Yes, this has good results,fundamentals are good, but investors/speculators are bringing down 20% in a day, huge drop is an opportunity to buy.

=============================

What happened

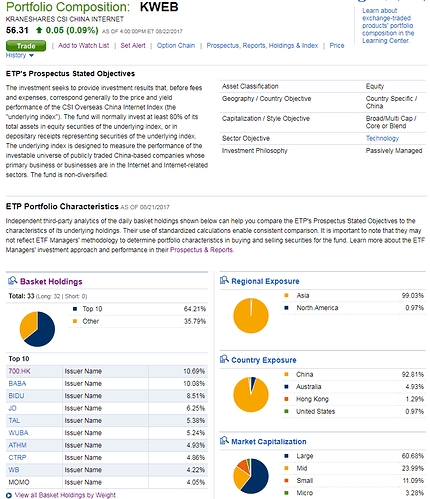

Shares of Chinese mobile social networking platform provider Momo Inc. (NASDAQ:MOMO) tumbled on Tuesday despite an overwhelmingly positive second-quarter report. The company beat analyst estimates across the board, and its guidance for third-quarter revenue was well ahead of expectations. A lofty valuation may be why investors are selling off the stock. At 11:50 a.m. EDT, Momo was down about 18%.

So what

Momo reported second-quarter revenue of $312.2 million, up 215% year over year and about $26 million higher than the average analyst estimate. Live video service generated $259.4 million of revenue, up from $57.9 million in the prior-year period, driven by 4.1 million paying users. Value-added service revenue rose 58% to $24.6 million, mobile marketing revenue grew 15% to $19.0 million, and mobile game revenue jumped 23% to $9.1 million. Companywide monthly active users totaled 91.3 million, up from 74.8 million one year ago.

Non-GAAP diluted net income per ADS was $0.35, up from $0.08 in the prior-year period and $0.04 higher than analysts expected. The earnings surge was driven by higher revenue, partially offset by rapidly rising costs.

For the third quarter, Momo expects to produce revenue between $337 million and $342 million, up 115% to 118% year over year. Analysts were anticipating revenue guidance of $307 million.

Now what

While Momo reported incredible growth that was well ahead of expectations and its outlook called for continued triple-digit revenue growth, the stock is unquestionably priced optimistically. With a market capitalization of nearly $9 billion prior to Tuesday’s slump, Momo traded for about nine times trailing-12-month sales, including the second-quarter results.

Momo’s results may have simply not been good enough to justify that valuation in the eyes of the market.

Source: Why Shares of Momo Inc. Are Plunging Today | The Motley Fool