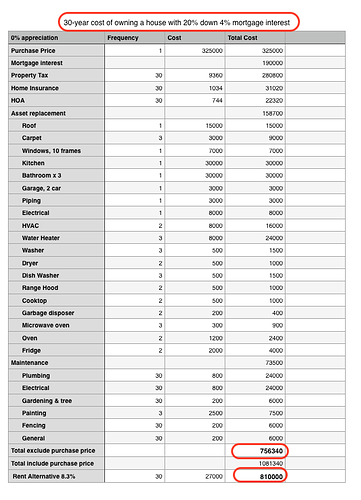

Refer to table below, for a family that has the necessary 20% downpayment and afford to borrow a 30 year mortgage with 4%, is it better for him to buy or rent (in Austin of course ![]() house price = $325k).

house price = $325k).

Assuming zero appreciation of house, hence also assume other costs like property tax, home insurance and HOA doesn’t change, and money if not put into downpayment & monthly PI is also earning zero interest/ return.

At the end of 30 years, renter pays more rent ($810k) than incurring all those costs ($756k). Both obviously would end up with the house, if you say is not, you’re not following the computation. Feel free to suggest changes to the costs (frequency, cost and missing items). I meant to prove both Harriet and manch wrong but guess they are intuitively correct. Anyone want to prove them wrong?

For non-zero appreciation of house and non-zero return of investment, we need to know which one is higher,

Appreciation of the $325k house vs Investment of downpayment + monthly PI. Obviously, the latter need to be at higher return than RE.