Simple equal weight… approximately.

You already have lots of aapl. Why buy more?

Guess you didn’t follow the conversation.

It was just an index he created; he never bought any of those stocks.

WHAT?? ![]()

Back to RE.

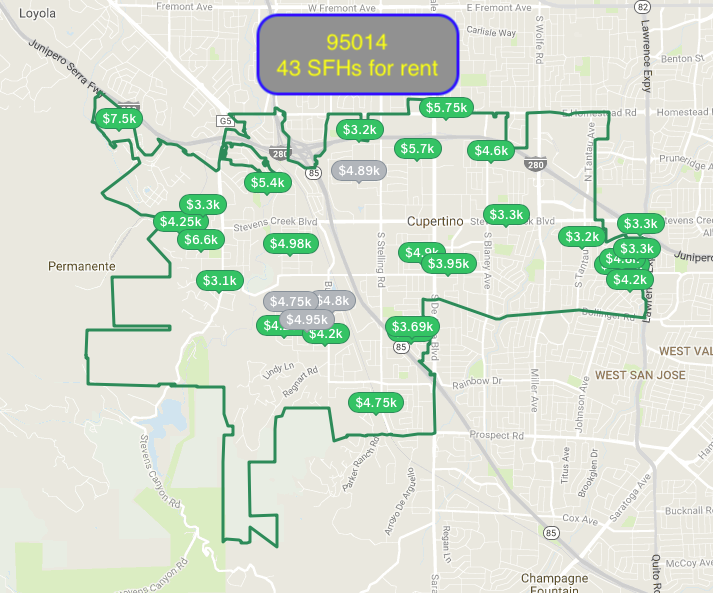

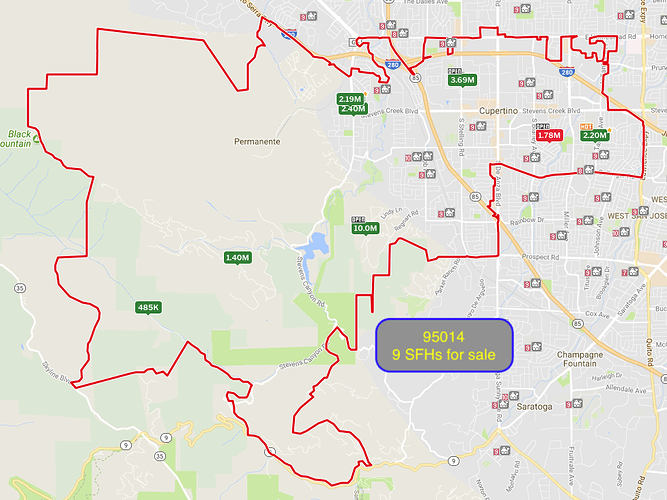

95014, 43 SFHs for rent vs 9 SFHs for sale

Slightly more inventory than 94087, cut n paste from previous post:

94087, 34 for rent vs 6 for sale.

As a landlord, very annoyed with the high inventory for rental.

To many investors and not enough homebuyers?

That means it’s easier to sell than rent. Was it much easier to rent than sell in 2010? If so, that means this is peak market.

The market will peak when tech crashes. No one on this forum is betting on that scenario. But is has happened before in 2001 and in 1990…

Tech is such a big part of the economy now. Tech crash is the same as economy crash.

For the 0.14%, they rebalance the index based on market cap. I’m not sure how often they do that. There’s also a ton of stocks in it if you wanted to replicate it yourself. Maybe if you bought the top 5 stocks, then it’d be easier to manage yourself.

I think that’s basically yes. People don’t want to sell fearing home prices will continue to increase. Better to rent out and purchase in cheaper areas to live.

So if there is a peak and prices drop, will investors head for the exits? Or will they be happy with 10-20% less rent and hold on? Like in 2002, after the DotBomb

Have seen the ups and downs. At one time, we saw price reduction of around 35% but never sold. Only one time, we actually reduced the rents as we tend to be under in what we charge. Prices recovered and have gone up as you know. We are now at the point where we no longer can depreciate this year and trying to figure out what to do next.

If rent can still cover most if not all expenses why sell? You always have to ask where to put your money after the sale.

Well, for tax efficiency, he should have “sold” the house to trust at a high price, not a low price.

Plus, you might end up with a big tax bill on the gains. It makes sense to just ride it out. I think the only people that won’t ride it out are the ones that are too levered. If a 10% drop in rent puts them into a big negative cash flow situation, then they may have to start selling.

RE is expensive to sell. Except exchanging a bad one for a good one, there’s no other reason to sell. Just hold forever and forget about it. Stock is high maintenance in terms of deciding on selling or hold. Too much stress.

Who live longer, stock investors or RE investors?

Easy, exchange property with me. Provided you exchange back to me later. Then both of us can depreciate again.

Polling again?