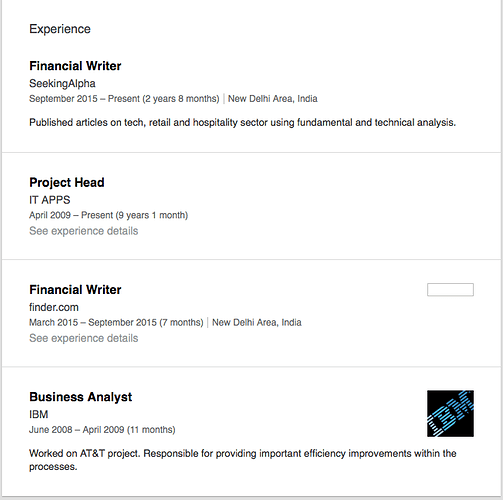

Past performance is no indication of future perfotmance…Will Appl grow 6 times in 10 years?

Friend, if AMZN reaches first, then it beats AAPL right? So meet up. Or you mean have to be both AMZN and FB more than AAPL’s? You want to be nice to me? If AAPL reaches first, then no meet up, that is understood right ![]() ?

?

Apple Found a Wall Street Narrative

After months of iPhone sales estimates being slashed by analysts, expectations have been reset. The iPhone mega upgrade cycle of 2018 that so many were calling for is not going to happen. One assumes such a reset would have been accompanied by a significant decline in Apple’s stock price. Instead, Apple shares have outperformed the market and continue to trade near all-time highs. The resiliency in Apple’s stock price reflects the company finally finding a narrative on Wall Street, and it’s not centered on the iPhone. Apple has become a capital allocation story.

Instead of iPhone sales or Apple Services revenue gaining importance, Apple’s balance sheet strategy is driving the company’s new Wall Street narrative.

There are three core tenets to Apple’s capital allocation narrative:

Superb cash flow generation. Apple’s business model predisposes the company to superior cash flow generation. Apple is able to monetize premium experiences more effectively and efficiently than anyone else. Instead of chasing scale, Apple sells tools that management think people will want and are willing to pay for. Scale ends up being merely a byproduct of a successful strategy. Apple is generating more than $60 billion of operating cash flow per year.

Capital efficiency. Apple’s business model is remarkably efficient in terms of the amount of capital required to generate these cash flows. Instead of owning a complex web of factories, Apple has built a network of third-party suppliers and assemblers that are second to none. In addition, the company remains focused when it comes to funding capital expenditures for organic growth. As a result of these actions, Apple reports more free cash flow than Alphabet, Facebook, and Amazon combined.

Returning excess capital to shareholders. Given such strong free cash flow generation, Apple is kicking off more cash than management needs to fund growth opportunities. Instead of sitting on the excess cash or spending the cash on unattractive projects, management has shown the willingness to return excess cash to shareholders via share repurchases and quarterly cash dividends.

I am a nice guy. We can do both amazon and Facebook.

Aapl took a big hit today

WB is waiting.

Investors (Big banks, financial institutions, hedge funds) are bringing down one sector to another sector. As I expected, they move out of highly appreciated stocks to bonds or cash so that they can be back at low point.

因人廢言?

Disregard the message because of the messenger?

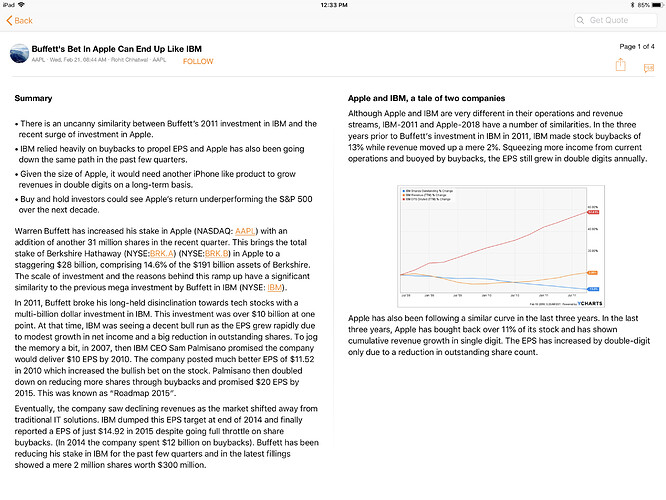

You might want to find out what WS thinks about IBM first.

