in Google ![]()

Equivalent to holding $5.2 million worth of rental with cap rate of 5% ![]()

Whatever you are doing right now, just multiply by 10x. That should be your initial money down.

Whatever you are doing right now, just multiply by 10x. That should be your initial money down.

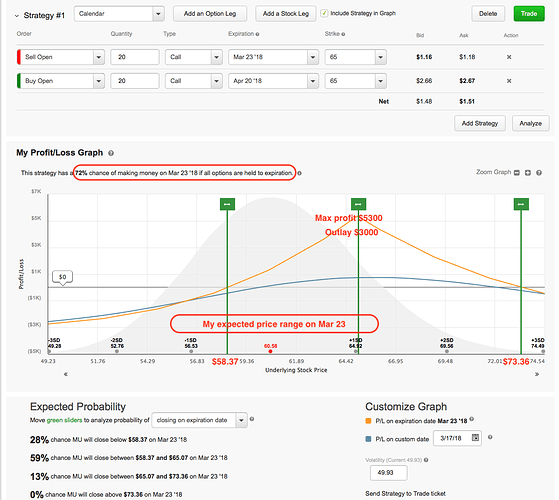

Under pressure from you guys, have already increased gamble from $500-$2000 to $3k ![]()

You guys don’t let up on me ![]()

That’s an interesting trade. I like it.

You don’t think micron can get to 65 next week? Why not go naked?

You don’t think micron can get to 65 next week? Why not go naked?

That’s extra ![]() If it gets near to $65 before earning, would close the calendar for lesser profit.

If it gets near to $65 before earning, would close the calendar for lesser profit.

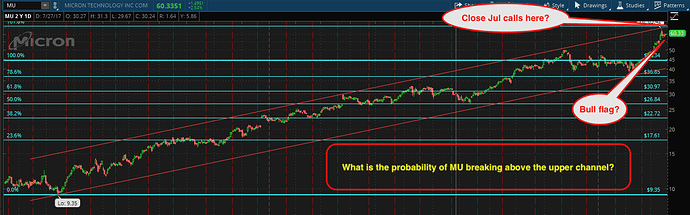

Holding 10 Jul calls ![]() which is really too few

which is really too few ![]() Good for bragging in % term, 200+% gain

Good for bragging in % term, 200+% gain ![]()

That’s an interesting trade.

72% chance of successful, pretty good odds ![]()

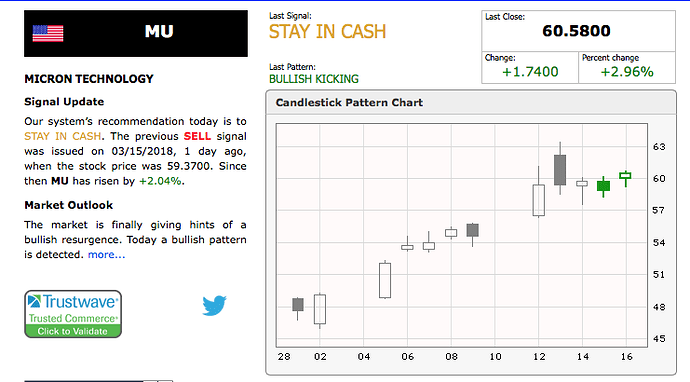

Luke Lango said Buy Micron Technology, Inc. Stock on this Dip, But Don’t Hold It Forever. His fair value for MU in 2018 is $50 and in 2019 is $68. If what he said is true, I won’t sell till it passes $65, 36% gain in a year is very good appreciation. Btw, MU closed at $60.58 last Friday, guess is time to close all position? Definitely closed all short term position, what about the 10 Jul calls?

Who is lango? Trading god?

Looking from the perspective of someone holding 10 calls (Jul $42), should I STC the position?

Technically if MU is not able to break above the upper channel, it would retrace to low $40s which would destroy the calls. Holding underlying is not an issue. Of course, any option position with shorter expiry should be closed. The hesitation is with Jul calls. Any ideas what to do?

Who is lango? Trading god?

Lango is still talking the old narratives:

The industry is inherently cyclical. While demand usually just goes up (with some exceptions), the market consistently cycles between eras of under-supply and over-supply. When supply is low, suppliers like MU have pricing power. Consequently, prices go up, margins explode higher and profits are huge.

Anyway, who’s this guy? Is he a taking head with no skin in the game or did he follow his advice and short the crap out of MU? Is he billionaire?

manch,

Have you read enough of the option bible to have an intelligent discussion about option position?

MU is the only one out of the 8 counters that I am investing that has high enough liquidity to trade options of amount $50-$100k frequently. The rest has too low liquidity, is why I do only 1-5 calls rather than 10-50 calls… in fact, for NTNX, VEEV and UBNT, suitable for underlying and LEAPS calls only… too hard to trade short-term options… may be sell some covered calls now and then, that’s about it.