Same: Content are given below.

Swelling supplies of apartment units are prompting big banks to pull back from new projects, forcing developers to scramble for capital, in a sign that the U.S. apartment industry headed for a downturn.

The apartment sector, which contributes some $284 billion to the economy annually, has been a winning bet for investors since the housing crash, as the economy recovered and more renters sought out units. Since 2010, average U.S. apartment rents have increased by 26%, according to data tracker MPF Research, a division of RealPage.

But fresh supply is beginning to overwhelm demand. More than 378,000 new apartments are expected to be completed in 2017, a 30-year high, according to real estate researcher Axiometrics Inc. In the fourth quarter of last year, 88,000 units were completed but only 50,000 of those were rented by tenants, according to MPF.

“Our business has radically changed,” said Toby Bozzuto, president and chief executive of the Bozzuto Group, which owns or manages 59,000 apartments in cities across the U.S. “I haven’t seen anything this seismically different since 2008, when credit dried up.”

Now banks are in retreat, forcing developers to look to nontraditional lenders and seek more expensive types of financing to complete projects, said apartment executives, industry analysts, mortgage brokers and bankers.

“We had fairly robust growth in our construction, real estate construction book, and that’s slowing now,” said P.W. Parker, chief risk officer of Minneapolis-based U.S. Bancorp, during an earnings call last month. “Multifamily is an area that, if you look at the forecasts, there are forecasts pretty broad-based of potential rent declines in a lot of the major cities. So we’re being more cautious there.”

Executives at North Carolina-based BB&T Corp. and Pittsburgh-based PNC Financial Services Group Inc. in December said they, too, are being more conservative about apartment loans.

In congressional testimony last week, Federal Reserve Chairwoman Janet Yellen noted that banks have started pulling back from making commercial-real-estate loans, which could be a sign of “some reduction in appetite.”

Even builders with proven track records are getting smaller loans than they used to, said Peter Donovan, executive managing director of multifamily capital markets at real-estate brokerage CBRE. While a couple of years ago most could get loans for about 65% of the cost to build a project, today they are getting closer to 55%, said Mr. Donovan.

“We’re certainly seeing the pullback,” he said. “It was almost as if all the banks got the same memo.”

To fill the gap, developers are tapping more expensive sources of financing to get projects off the ground.

Commercial mortgage brokers said they are seeing an uptick in mezzanine loans, which carry higher interest rates than traditional loans. Brokers also see a rise in preferred equity, which also comes with higher payments than bank loans and therefore poses a greater risk to developers of losing projects if things go south.

Other developers are turning to smaller regional banks, such as Bank of the Ozarks Inc., which can command higher rates, according to Willy Walker, chief executive of Walker & Dunlop Inc., whose main business is making loans to apartment owners.

Bank of the Ozarks last month reported the total loans on its books had swelled to nearly $15 billion at the end of 2016, a 75% increase from the end of 2015, although some of the growth was through acquisitions.

Adding to the risk for developers: Even as loans get more expensive, rent growth is slowing. Last year, average U.S. apartment rents rose 3.8%, a significant drop from the recent high of 5.6% year-over-year growth posted in the third quarter of 2015, according to MPF.

Rents in major cities, such as San Francisco, New York, Houston and San Jose, Calif., all declined about 1% in 2016 from 2015 levels.

Developers and their investment partners will have to accept lower profits or bet on riskier projects with a bigger potential upside, said Conor Wagner, an analyst at real-estate research firm Green Street Advisors. “You’re getting more aggressive in your underwriting, assuming some sort of recovery.”

Essex Property Trust, a California-based publicly traded apartment owner and operator, said it is helping developers bridge financial gaps by lending up to 85% of the cost of a new project. The deals give Essex a seat at the table if it later wants to acquire a stake in the projects, said Chief Executive Mike Schall in an email. He added that the risks to Essex are low because it is able to charge high rates.

