Still expensive too travel…My wife is trying to find a cheap fare to Russia, no deals…When I see bargains then I will believe there will be a downturn…

They are still growing much faster than inflation.

Most of the well established companies, such as PCLN or AAPL, grow way faster than inflation. Even the indexes such as S&P500 & nasdaq will grow faster than inflation.

Is growth slowing or are there just more competitive sites? Mostly leaders, such PCLN or AMAZON, slow reflects economy, consumer spending issues.

Overnight FED rate rate hikes direct impact on credit card rates and consumers start controlling the outflow.

These are all guesswork,logically trying to infer, nothing concrete as no one knows future.

The last 4 times it’s taken 2.75-3.25% rate increase to bring the recession. We are well below that. Also, inflation still isn’t picking up. I think there’s 0% chance of a rate hike in December and maybe 50% of one in December.

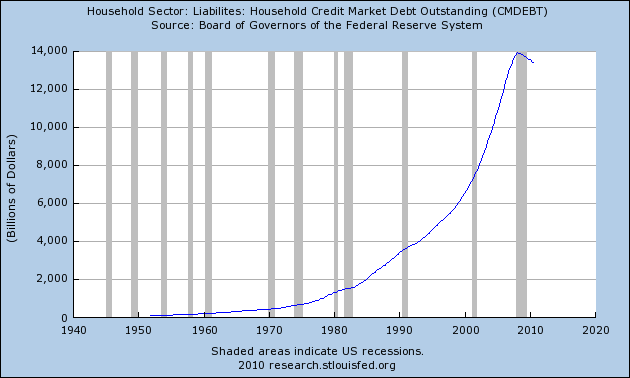

I think this does show the economy can’t grow without consumers increasing debt though. That’s not exactly a great thing long-term.

Economy doesn’t grow with consumers increasing debt. It grows along 2 premises:

- Population growth

- Technological advance

That’s economy 101 that everyone should have learned in high school…

Population growth used to be the main driver. Now it’s debt. We borrow tomorrow’s income to achieve this year’s GDP spending.

I am not expecting recession as FED is not driving the economy to recession level. But, growth slows as consumer starts reducing expenses, that will reflect in our ROI no matter whether it is stock or real estate or any other business.

So people are using debt to fuel spending… spending can also be building infrastructure which is a form of technological innovation that should help future economic expansion. So, it’s not all doom and gloom when people talk about a “debt-fueled” growth model.

I think home and some education are good debt. The home is a place to live and appreciates in value. The right education increases you earning potential. A lot of the debt is cars (rapidly depreciates) and credit cards (consumer stuff depreciates even faster). 69% of households have under $1,000 in savings. I doubt they are borrowing money to invest it.

People at the bottom of the pyramid have little contribution to economic expansion. I think the top 20% controls most of the weath and are the ones investing…

Can you put it in a better light. Investing is a dirty word to those guys, they think you are benefiting from their real work (remember that is how one fellow blogger thinks). The top 20% create jobs for the other 80% ![]() by providing funds to businesses so they can employ the 80%. You need to remind the 80% that businesses can’t function or don’t exist without the funds.

by providing funds to businesses so they can employ the 80%. You need to remind the 80% that businesses can’t function or don’t exist without the funds.

What do you mean? Rich people can only become rich by exploiting the poor. In the old old days it was the slaves. In feudal times was the serfs. With capitalism we have the “workers”.

Yes, I should say poor people do contribute to economic expansion and they benefitted by transforming themselves from slaves to serfs and finally, workers. Which took centuries…

OK guys, enough of the “I am making it rich out of this stock, or this real estate endeavor”. Remember, unless you are playing the indexing game, you can be rich today, and a beggar tomorrow. 2002-2008 it’s a cold and definitive example of what can happen. Don’t be too confident.

The cold fact is that at the end of your life, you need, and have to decide what’s going to be. Are you going to be old and all beat up answering calls from your tenant, or the management company about a situation in one of your places?

When are you calling it quits? Are you going to you enjoy life before you kick the can?

