We have a dumb party holding the reigns of our destiny. Admit it, they weren’t prepared for nothing. Not for Obamacare, not for the tax reform which is of the outmost importance on these modern times. All they are good is to obstruct and poised as the saviors of nobody, but the lobbyists, from NRA, to oil and high tech, insurance and whatnot. They had 8 years to draft a good plan to repeal and replace Obamacare but you saw the disaster they came to face.

Then, they just drafted a tax reform plan in the middle of the night, with the caveat: They didn’t allow members of their own party to know the specifics so they could consult with their constituents, if that exists anymore. You can’t run a country like that, not even a 7-11.

This country can’t go forward with this monopoly of our servants in congress living like queens and kings. The same pundits that told you they were coming to drain the swamp were caught, well, being monsters of the swamp riding in jets and nonetheless the liar in the white house spending $ millions every weekend playing golf. Something he swore never to do, which leaves his supporters lacking of dignity and empathy for those who are suffering in disaster zones needing that unnecessary spent money.

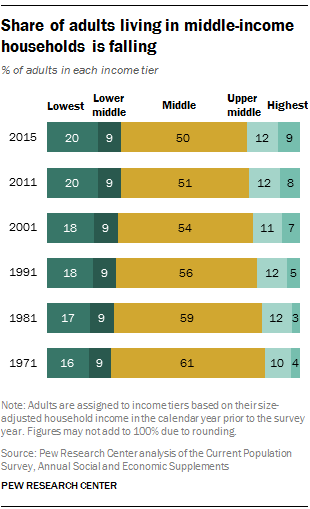

I feel for my adopted country, you may not feel anything, you may be accustomed to your way of living because you found, as corporations found, the benefits of incentives/tax deductions. Don’t give me that crap of saying that rich and poor people are different because of the financial opportunities. We may not think about it, but besides the Bay Area or CA to be specific, there are entire towns, states in need of an opportunity like the one you had. But nowadays, the chances of them becoming one of you are getting shorter and shorter. They don’t live here! Their incomes are not even enough to put a decent piece of beef on their plates, and you want them to know or be better than a rich guy?

I for once, believe it or not, expected something “new and different” with this tax reform. But as I felt and I knew it, another worthless move has been made. Another Reagan Trickle down effect is placed in the grinder. Excuse my French but the same old shit came out.