Deep-pocketed developers, meanwhile, are having to put more of their own capital into projects.

AvalonBay Communities Inc., one of the largest U.S. landlords, in 2015 purchased a site near Central Park in New York City for about $300 million, initially intending to sell the bottom portion of the building as a retail condo to help fund the construction, according to analysts.

But the company wasn’t able to find a buyer for the retail or a capital partner, so it will have to invest roughly $600 million in the project rather than the $340 million it planned. AvalonBay executives declined to comment.

The company has little choice but to move forward now that it has already paid a top price for the land, said Mr. Wagner of Green Street. "They can weather a storm that much easier than a local developer could, " he said.

Mr. Bozzuto said his 30-year-old family firm sees an opportunity to develop projects when others are pulling back, so that they are completed when the pendulum swings the other way. To make projects work, he is putting more of his company’s own money into deals.

In Baltimore, it expects to complete the first phase of a $130 million project this spring near Under Armour Inc.'s headquarters. The company and its partner, War Horse Cities, plan to embark on the second phase shortly afterward, which will feature smaller units at lower rents.

“I think there’s some white water coming, but isn’t the long game the name of real estate?” Mr. Bozzuto said.

–Rachel Louise Ensign and Katy Burne contributed to this article.

Write to Laura Kusisto at laura.kusisto@wsj.com

Add to it, some people being deported, plenty of supply for renters.

But no! Nothing will happen!

Now, will this be blamed on liberals too?

Again, aren’t we uniquely undersupplied with rental housing here in the Bay Area? Other parts of the country, yeah, probably can’t absorb that new supply quickly.

RE in SFBA is the first to climb and last to decline.

Since elsewhere is starting to decline, might be an early warning for SFBA RE investors/ landlords to sell or at least not buy. Still got some time before must make decision, the outskirts of SV are not falling yet.

Not exactly:

Come on, 1% is not sky is falling stuff esp the run-up owners have enjoyed over the years. And besides, that is just some average. Some Joes like me had the good fortune of renters actually leaving so brand new leases at higher decent rents.

Commercial RE might be overvalued. 2/3 of commercial loan is done by small banks. Fed has been warning about this.

Slowdown of commercial loan is good and it reduces the risk. Is this slowdown caused by the interest rate increase?

Commercial and residential RE can have different cycles.

Will the next financial crisis come from commercial loans and many small banks go bankrupt? I assume that these small banks are less important than big banks

No, not yet. But that looks like an inflection point where it changes from going up to going down.

In the end I agree we are mostly shielded.

Who’s having a hard time to lease now? And how many have tenants moving for better rent?

Rents are still going up in Sac, Stockton, South Lake Tahoe

My low end Sac rents are taking off. South Sac rents up to $1000/m from $850 for 2 bds. … Rent increases accelerating in low end… People have now where else to go

Rents skyrocketing in Tahoe. People leave and I jack rents 20%

They stay raise 5% annually

Data, data, data.

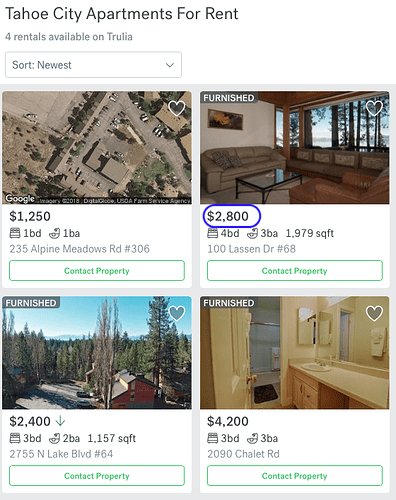

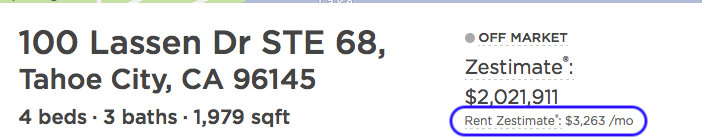

Asking $2800 whereas rent zestimate is $3263. At zestimate worth of $2.022 mil, the yield is less than 1.7%. What gives? High end condo can’t rent out?

