$4500 per month is normal rent for Cupertino. This house also looks pretty nice. Don’t know what’s going on. Let’s not make assumptions about the rental market based on one house alone.

Maybe Cupertino is too far away for Googlers and Applers do not like renting or already renting another house.

End of year could also be slow.

Another possibility is that this is a fake rental and the landlord has no intention to get it rented. Just posting an ad to make neighbors stop questioning why he kept a nice house vacant

That’s the reason I think. No need to overthink it. Even if the first rent is reasonable it’s cutting too close to school start date.

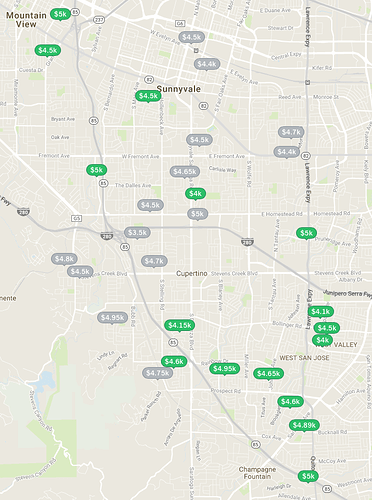

Similar houses for rent. Asking rent is between $4k-$5k except 1 asking for $3.5k.

Let’s not assume only family with school going kids rent in this general area.

$3.5k - 1

$4.0k - 2

$4.1k -1

$4.15k - 1

$4.4k - 2

$4.5k - 7

$4.6k -2 - Median rent

$4.65k - 2

$4.7k - 2

$4.75k - 1

$4.8k - 1

$4.89k - 1

$4.95k - 2

$5.0k - 5

My house made it into your map!

Well if the family is not renting based on school district they can find other places in the south bay for $500-$1K less. Why pay close to $5K a month otherwise…I wouldn’t pay that much more just to save 15 min of commute time but that’s just me.

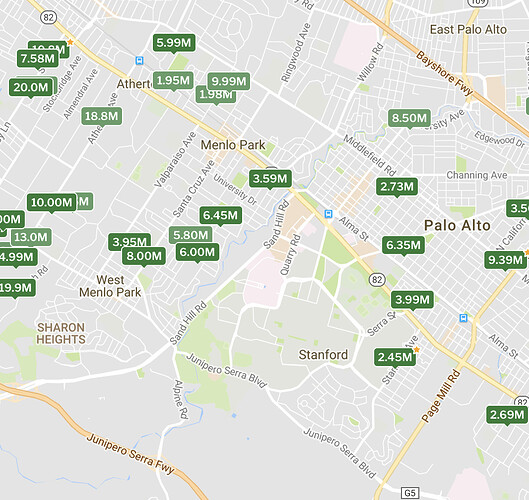

Yes will get there working on it… at least can make it to that upper right corner for sure…

They are not you ![]() Obviously I should know

Obviously I should know ![]()

You think I know? Can only guess based on what I know.

Obviously, one of the reason for softer market is because schools have started. So Harriet & you are quite right but not 100% right ![]()

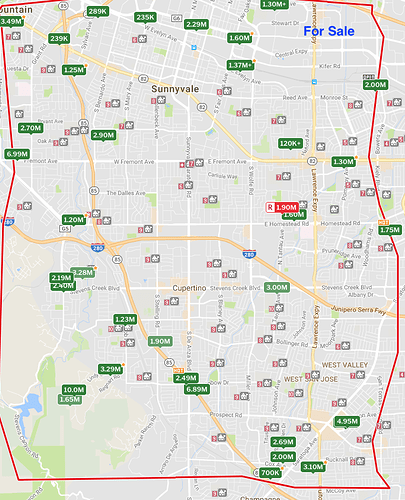

This year is softer than last year. My guess is there are lesser out-of-state guys or too many rentals trying to capitalized on this fact. The out-of-state guys are usually given 1-2 weeks to tour and make a decision, so they tend to pay a higher rental than those who are already here. After 1 year, they would try to negotiate lower or look for cheaper rentals. This year when I was trying to rent out, hardly any out-of-state, they are currently renting and from all over the places as depicted in the map I show (wuqijun - not pluck from the air, you implied my map covered too wide).

Well, maybe names like Cupertino are losing their luster?

Maybe renting next to work places to beat traffic and whatnot is making this home not rentable? Maybe construction of apartments is up deflating the lack of housing in some areas close to work?

I have seen several rents advertised on FB in my area. Not that cheap, but not that high, but still, you shouldn’t have a hard time renting a pearl like this one.

Now, to be fair and objective, aren’t the rent levels fairly high down there? I mean, if you took a little bit less is that gonna kill you? I prefer a fully loaded property rather the constant turnover. Remember, I am not a full time RE landlord like some of you. I don’t have unlimited time to deal with properties…

The problem is sudden decline in tenant pool compare to similar period 2016 or even just early 2017.

I dropped 10% fast and furious to secure a tenant, many came and I selected the most suitable, not the highest offer ![]() about 5% lower than the highest. Those still on the market is dropping too slowly.

about 5% lower than the highest. Those still on the market is dropping too slowly.

So, was that 10% drop from a fairly high level though? You know the game, you get what you can at a given time and you hope it works out (with the tenant, appreciation, no idiot decides to change the tax laws, etc…). I honestly don’t believe you are/will be hurting around these parts. Yes, my focus is J O B S always so if we lose a lot of those all bets are off but I am not thinking that will happen so dramatically.

10% drop from last tenant’s rent. Not market rent. That is, rent had declined 10%! 1 month vacancy is damn good because they are not out-of-state, they need to give 1 month notice to their current landlords.

Ok, whatever, but still decent??? Rent to mortgage/taxes/expenses?

Based on purchase price, not too bad ![]() but based on current market price of the property is bad, less than 2.5% gross yield which translates to cap rate of … didn’t compute

but based on current market price of the property is bad, less than 2.5% gross yield which translates to cap rate of … didn’t compute ![]() I didn’t bother to assess the viability of my SV property because it is meant for my son, just temporarily rent it out… really don’t care about viability so long the tenants are those who would keep the place clean and “damage” free. My goal is to keep the house well maintained, really didn’t bother about other issues.

I didn’t bother to assess the viability of my SV property because it is meant for my son, just temporarily rent it out… really don’t care about viability so long the tenants are those who would keep the place clean and “damage” free. My goal is to keep the house well maintained, really didn’t bother about other issues.

Like I said, you are too smart to be “hurting” or “losing” money when it comes to RE or stocks…