Sell take the tax free gain…

No, it will not change. What can change the decision, then?

Here are the details that can change.

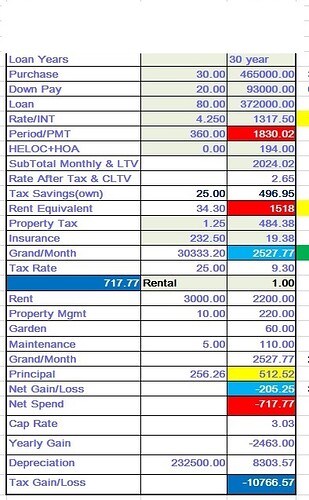

In order to defeat 4.25% mortgage, you need to earn equivalent money through investment returns.

Based on 300k pay, I assume 33% marginal tax rate and 9.3% CA tax.

If I assume 2% inflation, your break even comes, for long term capital gain, to 4.25 x (1.293) * (1.02) = 5.6%

If I assume 2% inflation, your break even comes, for short term capital gain, to 4.25 x (1.423) * (1.02) = 6.168705%

If you earn above 5.6% (or 6.17%) every year, which is possible, you are getting better returns than paying down the mortgage.

I would hold onto house #1.

Unless after you sell, you plan to do other real estate investment. I don’t think buying RE investment is good idea in today’s market. And I suspect you are busy working and RE is not your primary focus. So if you sell, I suspect you will be out of the real estate market for investment (except your primary residence). Thus, I suggest holding onto house #1.

But shouldn’t you make the decision yourself. Rather than really making a decision based on online forum talk.

If he holds on to it, he needs to let go 500k long term capital gain exemption. If he sells within 2 years, he can claim pro-rate LTCG exemption, beyond which he needs he looses 42.3% almost 210k.

On the other hand, he needs to wait for years of appreciation to match 210k loss, almost 17.5% of 1.2M. If the home makes 5% appreciation year over year, he manages to get the returns in 3.5 years.

Let me bring here that I recently suggested my friend to turn rental, Fremont, exactly like his case bought at 750k and now almost 1.2M.

He has locked at 3.75% thirty year fixed and his cap rate is 5% and appreciation rate 4% year over year. When I suggested renting, he has to go on rental more than 5 years to defeat not taking CG exemption. The longer he makes rental, better he is.

Alternate way if he wants to make rental home #1, better to lock primary home with fixed mortgage so that he has less risk. This way his challenges are limiting to rental home ARM alone.

BTW: I may be too conservative (being old as mentioned by wuqijun) as I always look at financial safety than aggressiveness !.

My experience is different, even though I agree with your statement !!!

You know how I came to know this?

Sharing true story !

I offered my son 20% free down payment to buy this home instead of paying $2200 rent for his apartment.

He declined to take on mortgage as he feels it ties him forever 30 years !

My ultimate lesson is “old people shouldn’t be giving young people advices concerning finances”

First rule in investment is never lose money ![]() wuqijun happened to ride the bull when he is ready, he has yet to see the bear! I’m wary of those who has not experienced one full cycle of stock/RE market. Those happened to ride the bull, always advise buy buy buy, those happened to ride the bear, always advise sell, sell, sell.

wuqijun happened to ride the bull when he is ready, he has yet to see the bear! I’m wary of those who has not experienced one full cycle of stock/RE market. Those happened to ride the bull, always advise buy buy buy, those happened to ride the bear, always advise sell, sell, sell.

$500k capital gain exempt is just too good to pass. Take it without hesitation. Forget about all other analysis. Anal… means clueless of future, claim the easy money, duh.

Asset allocation:

$500k Stock equities

$600k Equity in primary residence

Cash $200k + $500k (from sale)

Obviously too much cash ![]() usually cash equals to one year expenses (exclude income tax, 401k and IRA contributions) suffices. Since I’m a great believer in 50/50 stock: RE, I would deploy $300k to equity, $200k to pay down primary residence mortgage.

usually cash equals to one year expenses (exclude income tax, 401k and IRA contributions) suffices. Since I’m a great believer in 50/50 stock: RE, I would deploy $300k to equity, $200k to pay down primary residence mortgage.

You’re responding to wuqijun yet quoting me ![]()

I guess your son thinks he can’t sell ever. Long term he is missing out on the chance to live rent free.

How old is he? Does he have a family?

There is a saying, Don’t listen to the advice of the wise old man, suffer the consequence ![]() of a bad decision.

of a bad decision.

A lot on millennials are very conservative with money… .the recession scared a lot of them…They will be like the boomer’s parents who were raised in The Depression…Risk adverse

The long term capital gains savings is irrelevant unless he knows he plans to sell in near future and do not wish to re-enter RE market for investment. Or his re-investment is in completely different type of RE.

Let’s say he keeps current house and sells for $2M in the future.

Buy -$700k

Sell $2000k

Commission -$120k

Gain $1180k

Tax -$117k

Net $1003k

Then in another scenario, he sells $1.2M today; buys another house at $1.2M; and then sells in future for $2M.

Buy -$700k

Sell $1200k

Commission -$72k

Gain $428k

Tax -$64.2k

Net $363.8k

Buy -$1200k

Sell $2000k

Commission -$120k

Gain $680k

Tax -$102k

Net $578k

Total net is $941.8k

Keeping the current house will result in higher net, instead of paying sales commission twice (6% at sale price), if everything else being equal.

The net might be higher but ignores the tax savings…Take the $500k deductions as often as you can…The quickest way to wealth building

Saw the devil afraid of the darkness. Ride the bear, always sell, sell, sell mentality ![]()

I graduated right before the dotcom bust. My first investment was Dell stock…I bought a house right away too. Michigan real estate crashed years before the great recession.

Now is a great time to sell…Especially if you have had great gains…It is ok to take some profits off the table…Besides being a landlord is not for everyone. …

I hate using future assumed input to do analysis. We don’t know the future. Anything can happen. $500k capital gain exempt means $$$ savings in tax. Hard to make so much. If do like wuqijun invests in stock, and may be end up loss $100k which is claimable through future gain. However, if don’t take $500k now, they become taxable, and you have to lose all of $500k before having claimable capital loss.

The $500k gift won’t be around forever…Take it early and often. .It made me rich…I will always thank Bill Clinton for that…I call it the Clinton economic recovery act for builders and flippers…lol

I was in a similar position a few months ago. As Elt1 recommends, I sold and took the $500k gift. I will try buying a rental outside the bay area in a few years.

At the end of the day it probably doesn’t matter. Millennials who didn’t buy will get inheritance from their boomer parents.

We see this investment point of view or gain/value or effective use of money.

He sees mortgage means tie with big loan, and a commitment to stay in same place.

If he rents, he can move out easily anywhere in the world, no need to think about Long term asset appreciation etc.

He wants use his money and enjoy the world he wants rather than savings or tie up with mortgage.

He is too young, millennials, to appreciate the missing chance, even though he is intelligent enough to understand the details later. He does not have family.

He was not even ready to contribute Roth IRA or 401k. Finally, he agreed to contribute 401k up to company match !

All I can say this is a generation gap, millennials vs baby boomers !