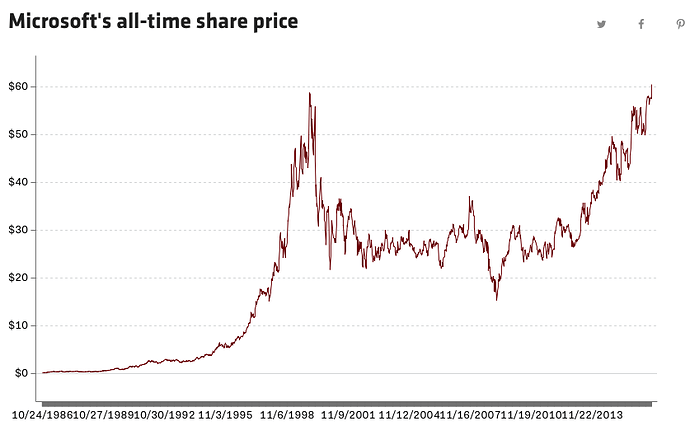

Microsoft’s stock price reached an all-time high today, beating a previous record set in 1999 (!) in the heat of the dot-com bubble. Shares opened this morning at $60.31 — up 5 percent from yesterday’s close — and reached $60.45 in morning trading before settling.

Broke even after 15 years…There were a lot better places to have your money in the meantime

If someone wants to grow their money, look out

- NVDA

- UBNT

- STZ

- WVVI

These are hints, do your own research for long hold. WVVI is very tiny company, but grew from $2 (2009) to $8 (2016). IMO, it may continue to grow like STZ in coming years. STZ has lot of Napa Breweries.

If you want to further research on what stocks, read this one and research further. Lot of stocks are discussed here, avoid the stocks people suggested not to invest, but research the new stocks people suggested

Not many people know UBNT. I think they are a buyout target with the new home products. The founder still owns 70%, so nothing happens without his approval. That also keeps the float small and minimizes the downside. I’ve been debating playing their earnings announcement with options. I sold my initial position.

True, that includes me.

Even though I drive through north first street, I missed investing this company as I did not research properly. This year,based on amazon feedback, I purchased ubiquity access point for my home. Easy to install, wide area coverage, not a single wireless disconnect ! There after, I followed this company, learnt CEO is ex-Apple executive. In recent meeting with another competitor company VP, he was casually pointing that Ubiquiti captures more market and more products.

Having good quality products (Almost all 4.5* in Amazon), like Apple products, make this company better in the long run. Above all, they are competitive, in price, with other sellers.

Then, I realized that this stock is 60% Up YTD !

I am reading the Intelligent Investor book by Benjamin Graham. One thing that really resonates with me is that he insisted on investing in large, well established companies. Looking back at my own investing history, that’s a lesson I keep forgetting. Job #1 for investors is to NOT lose money. It’s much easier to lose money on small or mid cap stocks than large ones.

Not to loose money is mandatory for investment.

Very large company, like Apple, Google and Amazon is for training ground to learn investment strategy, but growth is limited now.

Intelligent Investor has to identify these large companies, Apple, Google and Amazon, 10 or 15 years before when they are small cap or mid-cap !

Take my example, I choose two companies

- STZ

- WVVI

STZ is 33B, mostly napa related wineries growing steady. Low risk, high cap.

WVVI is 40M, very tiny company. The wineries are Willamette Valley Vineyard, Oregon based company. They were growing from $2 (in 2009) to now $8. Still they are tiny and high risk. My Assumption is economy is growing next 10 years. If my assumption is right, Oregon based wine company will grow faster - as the land value is cheaper - as they were able to get the market last 7 years.

While Apple grew 1000% in last 10 years, this company WVVI grew 400% in last 7 years.

I just try to explain what is my thought process. Forum viewers, it is your risk to invest or not to invest, Do not trust my words 100%. You do your own research.

I Still need to do research and I am not 100% perfect. I make mistakes and some time sell at loss too.

