If someone wants to choose, here are the 50 dividend companies

AAPL,ABBV,ADP,AFL,APD,BA,BMY,CB,CL,CSCO,

DIS,DOV,DPS,DPZ,ED,GILD,GLW,HAS,HD,HON,

HRL,INTC,ITW,JNJ,JPM,KMB,LMT,LOW,MCD,MDT,

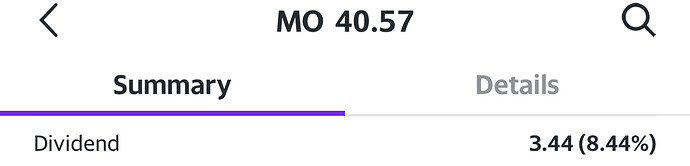

MKC,MMM,MO,MSFT,PAYX,PEP,PFE,PG,PM,PPG,

RTN,SBUX,SYF,TROW,TRV,UNP,UTX,VFC,WFC,WM