just bought some jd options.

Don’t understand you guys’ obsession with options trade.

They are speculating with play money. Will not win big but also will not lose big.

Long call is safer than using margin. Refer to the table below.

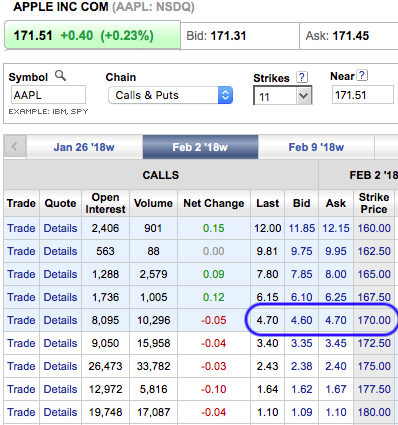

Apple is to report earning in Feb 1, so I use the Feb calls as illustration.

Note: All computation ignore commission and bid/ask slippage.

Say, you bought 100 calls ($170 strike) at $4.70, spending $47,000 leveraging 10,000 shares.

If result above expectation, say AAPL goes up to $180, make $53,000. For 10,000 shares, would be $85,000 gain with $1.715M investment.

If result is below expectation, say AAPL goes down to $160, loss $47,000. For 10,000 shares, the loss would be $115,000.

For aggressive traders, if bullish and expect to be at $180+ on Feb 2, can buy 100 calls ($177.50 strike) risking $16,700 to make $8,300. If want to get more return, long vertical spread ($177.50/ $180) for $5,700 to make $19,300 ![]()

That’s how much you’d make on Feb 2nd. What if AAPL tanked after earning but slowly ramp up to $250 over the course of a year?

With options, not only do you need to be right about the direction you also need to be right about timing. I am bad with timing so I don’t touch options.

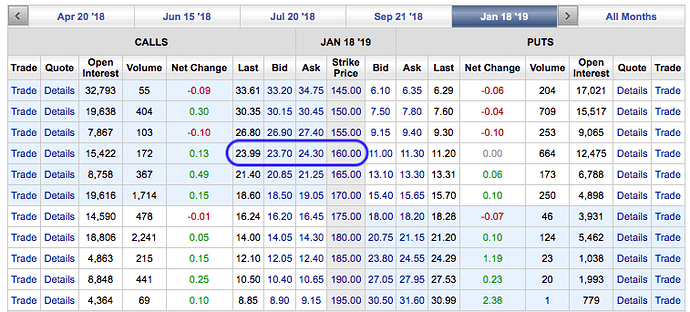

I was illustrating using weekly calls. You can also use LEAPS ![]()

If AAPL tanks, is an opportunity to grab LEAPS calls ![]()

Refer to the table below. To leverage 10,000 shares but don’t have $1.715M and not sure about short-term direction but pretty confident that it would hit $250 before mid Jan 2019, can long 100 calls (LEAPS Jan 2019 $160) at $24.30 i.e. $243,000. If you’re right, you make $657,000 ![]() 3x.

3x.

If you’re really that confident, like more than 90% sure, can daringly long 100 calls (LEAPS JAN 2019 $200) at $7.85, risking $78,500 for a potential gain of $421,500. If invest the same amount of $243,000, gain would be $1.3 M ![]()

Told you I am bad with timing. I am never certain about how a stock will move in 1 to 2 years.

How much did you make in options vs just buying and holding? Percentage wise.

Use to double every year but stop trading since 2016. Just small amount, so didn’t make million dollars. Turned $50k to about $500k over a few years… really nothing, if I’m aggressive, 10x a year is achievable. Some of my friends manage to turn a couple of thousand dollars to multiple million dollars. He traded very aggressively.

Btw, you can spend another $10 to extend the time by 1 year, call (LEAPS 2020 $160) costs only $34.30.

I am not sure about that. Maybe it is maybe not. You also have to model how being an aggressive options trader will affect you psychologically. Will you make more mistakes if you are trading 5m instead of 50k?

That’s correct. Initially, he trades short-term, gradually go longer and longer term, and eventually only trade LEAPS calls and fairly conservative. Of course he didn’t lie, he shows me his trading account ![]()

Using your example of AAPL hitting $250 or thereabout in one year, and long calls (LEAPS calls 2019 $160), you can short calls (LEAPS calls 2020 $200-$250)* along the way to recover way more than you invested, and continue to ride the run. *strike depends on the price behavior and how much you want to get back.

Refer to the IRBT call that I bought for $21.80. Is more than a double at $45.70.

I can recover my capital by shorting call (Jan 2019 $85). So long it is higher than $85, I got $35 gain per share for zero investment! Of course, usually traders don’t do that for ITM calls, usually they start off with an OTM call and when it is ATM, short an OTM to recover capital. Start off with ITM calls is not that lucrative.

When start off with ITM calls, the usual practice is to adopt marcus335 strategy of selling OTM calls regularly.

in Dec 4 last year.I usually go 4-6 months out then sell OOM against it every 2 weeks. It’s crazy how much that reduces the risk/cost of the trade. You might accidentally limit your upside, but I’m usually at 4x leverage to the stock price. If I get forced to sell because the stock is up 10% in 2 weeks, then I’m up 40% in 2 weeks. I’ll gladly take that gain and look for the next entry.

I’m trying some thing more aggressive on some new trades. I bought Jun OOM calls which are pretty cheap. Then I’m selling OOM calls at the same strike 2 weeks out. It’s basically a bet the price will increase but not that fast. If the stock stays flat, I can recover the full cost of the options I bought by selling against it. If the stock tanks, the options I bought were cheap and still have good time value. I don’t think enough people use time variance in option strategies.

Have tried calendar spreads quite often with some success. Same strike different date.

Or you did diagonal? That is strike of short call higher than long call?

I have tried kind of position, butterfly, iron condor, etc. Butterfly is fun, can get 10x in a week but very difficult to get it right. Iron condor has higher success rate but low return, high exposure.

I did same strike different date. I’ll keep selling against it, since I own Jun expiration. If the stock moves higher, then I’ll increase the strike of what I’m selling to maintain the 10% OOM.

I think short-term options trades are pretty difficult to hit. I can’t follow that closely during the day.

Note to people: next crash might be a lucrative time to try this on the way up. 2yr option would be nice i guess.

I am actually interested in buying puts as insurance if the market keeps melting up.

Im gonna do that myself too.

I smell bears…

Geez, we are educated people. Please don’t use foul language around here. ![]()

Where is Lexa when we need him?