OMG, HQ2 is coming!!! HQ2 is coming!!!

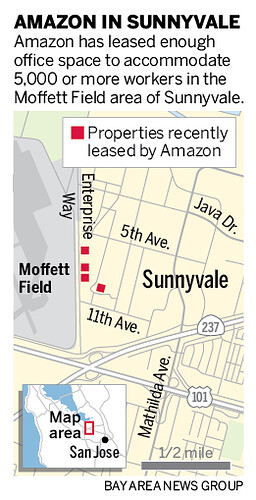

At this pace it doesn’t really matter if we got HQ2 or not.

Google is buying too.

Can we say “SFHs in the 3M range” boys and girls???

More on Google in Sunnyvale…

Wow, that’s in additional to Google’s plans for 20,000 downtown SJ.

I swear the Seattle buildings are moving at a snails pace. It appears they’ll have underground parking and digging that out took forever.

This is why when people ask about where to buy in SV specifically I say ANYWHERE you can find a relatively decent deal with multi units to get maximum cash flow. SFHs are just too expensive or would require a sig amount of cash to be remotely cash positive (so who wants to really do that?).

Isn’t it hard to get something that cash flows well at current prices? I think that’s why most people aren’t buying more investment properties right now. The current valuation and cash flow just don’t make sense to acquire more properties right now. It’s better to wait for an opportunity. It sucks to have cash not invested, but that’s better than buying at a bad valuation that might jeopardize you later.

The best way to do it is probably convert primary home to a rental and buy a new primary. If you can do that every few years then you’ll keep acquiring more rentals. By delaying renting it from the purchase, you should be closer to break even cash flow once you start renting it. The key is to buy something affordable enough you can save for the next down payment. That’s getting more difficult as prices get higher.

Agreed, especially SFHs though. One would be crazy to buy a SFH in SV with the idea of renting it out and hoping you will make money cash flow wise. Now, sure, there is the appreciation angle right? You park your money into a piece of property that with remodeling could garner a decent return (flipping). More units may mean more headaches but no one ever said it was going to be easy…

Yeah, I feel that buying a negative cash flow rental and hoping for appreciation is the equivalent of buying stock on margin. Except the margin rate could be a lot higher than it is for stocks.

I see you didn’t mention condos and townhouses.

For living here with all the congestion, high prices of restaurants, etc, we hate it, but we also own a rental property in SVL near all of this and for that, we are happy. Like a two sided coin.

Well, I have to accept that if that is the price point one can afford so be it. It wouldn’t be my choice.

Congestion? Don’t feel it at all. Guess, depends where you live and frequent. Wrt to US$, inflation in SV is higher than national. However, wrt to share price of any F10, deflationary prices.

Approx. where do you live Hanera and how long have you lived here? We’ve lived here for over 40 years in the middle of it all, and our town is getting slammed. People who live have had it with all the congestion through regular streets by commuters.

The BA is quickly becoming unlivable…especially for those of us who remember the 50s and 60s BA

What keeps me here are excellent medical care, 3 Japanese markets, 1 Korean market closeby, our older, but liveable home, close to airports, and good growing (veggie, herb, fruit) conditions.

Isn’t weather up there for you???

I like the weather here, but prefer more humidity for me. But, nothing is perfect.