AH SPLK jumps 8%+

All I need is its stock to blow my mind into an alternate dimension…

Mr Market is not nice to me. Always tradeoff. Previously, he was nice to my micro cap portfolio and now he is nice to my small cap portfolio but maraud LQMT. Could be a big investor lose interest and sell his entire stake. Not George Soros, of course, LQMT is too small for him.

Still looking for something big from LQMT.

Commanding the world’s respect

Meanwhile SPLK jumps more than 10%… now my coulda soul regrets buying only 100 shares.

Until year 2015, I tried

- call/put Options

- Micro caps (< 300M)

- Small Caps (< 1B)

- Margins buy

- Small companies, ( < 2B ) but not profit established companies (like SNAP)

Almost all of them resulted negative (except temp positive effect).

Now, staying away from all these. Even with this bull run, we need to do lot of research and hit the gain. Even with this, my gain is slightly (>2%) better than S&P.

Trying to move to Mutual funds, buy, hold and relax mode.

A Generational Shift in Technology Expands Products to a Wider Customer Base

Investors have also begun to coalesce around the view that semiconductors [Buy SYNA] are well positioned to capitalize on the rollout of the Internet of Things (IoT).

Recent corporate results provide evidence that the transition to the cloud [Buy SHOP, VEEV, NTNX] and the deployment of IoT [Buy UBNT and IRBT] are accelerating.

We expect that the refinement and adoption of artificial intelligence (AI) will further entrench these themes as key shapers of the technology sector in the years to come.

Of note were the data breach at a credit reporting company impacting more than 100 million Americans as well as Russia’s use of social media advertising during the U.S. election season. [Buy SPLK and PANW]

Oh, is that the secret???

Secret is: This is the start of new bitcoin bubble !

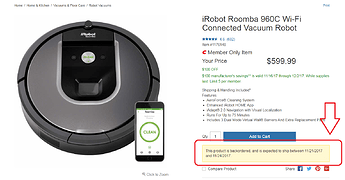

Today is the first day of costco sale ! When you see a sign like this, good candidate to buy, Yeah, I am buying some IRBT, coming Monday, after a long time.

The Internet of Things: Sizing up the opportunity

This connectivity trend is now recognized as a source of growth for semiconductor players and their customers.

Global Institute research supports that belief, estimating that the impact of the Internet of Things on the global economy might be as high as $6.2 trillion by 2025.

Analysts have predicted that the installed base for Internet of Things devices will grow from around 10 billion connected devices today to as many as 30 billion devices by 2020—an uptick of about 3 billion new devices per year (exhibit). Each of these devices will require, at a minimum, a microcontroller to add intelligence to the device, one or more sensors to allow for data collection, one or more chips to allow for connectivity and data transmission, and a memory component.

A new class of components will be required to address this opportunity: system on a chip–based devices produced specifically for the Internet of Things, with optimal power and connectivity features and with sensor integration.

Additionally, sensors based on microelectro-mechanical-systems (MEMS) technology will continue to play a significant role in enabling Internet of Things applications.

And security and privacy issues absolutely must be addressed. Internet of Things devices will not be used for critical tasks in, say, industrial or medical environments if connectivity protocols have not been established to prevent hacking, loss of intellectual property, or other potential breaches.

Given the potential 90 percent distribution of value to players that provide all the technologies “beyond” the silicon, there may never be a compelling enough business case for components manufacturers to develop individual chips and systems for hundreds of thousands of discrete Internet of Things industry applications. We believe semiconductor players should instead design a family of devices that are sufficiently flexible to cater to the needs of multiple industries—that can be used in industrial and consumer Internet of Things applications that boast similar characteristics.

Prospective IoT semis that are not mega cap: ARM (acquired by Softbank), NXPI (to be acquired by QCOM), SWKS, SYNA, STM, MCHP, TXN, CY

Since 90% is beyond silicon, should overweigh (90% of portfolio) SHOP, VEEV, NTNX, UBNT, IRBT, SPLK and PANW and about 10% on semi ![]()

Collective top 3 10x, UBNT (shot pass resistance), SHOP (around resistance) and VEEV (approaching resistance) are rocking… sell? NTNX rocks too.

You won’t get a 10x gain selling now.

We’re back in rally mode. I put on 3 option trades with Jan expiration.

Outside, have mar calls and leaps for ubnt  , just betting it might breakout

, just betting it might breakout

I want to reduce the number of stocks I have. I’m debating cutting TWLO and putting that money into the other 4 small cap. I might do the same with BIDU and put that into the other 2 BAT.

I am curious how all of you pay taxes on stock earnings. Do you have them in a 401k, IRA, or just pay capital gains tax as you go? Or is there something I am missing?

Have always been my aim but always end up more ![]() Guess I have plenty of time and curious about technology.

Guess I have plenty of time and curious about technology.

UBNT: Btw, STC Mar calls… took some profit. Still got 200 shares and 200 LEAPS $50. UBNT might appreciate quite a lot from here, hopefully that Citron guy doesn’t come in to scare me, well I’m ready for him this time ![]()

Make money, why care about tax.

I own the majority in IRAs - so no tax ( also means no tax loss harvesting ) and a small portion in a brokerage.

IRA - Almost all in AAPLs, some index fund.

Trading all in brokerage because allow option level 4 and future trading. Max level for IRA is option level 2 (sell covered call, long naked calls/ puts).

Most people probably have more retirement account money than non-retirement account. For non-retirement accounts, you have two options:

-

Just suck it up and pay the taxes at the end of the year.

-

Set your payroll witholdings at a lower number than where you’ll net $0 refund. Most people have pretty predictable deduction amounts for mortgage interest, property tax, state income tax, donations, etc. Plan your withholdings so you’re paying extra income tax every paycheck. Then if you don’t have stock income you get a refund. If you do have stock income, then you’ve already paid some taxes on it.

I prefer #2. It’s more conservative, since you’re budgeting on a smaller monthly income. I’m sure a lot of people would argue I should maximize my paycheck amounts. Not having state income tax will be awesome this year ![]()