TWLO revenue last year was $277M. That’s not going to excite big companies with revenue over $100B.

Upon marcus335’s urging, bought back 500 shares. Look like is about to breakout ![]()

Buy if higher on Monday?

I need to decide if I want to re-enter VEEV or TWLO. It’d make me even more weighted towards small cap.

They are all gone up now? What do you plan to do? Buy puts or wait for bottom? IMO, Whatever going up w/o real growth will likely come down.

VEEV and TWLO are both up on really bullish earnings reports. VEEV had 23% revenue growth. TWLO had 41% revenue growth.

I haven’t decided what to do yet. SHOP and NTNX are also doing really well, so there’s no point in selling them. UBNT tanked on the SEC investigation, but has gone up almost every day since.

IMO, VEEV is good with results, Revenue and profit, but this is too much over bought situation. Watch out for any dips, like what happened to UBNT or ANET, and get in. If not get this stock at some low point (which you feel at low point).

VEEV is going to be in my watch list to get sometime later.

Regarding NTNX & TWLO, they have reported lower loss than expected, but they made loss. With current state of stocks,volatile market, I would prefer to stay away from any loss making company.

All three went up, it is hard to catch now. Next week, stocks may bounce back as they went down a lot this week.

BTW: Nowadays, I do not prefer any stocks that makes loss ! When borrowing rate (interest rate) is increased, they are bound to make more loss. I stay with in positive Revenue and positive Profit Margin. That is me, looking for safety.

This is my opinion, feel free to take your own.

How will interest rate impact them if they don’t have debt? Young companies should focus on growing fast and grabbing market share. Especially if they are the first mover in the area. Slowing growth to achieve profitability only gives competitors more time to release a competing product. If gross margin is high, then they can easily become profitable. Young companies in new areas are way different than big companies in established and mature markets.

Interesting, neither TWLO, nor NTNX has debt ! Looks like they have some stability, but need to make it profitable !

If they do not borrow and run the company with own cash/equity, they will eventually make it work.

The only impact is their customer base must increase. Slight negative side is customer may hold orders when economy sinks, but debt free company may likely survive the wind.

Some EV/Sales numbers for the stocks mentioned here:

MongoDB: 1.74

Nutanix: 4.19

Twilio: 6.18

Atlassian: 13.23

Sailpoint: 5.13

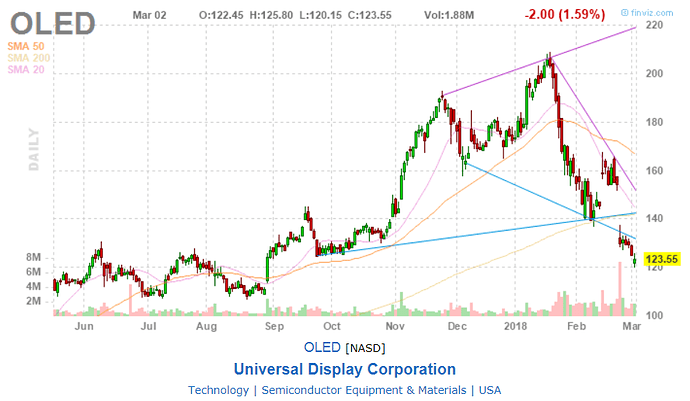

Oled: 22.84

Veeva: 12.61

FOMO again got the better of me and I will buy some NTNX and MDB. Already have TWLO and SAIL. Anything over 10 is too expensive for me.

May buy some YY too depending on its earning report on Monday.

FOMO again got the better of me and I will buy some NTNX

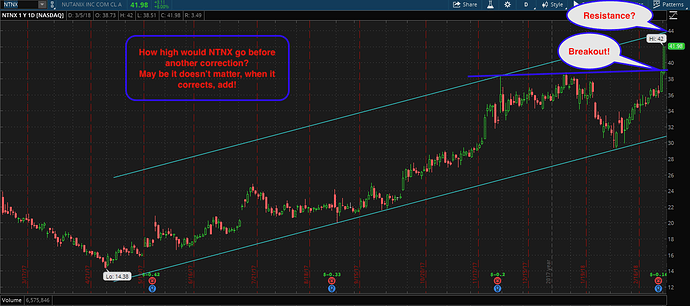

NTNX breakout, did you FOMO bought in time ![]()

Small caps continue to outperform megacap ![]()

MU and NTNX breakout ![]()

UBNT and VEEV continues to show strength ![]()

FOMO bought 500 NTNX… need to ride the momentum ![]()

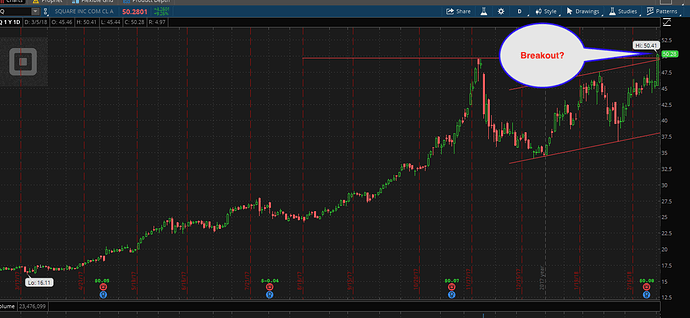

SQ is up big time wohoo (finally recovered from december crash) - should have bought more.

oh wait - i did, in my roth. not much but still.

NTNX breakout, did you FOMO bought in time

I always buy at market close. If NTNX is destined to go 10x it’s never too late. ![]()

I always buy at market close. If NTNX is destined to go 10x it’s never too late.

Bought 500@$40.62, let’s whether close higher or lower ![]() volume is decreasing as price is increased, should soften soon…

volume is decreasing as price is increased, should soften soon…

holy fuck ntnx

holy fuck sq