Pro tip: Never trust guys who date supermodels.

Ok… now I really have to seriously consider buying SNAP…

Because it could be as successful as TSLA?

Confucius said: “Improve upon yourself first, then manage your family, then govern your state; that is the only way to bring justice and virtue to the world”.

修身 齊家 治國 平天下

Men who go after actresses and models are far from that ideal. The other extreme is Mark Zuckerberg. He married an ordinary Chinese girl, settled down and raised a family. Or Bezos. You never hear about his wife and kids. The opposite of flashiness. These people rule the world.

Invest in these guys.

Not likely. I was just being funny after seeing manch’s pictures. I don’t think dating supermodels has any correlation with stock performances at all. I don’t mingle what people do in their personal life with what they do in their job.

Although, I only decided to invest in TSLA after learning Elon divorced his wife and won the court battle against her. Because I wouldn’t want to invest in the company if Justine was able to own 1/2 the stake…

Not really… He married a pedatrician. That’s not really ordinary even in modern times.

But you have a point that he has good taste.

If advertisers are bailing, then there’s no reason to own the stock. There is a chance that if earnings aren’t completely horrible it pops on a short squeeze. More shares exit lockup 4 days after earnings.

Somebody will buy them out and bail them.

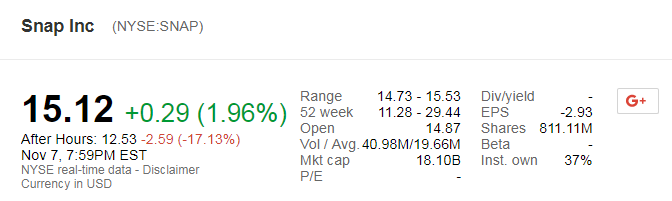

It appears to have bottomed around $12 after the last earnings announcement. I’m not sure it’s worth investing in, but it’s setting up nicely for a trade.

If you did buy at $12 then it is indeed great return of 15% in a week for a profitable trade. I was waiting for it to touch $10 before buying for a trade.

I didn’t. I was buying puts and kept rolling them until the earnings release. Both lockups have passed now, so I don’t see a lot of downside risk left. Granted, I also don’t see a lot of upside with instagram eating their lunch. That’s why I wouldn’t invest in it.

Would selling covered calls be exactly same as buying puts in this scenario? When would you choose one over the other?

What does “kept rolling them” mean?

Thanks for the education!

No. Selling a covered call means you own the stock. You sell a call at a strike price above the current price. If the stock hits that price, then you’re either forced to sell the stock or buy the call back. It’s good to use when the market is consolidating or going sideways.

For SNAP, I started with $20 puts. As it dropped in price, they were worth more than I paid. I sold them and went to $17 strike. Later, I sold those for $15 strike. Then right before earnings I took the profits and did a $14/13 put spread. It was $0.58 but a max payout of $1. That way I was only risking my profits, but could still make a good percent gain on the profits.

There’s another variation of covered call where you own a long-term call and sell short-term calls against it. It gets you better leverage than the traditional covered call, since the long-dated options tie up less money. I have some January calls that are deep enough in the money the time value is near zero. The price of the option is much cheaper than the shares of stock. I sell shorter term calls against them.

I always said the SNAP UI seems like it was designed by drunk people.

So now they are going to resign to copy twitter and facebook. What is the point of snap then?

SNAP dropped 17% results after hours

As a Tencent shareholder, that upsets me. If they are just throwing money around investing in failing companies, let me go build a terrible app real quick and get some cash.

This may be true, but timing of releasing such information from SNAP is to block the downfall of shares. The release of information has vested interest, and does not fly well with investors as they dropped SNAP 18% now.

Buy?

Tencent also bought TSLA earlier this year. Their foreign purchase has a mixed record.

Also Tencent’s objective is mostly not about making a few bucks on Snap I think. More like strategic alliance type of thing. Bloomberg had a article a while back about Tencent wanting to buy into Snap even before its IPO, but Spiegel said no. Now looks like Spiegel has limited options.