With the $24k std deduction even the $500k deductible becomes almost neglible

Too many ads, but a good article on all the tax dodges that still exist after this bill.

https://www.forbes.com/sites/baldwin/2017/11/02/tax-dodges-for-rich-people-the-update/#6c397bfe310c

People will rent rather than buy? (in the short term)

Nothing to buy anyway

I bet there would be 10,000 more transactions per year in the BA if there was lower prices and higher inventory.

Huge pent up demand… A lot will go to the exburbs

Yes,I also feel the same. It encourages renting (with great standard deduction) than buying (big mortgage liability, job loss fear)

Again, these will be done by investors, but not likely primary owners!

Go Sacramento

Most houses are under $625k

Short Intuit!!!

I was curious, so I went through and added up all of the net effects of changes to marginal brackets. Here’s a table of the cumulative net effect at each bracket inflection point. Of course this is done without incorporating any of the other changes such as loss of state tax deduction, increase in standard deduction, or loss of personal exemption, etc:

Ignoring all of that listed above, here’s how your tax would relatively change if you earned exactly the amount listed. Obviously the amounts between of the listed inflection points would shift if you earn between those points:

$19,050 your tax bill would increase $381

$77,400 your tax bill would decrease $1369

$90,000 your tax bill would decrease $3007

$156,150 your tax bill would decrease $3007 (ie, no net reduction from $90k)

$237,950 your tax bill would decrease $5461

$260,000 your tax bill would decrease $7225

$424,950 your tax bill would decrease $3926 (ie, less net reduction from 260K)

$480,000 your tax bill would decrease $3926 (ie, no net reduction from $424,950)

$1M your tax bill would decrease $27,843

above $1M multiply marginal amount by 4.6%+$27,843

Why don’t this news comes out earlier, rented out at 10% discount to last year rent ![]() after one month vacancy… and $10k painting, new draperies, electrical works, appliances upgrade, etc.

after one month vacancy… and $10k painting, new draperies, electrical works, appliances upgrade, etc.

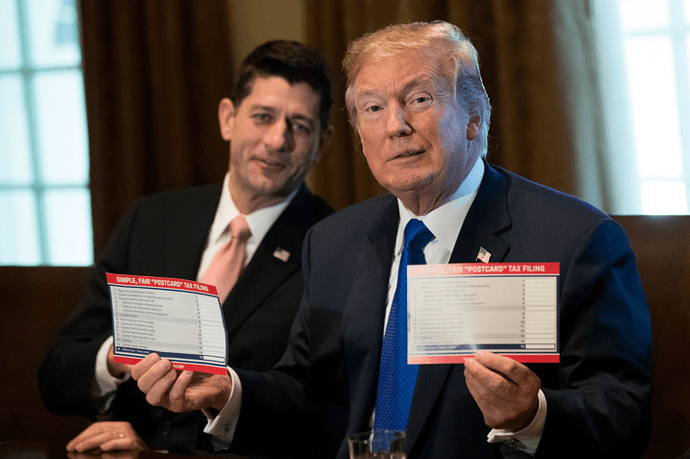

So, as a republican and very supportive of Twhitler would say, he uses graphics to support his dumb opinion, the poor is getting nothing.

And, as another dumb republican in government said, you can buy a new car with the savings you will get with this tax reform. ![]()

![]()

![]()

![]()

![]()

![]()

I think I am going to put that bridge I own somewhere for sale.

Is that for single or married? I’m guessing single, since a married couple’s standard deduction would be $24k, so the $19K would have zero tax bill under the new system vs. whatever they pay today. Kids make it more complicated, since they are proposing increasing the credit.

These are the married numbers but do not in any way reflect inclusion of any deduction. So that $19,505 number really starts after the first $24k of income. That said, you’re right the standard deduction would increase from $12,700 to $24,000, but that also ignores the loss of the personal exemption of $4150 per person which would no longer be a deduction. So really the change for a family w/o children is $3000 from $21k to $24k. With children it gets worse since each kid will lose net $4150, but that will be offset by an increase in the child tax credit. Caveat tho, that tax credit will not be available to everybody. Haven’t looked at the particulars but currently it can only be taken if AGI is below $75K for single/head of household, $110K for married, then phases out $50 per $1000 income.

Don’t the numbers depend on deductions you might lose

Don’t the numbers depend on deductions you might lose

Well, of course. That’s why I said I didn’t factor any of it in. I can’t. I don’t have any idea which deductions you are going to be losing or not losing. If you’re a standard deduction filer, things got better for you. If not, well who knows? You’ll have to work the numbers.

If you are in a high tax state you lose… In Nevada you win… already have my escape plan

That’s always been a winning game plan since Nevada of course is a zero tax state (only 6 of those). Still, you’ll do better moving to Alaska so you can get a rebate. The other way to go if you can make it work is to simply not have income. Put your money into Berkshire which doesn’t pay a dividend. Only cash in below the standard deduction except once every X years.

OH…no, no no! Somebody here told me that once “they don’t pay dividends” is a no no no no! ![]()

![]()

![]()

![]()

Any family making more than $200K is currently in AMT which makes state and property taxes non-deductible. Since the new plan allows $10k property tax deduction for all, isn’t the loss in mortgage interest deduction offset by that?