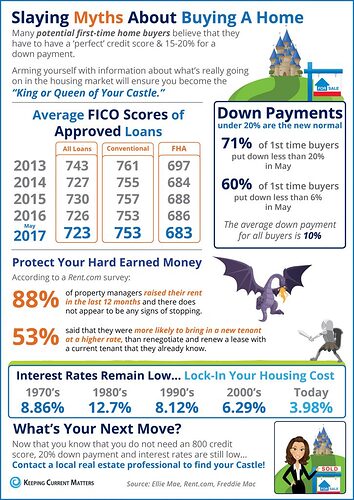

Average down payment for all buyers is 10%.

You know the bay area though. Try competing with only putting 10% down. You need to show the ability to put a lot down even if you decide to do less.

I know a veteran that uses the heck out of his VA loan benefit. He shows the 20%+ down then uses the VA loan to buy. As soon as he gets 20% equity, he refinances to a conforming mortgage. Shorty after, he turns it into a rental property. The refi resets the VA loan benefit amount, so he can use the VA loan to purchase another home. He’s done a 1031 exchange into some multi-family too.

LOL…Interest rates remain low…

I’m confused by how other people do the “buy, rent out, buy another place” thing. Having one cash flow positive rental property still had a big impact on my debt to income ratio and reduced what I could borrow for my next property.

E.g., making 15K W2 a month, with mortgage plus taxes insurance on first rental property costing 3K a month. Rent on the property 3K a month. 75 percent of 3K is 2.25K which is usual income measure used. Total income is now 17.25K a month. Existing debt is 3K a month.

Now you’re usually allowed 45 percent DTI ratio so with that income you can have 7.76K debt. You already have 3K debt so you can only have 4.76K (and they’ll include taxes there too and insurance.)

Without the investment property you could have 6.75K of debt (.45*15) a month. So you could afford a LOT more which matters. Every time you buy a property your ability to borrow goes down. Even if the first property cleared 1K extra a month it would still go down. Can you afford much in Bay Area with what is left?

Every lender I’ve ever talked to has calculated things this way - am I missing something?? Am genuinely curious how other people manage to do it.

The unsaid is they have other sources of fund ![]()

One blogger has an increasing revenue business.

One blogger has a growing stock portfolio which allow him to borrow more margin.

One blogger flips to get more cash ![]() for downpayment.

for downpayment.

I deploy funds from dividends and current rents to purchase more rentals.

Plus, a lot of people bought when prices were still rock bottom. So those properties have massive amounts of equity to tap.

75% is only when the rent is hypothetical. After the house has been rented for a while, like 2 years, I think 100% of the rent can be counted as income. Am I right?

That’s not the correct way to calculate DTI. Maybe I should become a loan broker to get mortgages for you guys

You calculate a net income or loss for your rental, add it to your monthly income. The negative rental income will reduce your income, your debt should not be impacted

@BAGB yes please help! I read that somewhere - that it would be a net income/loss calculation. But in practice NONE of the brokers I have ever talked to calculated it that way (Wells Fargo, First Republic, a couple different credit unions, SOFI etc.) The only reason I was able to buy a new primary residence was that my W2 income had gone up a lot since buying the first place and Wells Fargo considered my RSU’s as a factor, so they offered me a bit more than the other lenders. I also had to do 20% down for this reason, because with 10% down my loan would be too high. Who should I talk to that does this calculation properly??

@manch My place has been a rental for 3 years and they’re still only counting 75%.

This is really exciting as I want to move and buy a new place

And given I now own two, I had figured I had no hope to make the DTI work now…

And given I now own two, I had figured I had no hope to make the DTI work now…

Banks don’t want to loan money period…We have a banker on here…Let hime explain it…Dodd Frank put me out of business. .The subprime crisis caused by OC mortgage companies created the atmosphere of distrust that nearly destroyed our economy. …Lets here from our OC banker…

I have heard US bank is more reasonable to deal with than others…If Trump could eliminate Dodd Frank he would become a great president. …unfortunately the jackals in Washington are currently ripping him to pieces…Looks like 4 more years of do nothing Congress…

If you reported your rental income in tax returns for 2 years, lender will use your tax return, not 75% of rent. Maybe your have too much expenses and your rental is losing too much money in lender’s eye

@BAGB Yeah it was reported in my tax returns for 2 years and was nicely profitable. The first year was not a full year though in the tax return, as I lived there for first part of year - maybe that’s the reason?

![]()

![]()

![]()

100% none of the lenders I talked to did this for me!

The good news is that I know to ask for this specifically going forwards.

Hey, @Lulu, when you finally get your best loan, let me know what are the terms so that my Tracie can take a shot at beating it for you. She is with Googain. I trust her with all of my keys.

@sfdragonboy will do! I am so glad I asked for help in this forum. Thanks everyone!

@LbJW appreciate the detailed response.

FYI, I double checked one of my old emails with SOFI just to make sure I wasn’t mistaken.

The way they calculated it, they did count 100% of the rent from my investment property into my income. However, then then rolled my debt payments together for an “overall” DTI instead of doing income subtraction from qualifying income. The DTI max they’d approve was 43%.