I think he was an engineer not an exec. Apple turned down the idea, because the original product was a much more powerful power supply for WIFI to get a 5 mile range. That’s a game changer in developing countries who want to build out cell networks but running cables/fiber between towers is too expensive. There’s no real need for that with consumer products in the home. He maxed out his credit cards to start the company. That’s how he still owns 70%. He did one round of undisclosed financing, and he was pretty far along by then.

The new home stuff is not accurately reflected in the revenue and profit forecasts of wall street. I think they’d be an acquisition target for Nest/Google, Amazon, or someone else. The option premiums are cheap, so I’ll probably do that before earnings. That way downside is capped.

It’s hard to know all companies. There’s so many publicly traded ones. I run a filter to search for 13-week and 52-week highs of companies with a market cap over $500M. I use it as a starting point to see what to research.

As always, be careful. NVDA stock made a huge jump on the promise of increased revenues from new markets in deep learning. This was all promise/marketing/press. Time will tell whether or not they can deliver more $$$$. A PE of 45 is pretty expensive in our current low growth climate. Just my two cents.

True, A PE of 45 is pretty expensive

I have been watching it from $35, bought few times around $45…sold…bought, now holding for long.

NVDA Graphic card/Chipset has lot of demand on VR platforms, they supply to all automakers, including TESLA, I think GOOGLE, TOYOTA, FORD…etc. IIRC, they are unable to meet the demand.

As of now, I think NVDA is not going on hype as many really good people are scared to buy. As long as people are scared, I am fine to hold.

What’s with all these bald CEOs? Is it a style? Will I have to shave my head if I become a CEO?

I read a report on NVDA when it was around $60. This is not from famous analyst, but an experienced investor.

Nvidia’s foundation revenue stream is in its gaming-oriented PC GPU products. Despite diversification into other market segments, this product division remains the largest revenue-generator for Nvidia. Over the last six quarters, gaming-related products have accounted for more than 50% of sales revenue for the company. However, this relative share of revenue has declined as Nvidia has expanded into other product areas. Since their Q1 2016 report (4-26-2015), revenue streams from Datacenter and Automotive products have increased by 71.6% and 54.55% respectively. Nvidia also generates a significant portion of its revenues from Professional Visualization and OEM & IP products as well. Combined, these segments represent roughly 25% of Nvidia’s revenue. It is worth noting that over the last six quarters the revenue generated from OEM & IP products has declined 25.22% while the revenue from Professional Visualization products has increased by 18.2%

Regionally, Nvidia still derives most of its revenue from the Asia Pacific markets. In Q2 2017 (7-31-2016), revenue in the Asia Pacific region accounted for 66.67% of overall revenue. This is compared to 14.42% from the US, 11.69% from Europe, and 7.21% from Other Americas. There has been stable revenue growth from every region over the last six quarters, keeping in line with the growth in overall revenue. The largest regional growth can be seen in the Asia Pacific and United States regions, indicating improving consumer demand in both of these areas.

Having recognized the declines in relative revenue generation from video game segments, Nvidia has shifted their focus moving forward to larger-scale, more innovative market segments. At Nvidia’s GTC China 2017 presentation, CEO Jen-Hsun Huang highlighted the massive impact that deep learning and Artificial Intelligence (AI) will have on the world in the coming years. Nvidia seeks to push the boundaries of AI and deep learning technologies, and their first step is with their new GPU architecture, Pascal. Nvidia’s latest line of GPUs for both consumer and commercial use have been hailed as the best performing processors on the market. Furthermore, during the Q2 2017 earnings call, Huang reiterated his belief that deep learning is going to be the company’s most significant growth driver moving forward. Nvidia has very recently procured a contract with Chinese web company Baidu to develop AI platforms for their self-driving cars, adding their name to a client list which already includes industry leaders such as Tesla and BMW. A recent Bank of America forecast suggested that the deep learning and AI market could reach $153 billion by 2020, and Nvidia already has a strong position in the industry.

