We don’t even bother with it. The company gives everyone an orca card and pays for it.

They can only survive on the little guys…like my company

Wait, you mean subsidized train passes? You need a whole company to administer that?

Yes, and the FSA/HSA junk. Fascinating, isn’t it?

HSA I do not know, but why FSA is junk?

As a W2, if I need to spend $5000 for medical expenses, I can set aside $5000 from my paycheck and get tax deduction. I did not know this FSA route previously, but I used it last 3 years.

Uh…it’s a figure of speech…

HSA is not california tax deductible, it suuuucks!

3 Growth Stocks for Successful Investors

Helping companies set up shop online

Danny Vena (Shopify): Sometimes a stock has more going for it than a groundbreaking product, a new approach, or a novel solution to a problem. The best-case scenario is when a company can do all of these, while riding a broader secular trend to success.

E-commerce is undoubtedly one of the biggest trends around, expected to grow from $2.3 trillion worldwide in 2017 to more than $4.88 trillion by 2021. As gargantuan as those figures are, the simple truth is that online sales are still in their infancy. For the fourth quarter of 2017, e-commerce accounted for just 8.9% of total U.S. retail sales, more the double the 3.5% from a decade earlier.

Shopify is perfectly positioned to benefit from that trend by making it easier for businesses to establish an online presence without the need for major expenses or technical expertise. The company provides a plug-and-play solution that allows small and medium-sized businesses to customize a website that’s right for their customers. The platform also handles many of the details like order tracking, payments, and invoicing, freeing entrepreneurs from these necessary but tedious tasks.

Another article to convince manch that Shopify is a buy.

I think Shopify’s ability to add customers quickly, earn more from them, and also grow its more lucrative Shopify Plus business makes this company a buy. Investors should keep in mind that the company will likely see some volatility because it’s still in growth mode and isn’t profitable yet. But the e-commerce market is still in its infancy, and Shopify is already well positioned to benefit from its continued growth.

Any articles that talk about online commerce without addressing the amazon question is crap.

(convince? manch shop)

=>#\f

We could finally close above the 50-day. NTAP, STX, MTCH, and NTNX seem to be leading higher and breaking out. In non-tech, LULU and a bunch of energy names are breaking out.

SO is an interesting one. It’s breaking out of 4 months of consolidation and has a 5.1% yield.

Many stocks are breaking out.

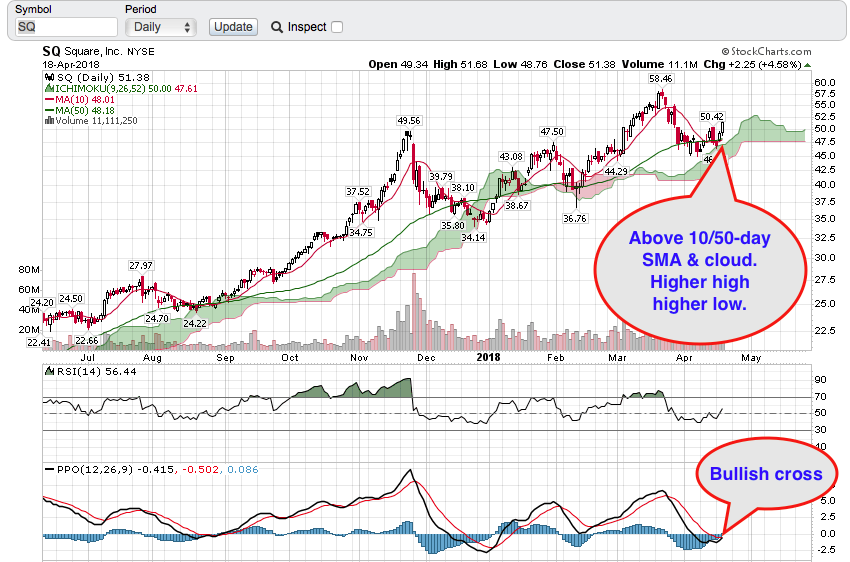

SHOP broke out of downtrend though not breakout to a new ATH.

UBNT also broke out of consolidation and I have no shares or calls

While manch hates SHOP & doesn’t understand NFLX, those who own them, listen to Shakira,

Waka Waka (This Time for SHOP)

I’m holding.

Two types of losing money,

- Real kind - avoid

- Engineered - buy if fundamentals are ok e.g. AMZN and SPLK

The criticism of SPLK has been that it is diluting the stocks with too much stock compensation.

I am curious if i should put some monry on bbby. Not sexy, but seems beaten vert much. To be honest, i havent read anything about their financials or anything, so i consider this a gamble.