Will they be able to get a tax reform done before the midterm?

Things important for Californians. Let’s hope Californian republicans have enough weight in congress. A balanced political power at state level would be actually better for California, but we got what we have. Hope NY has enough Repulican representatives to balance out

"Of course, not everyone is happy.

Republican leaders have faced a rebellion from colleagues from high-tax states over their plan to dump a deduction for state and local taxes, and lawmakers are tangling with the Trump administration over plans to push people out of 401(k) retirement plans and into Roth ones."

Eliminate 401K as we know it, and finishing off the tax deductions for homeowners are things most republicans are wishing for so that money can go to the rich people who don’t need any tax cuts. So far, no republican in CA has stated they are against it

On the other hand, the only hope for Americans is that the democrats pull a victory against the republican majority, that is, have them fighting each other while we witness the same republicans like piranhas eating each other, and add to the recipe Muller time. I think Muller time is what is going to keep them busy for a while.

NY, NJ and Ct are the only republican senators or congressmen wanting to stop the tax reform for the rich. Oh, Collins, the centrist republican too.

Trump’s tax plan benefits the 1%, hurts the poor and middle-class, and explodes the deficit, according to Trump’s own alma mater, the Wharton School of Business. If Sen. Collins prevents him from getting it done, she will be persona non grata amongst Trump and congressional Republicans like Paul Ryan who don’t mind this administration destroying our democracy, as long as it means they can steal from the poor to give to the rich.

Collins made clear she wants to get a “pro-growth” bipartisan tax bill through the Senate, but that she couldn’t promise to vote for just any bill…

“because I don’t know what’s going to be in it.” <------------

In other words, she’s still a Republican who wants small businesses like farms in Maine to get a tax break, but she’s not willing to do so while giving the very richest Americans an even bigger piece of the pie than they already have.

Collins’ suggestion that she won’t support Trump’s tax bill must be the cherry on top of that pie à la mode for this embattled president.

Most of the Californians, esp Bay Area, washed away when std deduction is raised to $24000 and state income tax is not accounted in itemized deduction.

Do we have a tax plan? No!

Nobody knows, not even Collins, Maine lady who said “I don’t want to vote over something I haven’t seen”.So much for democracy, everything done in the back room. No debate, no disclosure, as RE agents these dumb republicans wouldn’t make it

Legal experts say the Mueller investigation is likely to bring more charges, not to mention a protracted legal process that is likely to distract from other priorities.

“The charges brought last week could easily result in prosecutions extending into 2019, just on the trial level, not even the appellate level,” said Jonathan Turley, a law professor at George Washington University Law School. “That is going to continue to have a dysfunctional impact on the Trump administration.”

That raises the prospects for political distractions that could continue into the 2018 campaign season, possibly complicating Republican efforts to hold the House and Senate. It also undercuts the expectations of White House aides, who say they expect the Mueller investigation to conclude soon.

Already, there are signs that the growing scandal has begun to distract from a key week for Republicans looking to build momentum behind tax legislation. <------Here, here!

I think reducing the 401k deduction is good…Or even better make everyone go with Roth IRAs…Better to pay the tax now…Gets the economy going…Never know what the tax environment will be when you retire…

Plus the whole IRA industry is full of fraud and hidden fees

We are drooling, we start to see people coming to us to rollover their 401Ks. We open an annuity to allow them to cash a $500K 401K, $100K x 5 years, meanwhile, we open an IUL so their paid taxes are recovered next year. Double Cha chin!

Now, very strange, the lovers of 401K are pretty quite on this forum. Why? It will help them to count the pennies they will have left after paying taxes. Easy does it!

The GOP is facing an organization ready to defeat the tax reform they are planning to shove down people’s throat.

You can’t upset the National Association of Home Builders.

The Republican proposal to overhaul the tax code gained a powerful enemy over the weekend when the National Association of Home Builders, a trade group that been supportive until now, launched a drive to defeat it.

The decision came despite an announcement by a key House Republican, Ways and Means Chairman Kevin Brady of Texas, that a deduction for property taxes would be maintained in tax legislation that is to be unveiled Wednesday.

Joy. More special interest and lobbying power deciding what the tax code should be. That’s why the code is 70,000 pages.

Are you in general currently able to deduct mortgage interest from your California State taxes? Also, are you able to deduct property tax from the CA taxes?

Yes and yes

I am dumbfounded to find out some real estate investors don’t know about property taxes and whatnot.

Also, if you think the rich people aka corporations are paying their tax rates, you are either a fool or you bought that ranch I had for sale on the beaches of Bolivia.

The tax system/code wasn’t written to fulfill Joe the plumber needs, it was done to accommodate the richest families in America. Why do you think they make it so complicated? Don’t be dumb, don’t be naïve, tax loopholes are there to help them out.