I’m reading it now. Did he know about what WS thinks of IBM? I wanted to stop when he compares with IBM because he might not know what WS thinks of IBM… very bad comments by many WS pundits… WS laughed at WB investment in a business that is financial engineering its results…but since you insist, I read on.

WB’s intent is the same as everybody else’s: to make money. I think we can just focus on the likely result, that is whether AAPL will deliver good total return: appreciation of stock price + dividend.

Nobody knows for sure. We are all just guessing. I just think the guy sums up my own bear case pretty well.

Guessing is the wrong choice of word. Educated judge calls.

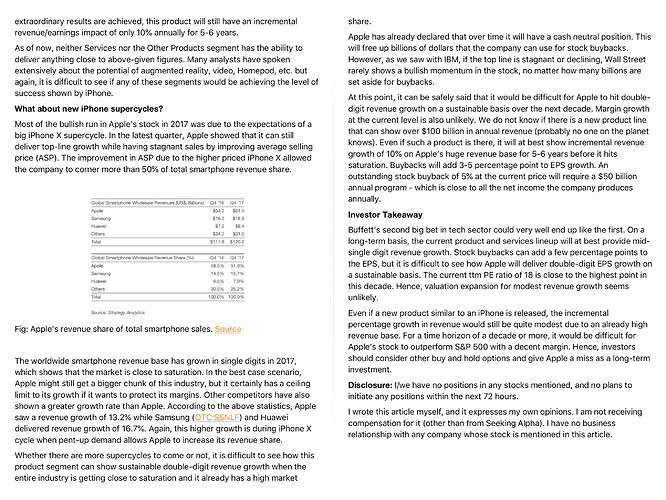

First define what is meant by good total return. If you mean high growth like those of 10x stocks, definitely no way. What about the historical annualized return of S&P of 7-11% for the next decade? How hard can that be?

Annualized return since,

Apr 2012 = 13.65%

Apr 2013 = 25.14%

Apr 2014 = 21.56%

Apr 2015 = 10.36%

Apr 2016 = 27.54%

Apr 2017= 18.33%

So far so good. Of course, past performance is no guaranteed of future results.

Do you own due diligence and make the educated judgement calls as to whether can still return 7-11% if you invest on Monday ![]()

Btw, don’t impose the decision of one who didn’t own any shares to one who’ve held the shares because the considerations is not the same. I have to point out this explicitly because I realize many bloggers’ comments seem to ignore the difference.

Beware of the endowment bias. Difference should be zero after adjusting for long term cap tax. Anything extra is purely psychological.

Are you implying WB only aims for return same as S&P?

The key sentence is here.

This is just an article, not a profound research. I can blindly say AAPL will meet Tim Cook last quarterly foretasted figures.

There are plenty of forecast software they (CEO team) run using various products, regions and finally declare the forecast. IMO, CEOs team used to review those figures to actual results on daily, weekly and monthly basis. That is the main reason, they are put in insider (who knows company financials).

No big company, like AAPL, fails to meet the forecast unless economy tanks.

The brighter side for AAPL is tax reduction (Increased profit), changes in supply chain (increases profit) - there are (will be) supply chain changes happening re-routing shipments to get max benefit from US tax and tariff changes.

IMO, You should not be concerned too much what WB is trying do.

His decision is one among the factors, but do you individually feel AAPL is worth buy or hold or sell, that really matters.

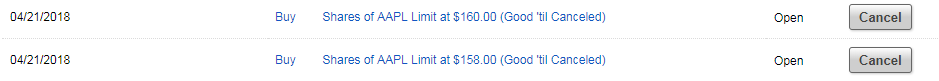

I am confident AAPL is going to spike after results, trying to speculatively buy at 158 and 160 (if it hits that figure).

Having done some research for AAPL, I am tempted to Speculative trade AAPL now. I have just try to buy trade (GTC) at $160 (confident to pick) and $158 (in case AAPL falls this range, pick 150% of $160 pick)

This is pure speculative as I may sell AAPL any time later (wuqijun to note - not necessarily holding long)

IMO, You should not be bother too much what WB is trying do.

I don’t put much weight into what WB does. But since you guys seem to be, I want to make sure your reasoning is consistent.

Beware of the endowment bias. Difference should be zero after adjusting for long term cap tax. Anything extra is purely psychological.

I was mentioning one aspect. The other is you need to find another place to park the proceedings.