Alright… Seattle residents will go to Red Robin instead of MCDonald’s, go to walmart instead of salvation army… and national parks instead of local parks

. I’m glad they’re happy…

. I’m glad they’re happy…

True but… Is decreased demand lower than supply?

There is another reason why Trump’s tax reform needs to disallow claiming of state and local taxes. If they are still claimable, the tax burden on Americans would be lowered. States would get cheeky and raise the tax rate ![]() such that the tax burden would increase to the level before federal tax rate is decreased.

such that the tax burden would increase to the level before federal tax rate is decreased.

Ooops… ![]()

This is clearly a Tax law to punish the blue coastal states.

Owners selling a house within five years in the region, one of the nation’s most expensive real estate markets, would be punished by new capital gains rules found in the GOP tax proposals, according to a new study.

Analysts fear the new rules would also encourage Bay Area homeowners to stay put, further choking the already limited supply of available homes. A typical home seller in the region staying in a property less than five years could see his or her capital gains tax bill go up by as much as $75,000 in pricier neighborhoods.

“It’s a really big number, and it’s going to be felt,” said Skylar Olsen, senior economist for the real estate platform Zillow.

The tax proposals in the House and Senate would extend the length of time an owner must spend in their primary house to be excluded from capital gains taxes. The taxes are levied on the profit made on a home sale: the selling price minus the purchase price, and certain transaction costs and home improvements.

An owner now can avoid paying capital gains taxes on a profit of up to $500,000 on a home sale if they have stayed in their home for two of the past five years. Under both the House and Senate Republican proposals, owners selling before living in their home for five of the last eight years would be subject to federal levies on the first $500,000 profit on a sale.

How come there is no rushing to sell

You’d have to trust the Republicans to screw the poor and take care of rich people.

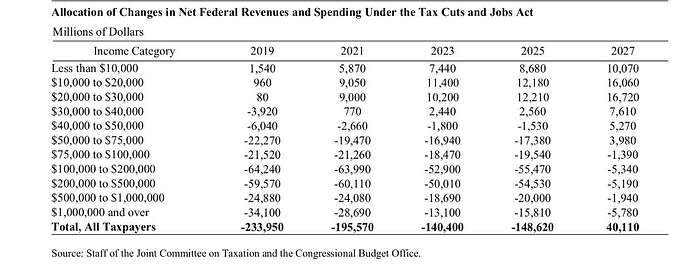

By 2019, Americans earning less than $30,000 a year would be worse off under the Senate bill, CBO found. By 2021, Americans earning $40,000 or less would be net losers, and by 2027, most people earning less than $75,000 a year would be worse off. On the flip side, millionaires and those earning $100,000 to $500,000 would be big beneficiaries, according to the CBO’s calculations. (In the CBO table below, negative signs mean people in those income brackets pay less in taxes).

Are you screwed up or taken care of?

While most of us, except some dumbfounded participants, are against this horrible bill, democracy as we knew it is dying in congress. The same idiots complaining of not having enough time (Obamacare) to look at it, or any other bill, are not giving a read out of the bill to even the rest of dumb republicans.

They are pushing this bill, because once stupidity sat on their republican camp by not even being able to repeal and replace Obamacare 2-3 times, to inflate the ceiling debt after they were championing about how democrats were increasing it, to even shutting down the government for any risible discussion of any law. They need this bill, against the people to pass. If they don’t pass it, it will be the end of this moronic party. Actually, by doing this, they are just signing their death warrants.

Now, we have a reverse situation, the once loving anything to destroy the economy democrats per the patriotic idiot horse’s mouth aka GOP, are now trying to defend the economy.

Putin was right, he didn’t need to fight us on the battlefield, he got his Russian candidate doing the job for him.

We are winning so much comrades!

This nutzi in the white house is vindictive. He has some agenda against people like Bezos who are really, really rich. He can’t stand the fact that they have made so much progress in their lives, that people love them, that they care for people.

He hasn’t forgotten the moment Obama made him the laugh of town during a dinner. That hatred for anything better than him will sink our country.

Using his same words, I hope Muller gets this son of a bitch.

If they (we) rush and sell, we will not get the same home later or be priced out forever ![]()

IMO, Yes, This will happen by Economic correction in 2019-2021, but not by Tax reform.

The only people who know what will happen are the people who can employ experts, and those people are low in number.

Most other people are waiting to see how the movie plays out. Once they figure out what will happen & IF it falls, it will be too late for most people, by the time the movie ends .

This tax bill is a result of the 2016 election… Trump is finally going to get a victory… But if the toothless masses that voted for him feel they were cheated and lose their health care and have to pay higher taxes the GOP loses in 2018 and he gets impeached.

Maybe he does not even care… He only ran for the adulation and the chicks…I don’t think he is getting much of either.

He knew very well, before election, that President post will not give anything except fame of being a President of US. that is all.

10k property tax deduction will be saved

Other issues can still be negotiated. Hope the final bill is not as bad as feared. As RE enthusiasts, we would like the propert tax and mortgage dedication can be retained. State tax is ok since it can make housing more attractive

Maybe people will work less hard to earn a lower salary to avoid paying too much tax

I am ready. Been planning my exit strategy for 4 years.

Plenty of other boomers will leave the BA in the next 30 years. Of course most will die there. And thanks to Trump will pass on their estate tax free…The ultimate exit strategy… lol

What you are looking at is the fact that this fat arsehole hates productive and entrepreneurial people. Basically the people strange to his way of doing business, stabbing people that is, are going to be hurt in the process.

If you, as a RE investor, or landlord, voted for this clown, you deserve what’s coming to you.

Just allow me to give you a huge hug comrade!

I told you! These dummies are looking at the pitchforks being pulled out by the people and they are still going to vote for this stupid tax reform. They will pay on the elections next year or 2020.

In unifying around the tax bill, Republicans are setting aside polls showing it to be unpopular with the public, analyses finding that it benefits the wealthy at the expense of the lower and middle class, and their own acknowledgement that it will dramatically increase the deficit in the short term and likely beyond. But to an even greater degree than during the health care debate, the risk of another high-stakes failure is holding an otherwise divided party together. As Roth told me on Tuesday: “They know that they can’t strike out on this.”

So you’re claiming it simultaneously attacks the rich and the poor. Maybe the reality is we either need to spend far less money or everyone needs to pay more taxes. The government has been kicking the deficit and debt can down the road for years. We started down this path in 1932 and have been on it ever since thanks to democrats.

What do people think when the CBO says Medicare, Medicaid, social security, and interest in debt will consume every dollar of tax revenue by 2032? That’s only 15 years away. That’s around when social security will only have enough to pay 80% of promised benefits. Does the public not understand what that means? Do they not care about something that’s 15 years away?

I’m hoping this leads to a mini revolution where the outcome is constrained government spending. If it doesn’t, we’re all about to pay a lot more in taxes.