Looks like realtors and flippers will be hurt most. Won’t be many buyers or sellers. Different story in Nevada. Californians are desperate to buy there… talked my Nevada agent … there is a buying frenzy…

I would think some of the California owners who will buy in NV, OR, WA, ID will sell their CA homes? Maybe 50%?

You guys are wasting your time doing spread chit and whatnot

The point is that the idiots confabulating this fiasco are not listening to you or me. The idiots, no other name for them, are pulling strings here and there thus making the hole they are in deeper, and deeper.

Would you hire this group of numb nuts for your company?

70,000 pages turned into 500? In less than a month? 30 years of a mess being fixed in 30 days or less. Are you kidding me?

So, wait until this travesti of a reform is done. There’s going to be a revolt somewhere after one of the numb nuts finds out the promised Mana didn’t fall from the sky. That’s the laughable part of this reform, incentives for x or y state are being given for a vote. I thought this was a reform, not a stockholders meeting.

Unfortunately, we KNEW that changes were coming once he won… God, 3 more years…

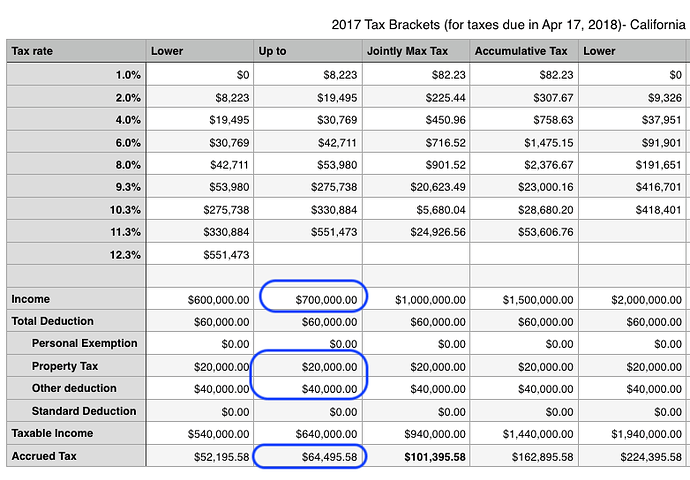

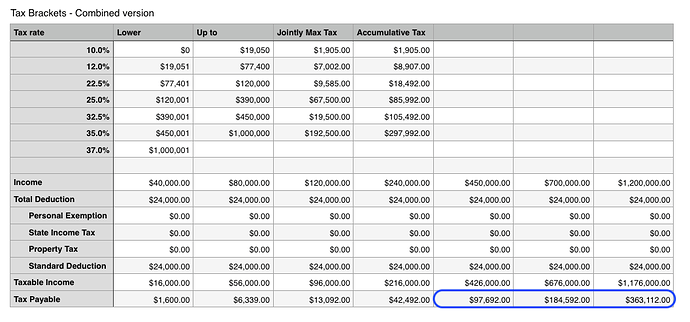

I used below table.

https://www.tax-brackets.org/californiataxtable/married-filing-jointly

I used 2016 number but found that 2017 numbers change slightly.

You used 2017 number for single filer.

I assumed Married couple.

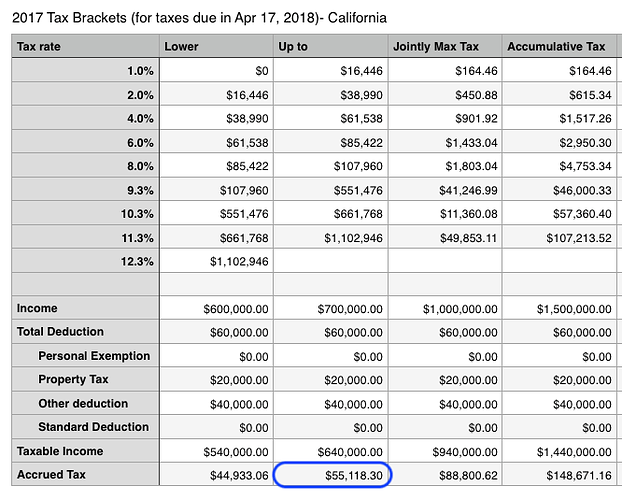

Thought I used married couple… will verify. Edit: Rectified to married couple filing jointly. Tax payable = $55k ![]() $5k higher.

$5k higher.

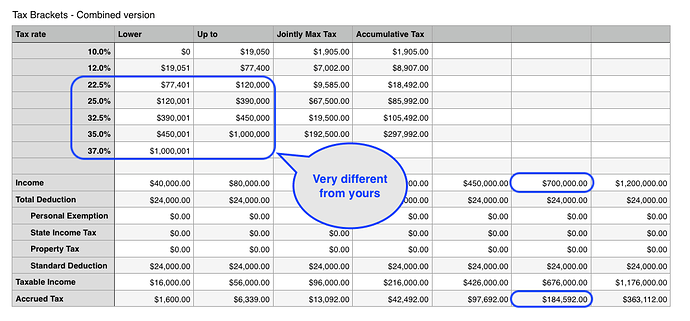

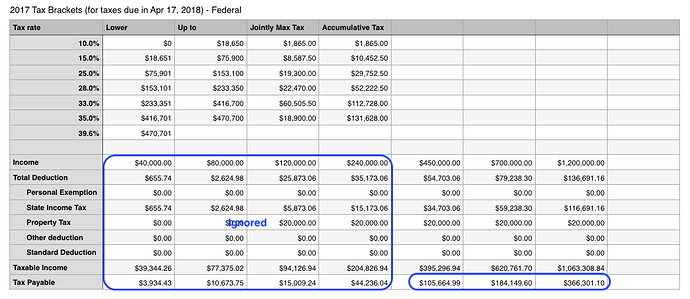

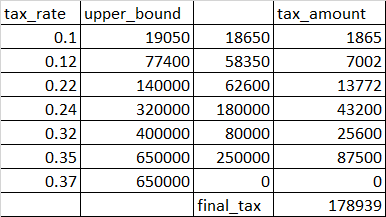

Did the new compromised fed rate out? Haven’t check the web yet. Edit: Can’t find the latest for 35/37% cutoff.

