Do people realize you can’t run a trade deficit forever? It’s literally the path to financial ruin. It’s like running a monthly spending deficit at home, and the deficit is spent on stuff that rapidly depreciates. Would you borrow home equity every month to buy clothes and electronics? That’s literally what the country is doing. The US can’t go on forever selling equity in business and RE to find consumable spending on depreciating stuff.

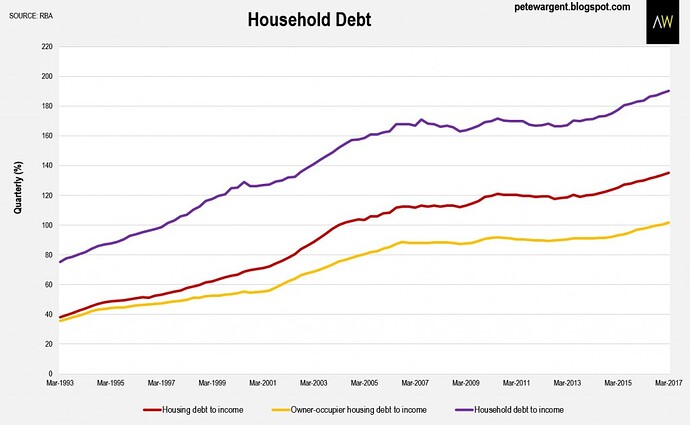

The US has been spending itself broke for decades. Checkout how debt is growing faster than income as shown by debt to income ratio.

People talk about post WW2amd all the growth of the US economy. The savings rate was over 7% for most of the 50’s and 60’s.