Are we in the same planet …ALL THE SUDDEN I LOS CONTROL OF THE SYMBOLS IN MY KEYBOARD, BEAR WITH ME.

What’s this graphic got to do with what I said? You just woke up the buyinghouse in me. LOL

I always advocate for something different to deferred accounts for the simple fact that you can’t use your own money and if you “loan it” you are in big trouble if you don’t return it on time. So, I am against anything 401K related, I love indexing, so your question shouldn’t be addressed to me, but those who abhor new ideas, those who are stuck in the old way of doing things. These people are very rare to sit down, enjoy life, look at how the world evolves around while their money is making good returns, safely, and a disciplined manner, with no stress, knowing that their money is growing, slowly but surely without the excitement or disappointment of the stock market pulling tricks on them.

I am not here to change anybody’s minds, just to support what I believe in. I can’t make them change, they fear new ideas and they are satisfied with their lives. I am not into making anybody gambling their lifetime savings, no, I don’t like to gamble on the stock market at all, I belong to a conservative approached company. Who am I to change their ideas?

I was at the office last Thursday witnessing how an old couple put $1M into this account. Every $1 they put, will save them $16 in taxes. It is the use of their own money in a strategically way that will make them retire in 10 years with lots of income. They are in their 70s. And they have bunches of $ millions to start some other insurance or similar policies. The rich people understand this, ask Warren Buffet.

I am telling you, some people think that life insurance is a policy when you die your beneficiaries cash in. No, it is used strategically in, well, I can’t say investment plain and simple, but it is used as a vehicle for insurance carriers to invest the excess over your cost of insurance as the IRS rules dictate in the S&P 500 in an indexing account.

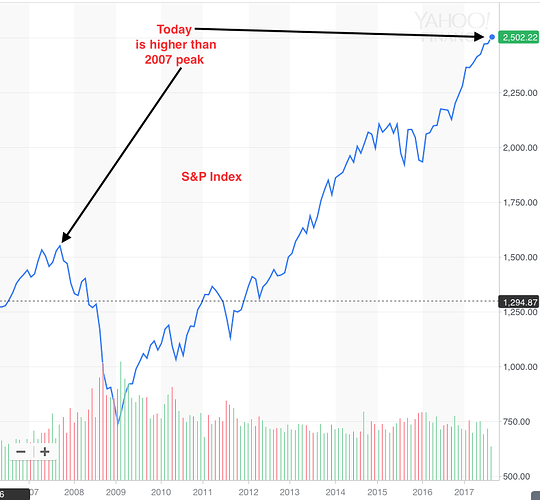

Actually, your graphic actually helps my point of view of supporting indexing in life insurance.

Do you know what indexing means? It is not representative of what 401K is, that’s for sure.

Do you see…which we may call them? Crests on that graphic? Going up and down? That is how 401K works. Except that you don’t have the protection of a 0% floor. If 401K had that protection, it would be a good retirement plan, which is not.

FYI you need to reach retirement with no “ordinary income” to enjoy your SS benefits, otherwise, they will be taxed…again! See? Any money in life insurance is tax free. Not counted as an ordinary income.

In 2008 there was a 38.5% loss of your capital. That means, that in order for you to recover, you had to gain app. 77% (100%) to be at your last best level. Then, look at the ups and downs. That is the bleeding of your money, not counting the points the account managers charge. Wait for your taxes to be deducted. And, even when you are on the age to start pulling your anual income, the account managers keep charging you 1 point here, and there.

I hope I clarified my position here. It wasnt about doubling anything.

I made the bet last time, put $360K buying any home, any property you will rent, then tell me if this property is going to give you the same amount )$360K) every year after 30 years of $1K monthly premiums. OK, let.s not go that far, say $100K a year. That simple.

I am still waiting for anybody to tell me they found something better. The beauty of compound interests without the downs is amazing.