I thought you were up 9% a few days ago. A 20% fluctuation within a week? Too much volatility.

No. From down 9 to down 13.

Oh… that makes sense.

Buy Real Estate and sleep at night…otherwise you are up at 2am worried about the stock market…something that which you have absolutely no control over…

The problem is not stock market, he is using excessive margin. I have no problem sleeping at night with a stock portfolio that is likely bigger than manch’s. I have no margin. I don’t even bother to monitor AAPLs.

If your portfolio is big and you bought years ago then it doesn’t matter…As far as margin…thats a young man’s game…Not ever going to sleep at night with margin calls waiting…

Not only margin issue, but options additional pressure as options are volatile, high risk, high reward side. Options work best when stocks are going up, but some options won’t work when it is going down.

You AAPL, wuqijun’s FB or TSLA are frozen forever unless they go to bankruptcy stage…

Option is margin  and amplifies change, obvious? All stocks are volatile now, any leverage would amplify that volatility.

and amplifies change, obvious? All stocks are volatile now, any leverage would amplify that volatility.

The good thing about stocks is that you don’t have a pissed tenant threatening to sue you like it is with real estate. You hold all the cards when it comes to the law and you can sue the companies that did you wrong.

Any not so smart guy out there?

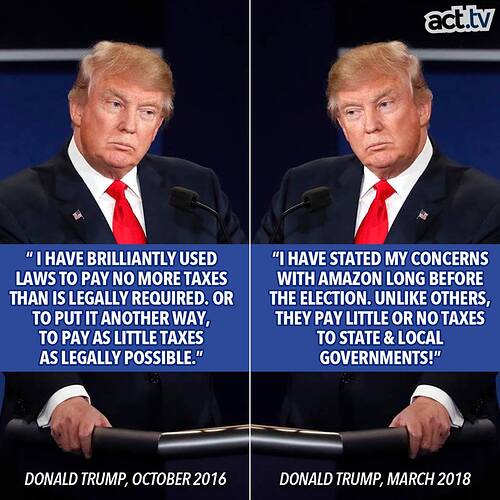

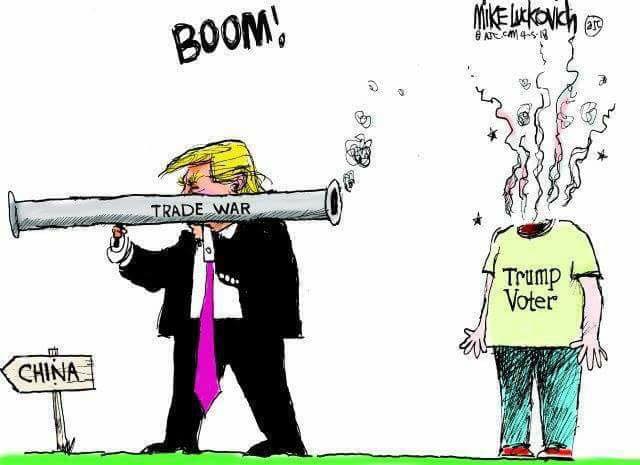

“All of which has dented Trump’s reputation as the stock market president.”

No ideal investment hence mixed ![]()

The turmoil has damaged Trump’s ranking when it comes to equity returns. The Dow Jones Industrial Average’s 32 percent rally during his first year gave him the third-best start by a president going back more than 100 years. But tack on the turmoil since January and he drops to the middle of the pack, behind former Presidents Barack Obama, Bill Clinton and George H.W. Bush.

Who are going to sue for the 13% drop. Trump?

Stocks are passive investments. I doubt an individual can achieve any satisfaction with a lawsuit. I am like you I buy stocks for the long term. Not going to sweat this years volatility. In fact just using it for a buying opportunity. Need to lighten my work load. Plan to sell real estate assets slowly over the next 20 years and convert to stocks, trust deeds and syndicate deals.

Everybody listen up!!! If even @Elt1 is planning to convert RE into stocks, you know which side you should be on in this stock or real estate debate.

In other words, those in stocks now are the front runners😀

Stocks are for lazy investors. I am getting old and lazy. For you youngsters ,RE is the best way to control your financial destiny. Even if a tenant threatens a lawsuit. Besides tenants are usually too poor to carry through with a suit.

There are predatory lawyers, recall 3 families harassing the female landlord in SF for a couple of millions?

Afraid of lawsuits, move out of state . We are surrounded by lawyers. Even my own sister. My first lawsuit was when I was nine. My family was sued by a neighbor.

Just become rich enough to be able to hire lawyers like Trump does.

Peter Thiel said you don’t have any rights in America until have 10m in your pocket. Be rich enough to hire good lawyers.

Then only deal with people with less than 10m in their pockets. If you also have less than 10m then you’re on equal footing with them. If you have more then you have rights and they don’t, which is even better.