Enter at the wrong time, buy n hold means holding dead money. One has to outlive that period to benefit ![]()

I draw a different conclusion. One must not be afraid to enter after stock already made 2 or 3x run. Many will tell you you are already too late. Ignore those people.

I’m impressed by that comment!

Many conclusions can be drawn, your conclusion is not exactly related to what I was illustrating ![]()

Can you outlive or willing to hold on to those stocks for the 10-20 years sideways?

Judging from your posts, you keeps jumping around FOMOly.

Well, we already know that @manch is not the buy and hold type. The only long term buy and hold people on this forum are me and you.

Longer than you since I’m older than you.

That’s my point. Don’t hold during the sideway years. Buy after the breakout. In Apples case buying in 2005 is better than waiting for Jesus during the sideway years.

Or 2007 after you are absolutely certain the breakout is real with the iPhone.

There are three failed breakout  e.g. year 2000

e.g. year 2000

Right. So there needs to be follow up actions to increase or decrease bets over time. Everyone got hurt in dot com. Unavoidable.

Holding through 2001 or 2008 downturn needs stronger mindset. Frankly, I do not have. It is too hard to hold seeing portfolio going down!!!

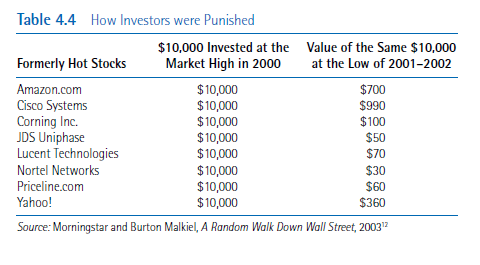

See what happened.

I’ve designed my portfolio to withstand a 65% plunge. It is more conservative than the list of dot com companies you have above so it will not go down that far. I use margin heavily so a more conservative approach would be prudent.

It is very difficult to “Conquer the Enemy in the Mirror” ! I have to overcome that !!

We shall see what happens… if I had to give in to the pressure by selling I would be very disappointed with myself.

Depends on stocks, margin requirements might increase. Instead of 1 for 1, might drop to only 80cents for $1. Brokerages are fond of doing that in a bear or volatile market.

Well, you got to take some risks there. Everything in this world is a tradeoff. You can only go furthur if you are willing to walk the extra mile.