I was about update the same “As of year-end, WB owned some 57 million shares, up from 15 million shares in the third quarter. That stake was worth approximately $6.6 billion as of December 31.”

Is the investment done by WB? Or those younger guys working for him?

Some of Bekrshire’s other investments are pretty out of character for WB. Monsanto? Sirius XM? Airlines that he has badmouthed for decades? What’s going on here?!

From what I know each of the wonder kids have $9 B to invest, and if more than $1B for a counter/ ticker, need his approval. Since at the point of disclosure, the total investment in AAPL is $6.6 B, not sure from one of the two or both two, it doesn’t matter, WB has to give the green light because $6.6B is more than $1B or $2B combined.

JIL,

What is the point you’re making? There are many hedge funds, they buy and exit often, and many do take opposite position. Are you suggesting that these are the guys that we should be following?

Btw, do you know why WB think Airlines are good? Is he thinking that oil price is a secular decline or there would be a surge in tourism?

On Monday he ate through one Apple. But he was still hungry!

And as far as Apple’s competitive position – this one has a moat for the ages. Once you buy an iPhone (and humans around the world have bought over a billion of them so far), you become locked into the Apple ecosystem for almost all of your devices and services. Think cloud access, iTunes purchases, the App Store, etc.

Services is a great business, a fact that is becoming more apparent every quarter. Apple’s services business is growing at approximately 20% a year, to $24 billion in calendar 2016. To put that number into perspective, McDonald’s does $24 billion in revenue per year – Apple’s services biz is now the same size as the largest restaurant chain on earth.

And Apple users are kind of sort of compelled to stick with the ecosystem, unlike the fierce competition faced by McDonald’s every time even its most loyal customers drive by a Taco Bell or see a Burger King ad. It may have one of the most impressive moats in the history of technology, right up there with what Microsoft had in the 90’s and Google and Facebook are currently enjoying today. This is rare for a “consumer electronics” company, which is what Buffett has always been wary of.

Apple’s moat is a thing of beauty. Hell, take a look at it’s brand new headquarters building, soon to be completed – the whole f***ing thing is shaped like a moat!

I guess it is following the ‘cup and handle’ pattern after all. They are opening 2 more R&D centers in China (to gain favor with govt and also to become more fine-tuned to the local market, since sales are slipping):

http://www.cnbc.com/2017/03/17/apple-china-two-more-research-centers-as-challenges-continue.html

Oh my gad! I’ve been waiting for a red phone!

Jinxed. Drop below $140 upon above posts.

Hey, do not doubt the power of the pen…err, keyboard

Up more than $3 or 2+%… a new ATH… Same for RE in Sunnyvale/ Cupertino soon.

I get it, but how would it really be different if I got a Samsung phone instead or a Motorola phone?

https://www.dailydot.com/debug/undercover-student-apple-iphone-factory/

My cousin worked at a chip assembly factory doing QA in southern China. He was on the line before that. This work is not glamorous but it was still much better than farming! He also said the wages and perks have been going up since the turnover was getting higher and higher. Most people didn’t want to work in a factory. They rather make less and do a service job since it looks and sounds more glamorous.

Come on, when was the last time you saw or heard of a poor plumber?

God, really, Tim??? Pimping that pathetic Watch now???

Oh ok, Tim needs to push that Watch to fund that future commitment…

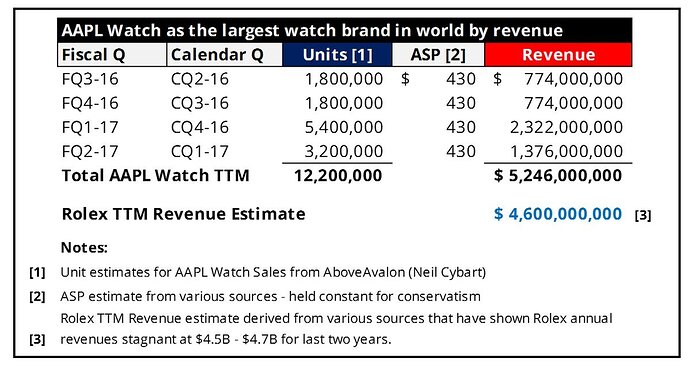

Apple watch has a rev run rate of 5B. Hardly a failure.

In comparison, Tesla does 7B of business a year and worth 50B in market cap.

I bet the watch is far more profitable too

For most companies, above $1B revenue products are blockbuster hits.

WS holds Apple at a higher standard, at least $10B revenue, so Apple is a product company by that definition.