I’ll bet money SF and SJ median home prices are higher in 1 year than they are today. There won’t be a drop. Everyone will look back at this and laugh. Remember when everyone said prices would fall once interest rates started to increase?

Jane,

Can you provide a link to the basis for your table,

Why 19050 is reduced to 18650?

According to what I find, should be,

Final tax payment is $185k which is higher than the current tax payable of $181k (AMT). So you get a tax hike

If your tax bracket is at 35%(income of roughly $420K+), your AMT exemption is at most $20K(the $84.5K starts to phase out after $160K AMT income at the rate of a quarter for every dollar exceeding that limit).

With no mortgage, new tax reform means lower tax.

Clearly the reduction in tax rate results in less tax payable than the loss of SALT deduction (now max $10k).

So the statement below,

is wrong. Jil - Any counter?

Source of bracket is based on senate bill with the recent adjustment on the highest bracket to 37%.

And yes, what you pointed was copy-paste-error.

After fix, the final number is $ 178,979 ($40 higher than previous calc).

Sorry, i did not have time to completely analyze, but based on Jane’s update, there are possibilities people may get some benefit.SALT removal is an irking issue.

IMHO, removal of SALT is the right thing to do🙂

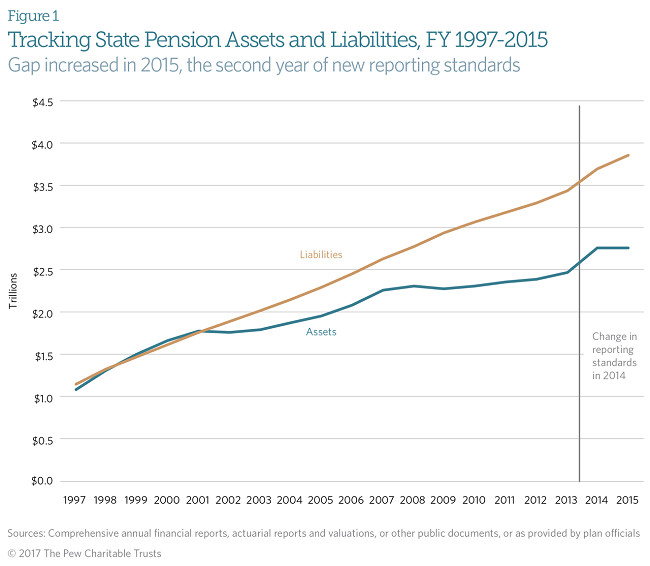

It is probably good long-term. I don’t think people realize what a financial mess a lot of states are. They need to get their financials in order. Local governments are almost as bad. The biggest issue is pension liabilities. They don’t count as “debt” even though bankruptcy can’t get rid of them. It’s scary how under funded the public pensions are. All that money is invested in the market. The next recession will only increase how under funded they are. It could be the biggest crisis ever. Notice how the gap is growing even when the market is going up? Imagine when the market takes a dive.

Local government can declare bankruptcy and push pension liability to federal insurance, right? GM and Ford have done that

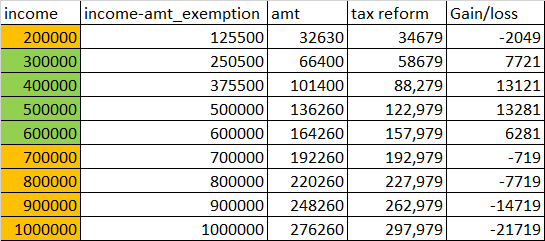

I did another quick and simplified analysis.

From my perspective, tax reform is very similar to AMT with different tax bracket.

In terms of applicable income after deduction, only difference is $10,000 deduction on SALT in case of tax_reform.

I assumed up to $1,000,000 mortgage interest deduction would stay because it would stay for current home owners at least.

Anyway, here’s my new table.

I used the same table in my previous posting to calculate tax after tax reform.

I used income for AMT calc and “income-10,000” for tax after tax reform.

Income in green color range will pay less after tax reform no matter what because AMT means really “minimum tax you paid before reform”. Correct me if I miss anything.

Income in orange color range who currently pay AMT will pay more tax indicated in the table.

Income in orange color range who currently done’t pay AMT, they may or may not pay more after reform.

However, after $700,000, usually, AMT phases out under current tax law.

Thus, increased tax for those group will not be as high as this table indicates.

Nope. That’s because GM and Chrysler pay into the insurance fund. (Ford didn’t declare bankruptcy). Public pensions do not, since they aren’t required. You know there’s the assumption that corporations are evil, so the government has to protect us from them. The government would never mismanage pensions, so there doesn’t need to be insurance.

Detroit was able to cut pensions. That’s going to be a mess if most states and major cities have to declare bankruptcy.

If California declares bankruptcy and forces its pension liabilities on to the Fed government then maybe Trump loses his game of chicken…

Trumps days are numbered. Can’t imagine being president is food for his health.