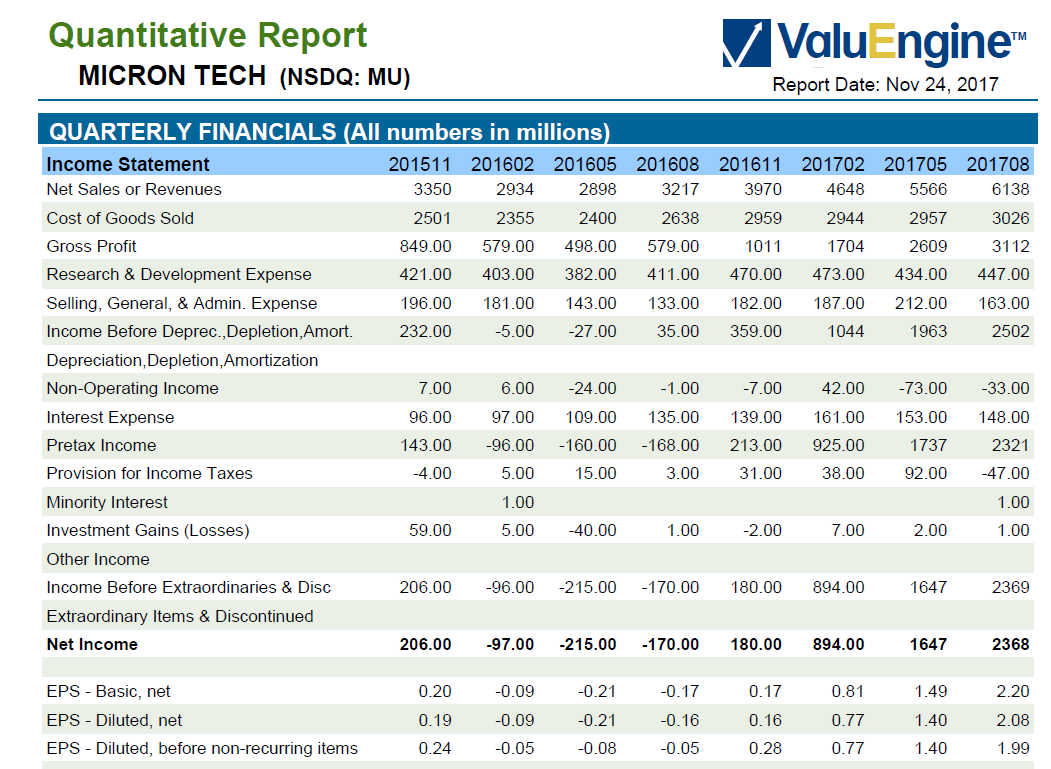

Look at SQ and MU, both are too good, I hope. I do not know whether MU is value trap, but looks nice with low P/E and low PEG

I’m debating starting positions in MU and NVDA while they are beaten down. I’m trying to own fewer stocks though not more.

It is really tough to decide.

Short term recovery is easy for NVDA. It is almost at low point and may not go down further I hope. Still, this is better.

MU is attractive with 16% fall with P/E=9.71, PEG=0.54 and PM=25%. I am just trying with MU, no idea how good it was in the past.

My NVDA vs MU is 6:1 range.

NVDA - try trading calls

MU and INTC - Can own if it hits 200-day SMA

MU broke below 50-day SMA.

NVDA broke below and went back up.

INTC is still above.

BAT = 13.8%

Small cap = 11.9% (including loss from selling TWLO)

NTNX is leading at 46%

VEEV is lagging at -1.2%

Small cap = 11.9% (including loss from selling TWLO)

Good play. I capped NTNX with covered calls and didn’t cap SHOP ![]()

Tech is in full on correction mode as people are tripping over themselves to rotate into stocks that benefit more from tax reform. This is where the individual investor has a huge edge. We can quickly shift while big funds will take weeks to fully reallocate.

I haven’t shifted one bit…

I haven’t shifted one bit…

I haven’t changed the stocks I hold, but I added trades.

Diversification

If you have a diversified portfolio of tech stocks + US based stocks, there is no need to do anything according to diversification advocates. Tech stocks down, US based stocks up; next time tech stocks up, US based stocks down; but aggregate moving up! All my US based stocks are GREEN, CAT, CLX, COST, CVX, DE, RSG, VZ and WM

Diversification

If you have a diversified portfolio of tech stocks + US based stocks, there is no need to do anything according to diversification advocates. Tech stocks down, US based stocks up; next time tech stocks up, US based stocks down; but aggregate moving up! All my US based stocks are GREEN, CAT, CLX, COST, CVX, DE, RSG, VZ and WM

If you do that, then you might as well just own SPY.

How about create your own Silicon Valley fund? Just invest in SV companies that are doing well. That should outpace S&P 500.

If you do that, then you might as well just own SPY.

That won’t give you a sense of in control ![]()

Humans are control freaks.

Also no sense of achievements.

Humans are achievers.

Me too

I guess with no profits they aren’t a winner in tax reform. Their customers are about to have more cash though.

Who are the competitors of SHOP?

Are AMZN, FB and GOOG quietly building a better mousetrap?

SHOP has to move fast in adding functionalities and expand geographically carefully.

Is the management up to task?

Me too

Who are the competitors of SHOP?

Are AMZN, FB and GOOG quietly building a better mousetrap?

SHOP has to move fast in adding functionalities and expand geographically carefully.

Is the management up to task?

The UPS shipping is huge. It gives small merchants access to shipping rates that only big companies get. Also, SHOP integrates with all those others. I’d be surprised if any of them try to directly compete against all of SHOP’s functionality.

BAT 15.6%

Small CAP 8.6% (rough week for VEEV with 2018 guidance that was perceived as soft)

I need to read up more on the VEEV details.

SPY is in bullish trend. Sector leaders are consumer discretionary, industrials, materials, and financials. Tech is bouncing back nicely.