Why do you think you, yes, you, are using 1031? Do you think that’s fair for the rest of Americans? Why do you need daddy government to not pay taxes by using 1031?

Gee! I am losing hope on this bunch.

On the topic: You just need to follow the money to find out your politician is bought by special interests. I think the NAHB got more guts $$$ than any republican voter. It seems they are leaving the PTD alone.

With money you can make a monkey dance.

Adding: Why do you think the Kennedys and other rich families are big? Because they use the tax system to allocate money for every kid. They are conservative on their investments, many use the life insurance products believe it or not.

I feel like I’m being attacked, and I’m not even a rich real estate investor.

Oh the irony that the top 1% pay 35% of the income taxes despite the allegations that the tax code was written for them. The top 20% are paying 87% of the income taxes.

There’s 42% that don’t pay any income tax and they are middle and lower income.

And in the Bay Area, the lower middle class are that top 1%. Evil me trying to step out of my rank and afford a house though tax deductions…

It’s a great interview, please go to the link to read the whole thing.

Michael Winship: The Republicans are proposing $1.5 trillion in tax cuts. Do you think it makes sense?

Bruce Bartlett: Let me put it this way: I don’t believe that our economy needs this sort of tax cut at this time, and certainly not one that is grossly, overwhelmingly, [weighed] toward the ultrawealthy. I think there are policies that the economy does need, and $1.5 trillion will go a long way toward meeting those needs. So if we’re going to raise the debt by at least $1.5 trillion, I think we should do it in a way that is much more likely to raise growth and improve the lives of the people.

MW: In fact, on Monday morning, you tweeted that our major cities are dangerously vulnerable to flooding, but there’s no money proposed for infrastructure, only tax cuts.

BB: That’s correct. And I think it’s sad that Donald Trump, who said he wanted to have a big infrastructure program, has apparently abandoned that in favor of a tax giveaway to the wealthiest people in the United States.

My feeling is that the economy is suffering from a lack of aggregate demand — that is to say, spending. And we need to be doing something to get that going. One way is to get people who don’t have jobs to get jobs. Then they have money to spend. Or to raise wages — then people who are working will have more money to spend. So I think that that is what the economy needs, but if you cut taxes for the ultrawealthy, this does not lead to any increase in spending at all, because the ultrawealthy already have everything they could possibly want. They have no unmet needs. They’re not going to go out and buy second and third yachts just because they’ve gotten a tax cut. All they’re going to do is save the money.

On the surface, that sounds like a good thing, but the fact is, interest rates are so ridiculously low, this is pretty strong evidence that we don’t really need additional saving. We need spending. And therefore, I think to the extent that there’s any potential growth effects of this tax cut, it’s correctly characterized as trickle down and I just don’t think that is going to work or have any meaningful effect on the economy.

MW: Trump has said, “There’s no way that the middle class doesn’t greatly benefit” from the proposed tax cuts.

BB: Well, that’s just a lie… the middle class really isn’t going to get any kind of tax cut and in fact it’s going to get screwed in lots of ways. For example, he’s talked on many occasions about getting rid of the deduction for state and local taxes. He’s talked about reducing the ability of people to save in 401(k)s. These are tax increases, really, that are going to hurt the middle class.