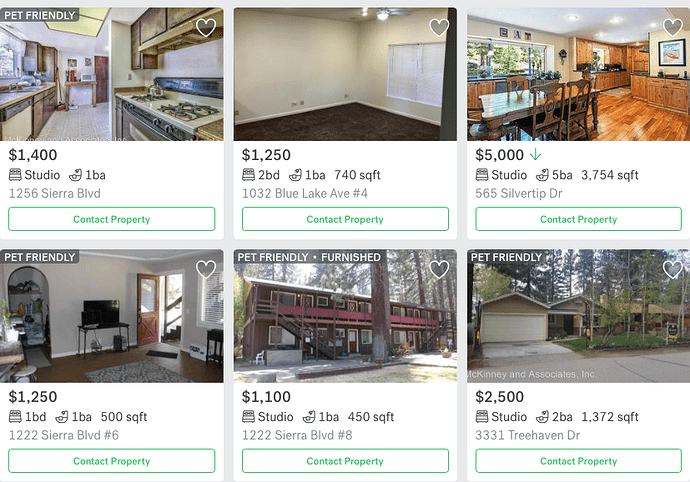

Money in apartments is in the low end. Nobody will pay more than $3000/m rent in Tahoe. Apartments go for $100k In five units and above buildings. Rents are $800-1000 for studios 1000-1400 for on bedrooms 1200-1800 for two bedrooms. 1800 -2500 or more for 3 bedrooms

Hard to find houses. But the sweet spot is under $400k

Preferably with a garage…

Data?? Craigslist only., Zillow is for losers.

Just rented two units by word of mouth.

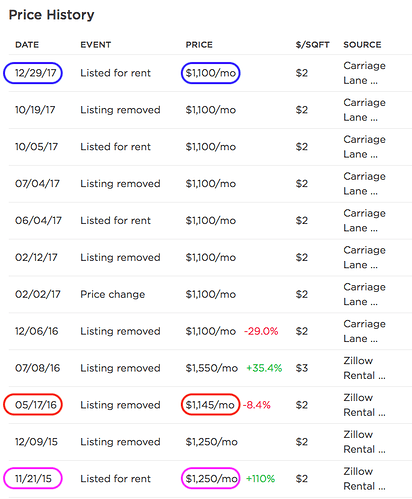

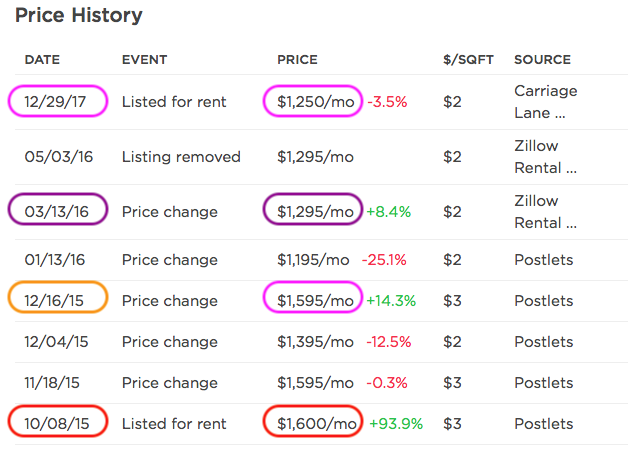

Craiglist doesn’t show past history. Zillow has the historical records. Clear downtrend since 2015.

Craigslist is a perfect picture of actual rents .

Do your own search, but there are O vacancies. I know my market and don’t have to prove anything to anybody

What you see is what you get. Someone who overprices a place on Zillow is a fool… Shows no facts about the real market. If you care about the Tahoe market call Coldwell , Tahoe Rents or Realtyworld.