Nvidia has very strong fundamentals currently. Over the last seven years, Nvidia has reported positive revenue and net income. Both of these metrics have seen substantial growth as costs have been reduced and profit margins have improved. Since 2010 both the total assets and total capital available have nearly doubled to $7370 million and $4580 million respectively. Nvidia has also seen substantial improvements in its ROA, ROC, and ROE. As of FY2016 reporting, ROA is 10.59%, ROC is 17.04%, and ROE is 17.46%. It is estimated that in FY2017, Nvidia will see revenue of $6098 million (12.12% increase from FY2016), net income of $1381.4 million (41.8% increase), and an EPS of $2.30 (67.9% increase).

Nvidia’s TTM P/E ratio is currently sitting at 38.28 compared to an industry average of 15.2 and has a P/BV ratio of 7.51 compared to an industry average of 2.7. Normally these may indicate that the stock is overvalued, however Nvidia is seemingly at the forefront of a huge growth phase in an emerging industry and it appears that the market has priced this future growth in. In the coming months we should see a reduction in the P/E ratio due to higher EPS levels. As of their latest reporting, Nvidia has a current ratio of 2.56. This shows a lot fundamental strength for Nvidia to meet and short-term liabilities. Nvidia’s FY2016 profit margin was 15.58%, and impressive number alongside an equally impressive ROE of 17.46%.

Given current fundamentals, Nvidia will be able to see a growth rate of 11.1%. This number is based on an equally-weighted average between the company’s Long-Run Growth Rate (10.90%) as shown on the company’s Bloomberg Terminal page and the Sustainable Growth Rate (11.28%) derived from the following formula: (ROEb)/[1-(ROEb)] where ROE is the company’s return on equity for the previous fiscal year and b is the retention ratio for the company. Nvidia’s current WACC is 12.5%, which is used as a benchmark for required return. Based on these two values and Nvidia’s returns over the last six years, Nvidia has an implied value of $46,827.67 million when using an earnings power valuation model. With 535 million shares outstanding, this implies a stock price of $87.52 per share. At the closing price of $62.84 on Sept. 16, there is a margin of safety of 28%.

In spite of the huge returns Nvidia has already seen this year, I believe that it still has huge upside potential and would be a fantastic long-term buy. Nvidia’s upcoming product lines and revenue streams have positioned them positioned the company to be at the forefront of a growing deep learning and AI industry. Automation and self-learning software are becoming a larger part of our lives every day and Nvidia is creating the tools necessary to meet these new computational demands.

If Donald wins, all you will need is an orange wig…lol

Google made their own chips for deep learning. I imagine Facebook and all the other big players will soon follow. Intel recently bought a startup making chips for AI.

I expect Nvidia lead in AI will collapse in 2 to 3 years.

Making a chip is expensive though. Only companies with deep pockets can do it. All the startups need a different option.

Yes, Google made their own chips for deep learning, but it is more for promoting its TensorFlow framework, I feel. It is used for inferencing, instead of training. GPU is still the defacto platform for deep net training. At the training stage, it is still too early to determine which framework is best for the tasks. It is impossible for TensorFlow to win it all, no matter how good it is ![]() .

.

I am sure a few years from now, Google, Facebook, Apple, Amazon, MS will all develop their own chips for their own software frameworks. But that will not hurt NVDA at all, as all that is only promoting AI in general. My belief is the AI revolution is much bigger and beyond my imagination.

Copying my words again:

“Chips can be used to compute or to communicate. Up until now, communication still dominated the usage of chips. That had shifted since 2014. Thanks for deep learning AI and VR advancement, we finally using chip to do computing. Simply floating point calculation, but a lot of them. Nvidia is leading by a wide margin. The stock price reflects that and it is still the infancy of it.”

@manch I know you were from Intel, may be harder for you to accept NVDA’s promise ![]()

It is hard to believe it until you see it. The age of AI have arrived. By the way, Tesla self driving chip vendor is NVDA.

It’s amazing how much data those cars create too. NVDA and AMD are increasingly powering the data centers. Their graphics ships are superior to Intel’s for that use case. It’s a reason to be bullish Seagate and WDC too. Maybe even Digital Realty Trust who builds out data centers then rents the space.

Uh oh…