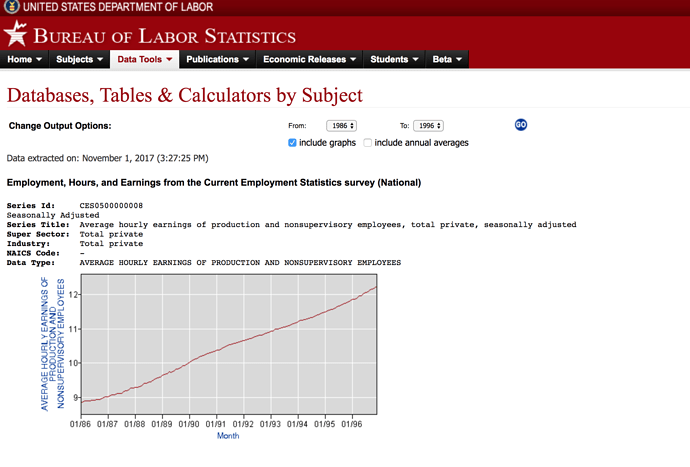

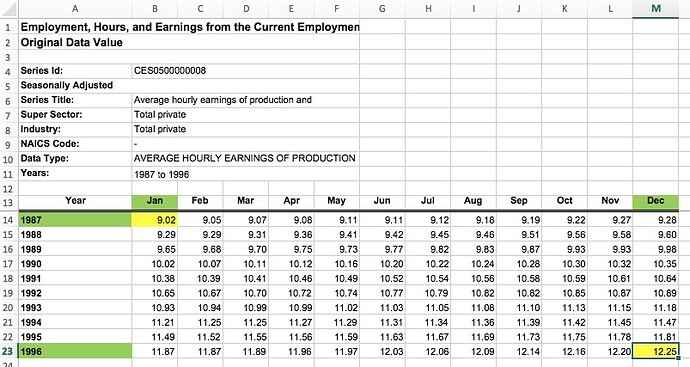

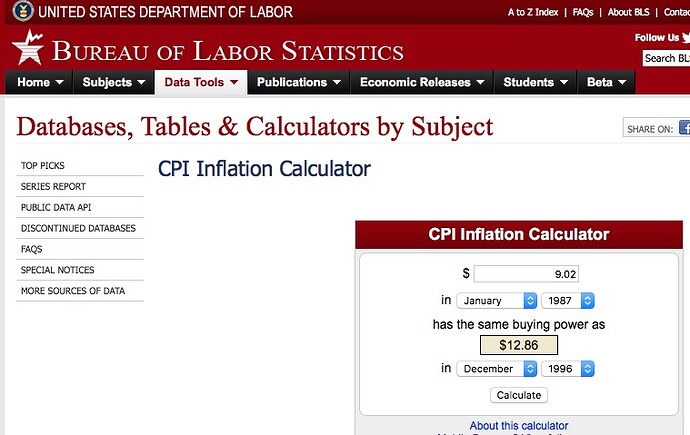

So what his economic advisers have done is come up with this ridiculous rationalization that workers will see a huge increase in their wages if we cut the corporate tax rate. The fact is that we have experience with this. We don’t need to look to some esoteric mathematical model to know what’s going to happen. You can very easily go to bls.gov, which is the website of the Bureau of Labor Statistics, and look up real median wages and you can see what happened after the Tax Reform Act of 1986, which lowered the tax rate on corporations from 46 percent to 34 percent. And if you look at what happened to wages in the 10 years after 1986, wages fell. They did not go up. They fell. Workers were worse off.

Now I’m not saying there’s a cause-and-effect relationship. I’m not saying that cutting the tax caused workers’ wages to > fall. All I’m saying is that we have a real-world experience in which the results were the exact opposite of what the administration is asserting.

MW: You wrote that you think the ultimate goal of the GOP is to create a deficit so large that Medicare and Medicaid can be decimated.

BB: That’s correct. The Republicans don’t advertise this, but in fact they all believe in a theory that I call “starve the beast,” which says that the purpose of cutting taxes is to create a deficit which will then justify spending cuts. Under normal circumstances, you’re not going to be able to cut popular programs like Medicare, Medicaid, Social Security, but if the deficit gets really, really big, people may be frightened of it and be willing to accept as necessary spending cuts that would not otherwise be politically plausible.

We saw an excellent example of this strategy just recently in the state of Kansas. Republican Gov. Sam Brownback and his party rammed through huge tax cuts relative to the size of the state, equivalent to what Trump and the Republicans in Washington are proposing, and they even hired economist Arthur Laffer of Laffer curve fame, paid him $75,000 [but] he didn’t even do a real study. He just lied and said this tax cut is going to be so powerful, it’s going to lead to so much additional growth and jobs that revenues will not decline, so we won’t have any increase in the state’s debt.

Well, what happened is, of course, revenues collapsed. The state — states have to operate under a hard balanced-budget requirement — was hemorrhaging revenues. They were desperate to balance the budget. But did they say, “Okay, these tax cuts apparently are not working, let’s just go back and restore the taxes that previously existed”? They did not do that. What they said was, “We must slash spending for the poor, we must slash spending for education, we must slash spending for police and fire and roads and bridges” and all kinds of popular programs that would have been impossible to cut except under the circumstances of an extreme fiscal disaster.

So this is very much in the Republican playbook. They cut taxes, they lie and say they will not lose revenue. When the revenues collapse, they say, “Let’s slash spending for the poor. That is what’s causing the deficit, not huge tax cuts to the rich.”

That’s honestly a garbage piece. He should look at the data on what percent actually use those deductions and what their income levels are. Also, he doesn’t even consider the increase in standard deduction. That would make it so only the top 10% or so of earners would even itemize deductions. The implication is that anyone below the top 10% ends up at least neutral or ahead.

We already have a situation where debt, medicaid, medicare, and social security will consume every dollar of tax revenue by 2032. No one has to do anything to make them unsustainable. They already are. You can tax the top 1% at 90%, and it wouldn’t balance the budget then. So what’s his bright idea to fix it?

I am genuinely interested in this area. So I went to the aforementioned site and did a search, but I got different wage growth data. Was he talking about inflation adjusted data?

Edited: there is a difference between mean and median. However, the graph I posted is for nonsupervisory employees, so I don’t think there would be a big gap between mean and median.

Will get back to you later (because it needs time to properly respond)