I have my IB account setup so short sellers can borrow my shares. I’m surprised it hasn’t happened yet given I own UBNT and SHOP. I wouldn’t mind getting paid the extra interest for owning the shares.

A Tiger Cub Bites Into SHOP

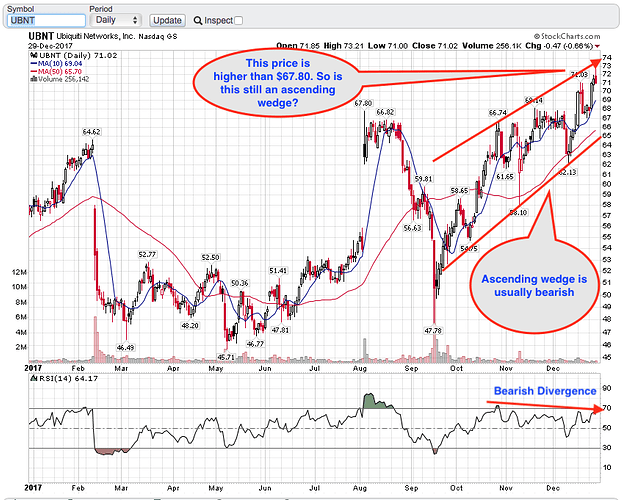

Shorting won’t come till touching upper channel, I hope ![]() need to close the dec calls

need to close the dec calls ![]()

UBNT, awaiting for Andrew to re-issue scam alert to buy back the 200 shares sold ![]()

My nervousness with UBNT is one of the Grizzlies minority owners triggered the buy/sell cause. That gives Pera 90 days to negotiate a buyout which ends in January. If they can’t agree on price, then the minority owner names a team valuation. Then Pera gets 60 days to decide to buy him out at that valuation or sell at the same valuation. I’m pretty sure he’d have to sell some of his UBNT to buyout the other minority owner. Who knows what sort of loans are available at that level, so maybe he wouldn’t have to sell stock.

Pera owns 25% and there are two minority owners that own 14%. At a $1B evaluation, he’d have to pay $140M to buyout one and maybe $280M to buyout both minority owners. I guess UBNT is up so much, he’d only have to sell 7% of his stake which would mean he’d still own 65% which is still an easy voting majority. The risk is probably smaller than I thought. It was a lot bigger back when the stock was in the $40 range.

Vacuum cleaners don’t seem much of robots to me. More interesting to find out what the Jeff-bots are doing…

I am positive on UBNT, holding YTD 30%, as they have good profit margin 28.8%, ROI = 30% and this will reach good level even after economic correction happens.

I am negative on SHOP as they are not profitable yet. IRBT is too good on product, but their margin is coming down by competition.

PG&E anyone?

No for PCG.

Here are the stock I reviewed, tried but failed to gain. 1 PCG, 2. SCG, 3. PPL. all utilities are coming down. I do not know whether this is year end tax loss harvesting issue. But, chasing dividend was failure to me.

Dividend stocks usually do poorly when interest rates are increasing. I think tax loss harvesting will drive down companies with a loss. It shouldn’t have much impact on winners.

It’s crazy how many ways there are to do technical analysis. Your chart shows it’s testing the bottom of the uptrend channel. The moving averages are:

200-day 93.91

50-day 102.30

10-day 104.13

Closing price 104.80

The moving average trend says it’s going higher in a bullish uptrend. Although, I think if it broke below the 10-day it’d also drop below your bottom of the uptrend channel. Then there’d be 2 indicators matching that it’s broken down.

NTNX which is the biggest winner of the small caps is now below the 10-day and consolidating. It’s up 41% in just a few months, so some consolidation before the next earnings announcement is good. If it was an option trade, I’d but it here and look for a new entry later.

BAT all seem to be consolidating ~10% below recent highs.

The moving average trend says it’s going higher in a bullish uptrend.

SHOP is being supported by 10-day SMA as well as the lower channel line.

Which moving average trend says it is going higher? Thought it just says in an uptrend. Also, don’t forget about timeframe. Can be multi-day uptrend, multi-week downtrend, multi-month sideways, multi-year uptrend… which time frame to use depends on whether you’re day trading, swing trading, position trading or investing.

Btw, the channel in the diagram is in an uptrend ![]() and I was speculating on a multi-day to 2 week timeframe.

and I was speculating on a multi-day to 2 week timeframe.

If the 200-50-10 are ascending, then the trend is going higher. I make most of my options trades when SPY is in trend, then look for the stocks that are leading the SPY in its trend higher.

You’re right the time holding the investment is key. For option trades, the 10-day is my stop. For investments, it’s more about the fundamentals of the business. The small caps are about revenue growth and gross margin. If they perform there, then the stock price will follow even if the market lags in realizing it.

BAT - 17.4%

Small cap - 10.0%

Target hits. Sell?

I’ve been bearish on that one for a long time. The revenue growth is terrible and the R&D spend is very high. They should have a ton of new products and don’t.

That could also be a cup with handle.

That could also be a cup with handle.

Too steep and not sufficiently round.

https://finance.yahoo.com/news/3-artificial-intelligence-stocks-shouldn-224800631.html

TWLO popped today. They are now in the voice recognition AI game.