Believe me, I don’t want to advertise my services, but we get old people in our office not wanting to deal with the call in the middle of the night about the toilet get plugged up or the usual garbage disposal not working and so on. They are fed up! They just want to go cruising, they want to forget about uncle Sam forever. I am helping this individual, very young, to get rid of about 20+ properties all over the US. He either smells something or he wants out. He will defer the capital gains for 30 years and after that, another 30 years. He dies, the debt dies with him.

Measure your wealth on what you can enjoy at the end of your life. You may have $5m in assets, but really, is that all yours after paying uncle Sam for all the handouts he provided you in the name of depreciations and whatnot?

Are you slave of yourself by investing, investing, and investing to the point that you don’t have what we call “life”?

You have played what we call “people’s money” scenario for most of your life. But, as I said, do you have what it takes to get away from that and go in retirement without the fear of losing everything to the IRS?

Enjoy what you do now so you don’t suffer in the future, it is OK to do anything, including cutting food coupons and whatnot to increase your wealth so you have a nice and disciplined retirement. But you have to call it quits one day or the other. Enjoy life, that’s what matters. Money? Can’t take it with you whether you go up there or down there in hell.

Have a nice and prosperous day, go out and beat up that stock market piñata while you can.

The apartment building I bought a year ago had a 86 year old landlord…She just died… Investing is a life long pursuit.

My time horizon is long term since my wife is 45…I am teaching her everything I know. …Her investing time horizon is 50 years…So I will die with my investments and she will be able to carry on…

Investing can be carried through the generations if the younger generation has the acumen to carry on…Unfortunately most just want the money…I have a friend whose mother died and left her $50m in real estate. She negotiated with the IRS to make payments on the inheritance tax…Kept the properties. .now worth $100m…In 20-30 years the properties will go to her sons, who are in the business…

My friend, sorry to say this to you. You are one among the redfin-ian I feel for you and I regard you one of the coming up person with lot of experience.

However, I would like to clarify or explain some financial myth or misconception you have.

First remove your thought “Savers or Investors are not enjoying life”.

Remember this "Saver and investors are not only enjoying their day to day life and but also securing their financial future to face against inflation and economic uncertainty "

This is very common millennial’s dilemma (unless they are shrewd !) without knowing the direction what to do in life ! You are talking like ordinary redditians, not experienced redfin-ians!

Unfortunately, you are experienced aged person who carry the same dilemma now.

The fact is : Except for some right business work which grows exponentially, income stays flat while investment grows exponentially with power of compounding !

A friend on mine told this to me 12 years before, "First save your 50k liquid emergency savings and invest it, then you will see the change! ". He told me this truth just before leaving our company.

I am more than confident that you have not saved $50k liquid investments (as cash or stocks). First, you save this much at least and then try to maintain the emergency fund against inflation, you will completely understand the concept of investment !

Even after hearing our hanera’s AAPL hold, you still think indexing is the only way? My saving was negative 50k when I landed in USA 25 years before. For the last 12-13 years, my investment growth is 12.5% year over year. I have never bought any index funding !

You hate investing as you are unable to save ! Savings and investment are the key for financial freedom, securing your life without leaving enjoyment.

Simple Answer given to you (and everyone) by elt1 “Investing is a life long pursuit”. I can not say more than this. He has laid out clear plan what he intends to do which so many forum members, knowingly or unknowingly, follow !

Everyone here is aware of this. In fact, most of the members were positive during this time and saved, invested and secured their future during these troublesome period.

Finally, you are trying to preach a negative concept to well experienced community members, trying to be financially independent (FI) or FAT FI.

The true fact is that you need to change your concept and understand the balance between life & Investment and try to achieve financial freedom with the help of forum community members.

Wow, Millenials will be huge in real estate. Better buy sooner than later

“According to data from RealtyShares, 55% of Millennials want to invest (or are already investing) in real estate. Furthermore, Fannie Mae reports that 85% of Millennials view real estate as a “good investment.””

That’s a bit ironic considering their low home ownership rate.

They don’t need to own any homes. Most will inherit properties from their parents.