Ok, early reports indicate home interest deductions limited to loans of 500K max. There goes the Bay Area market…

Just noticed WSJ

Mortgage Interest Deduction

• Current law: Itemized deduction on loans up to $1 million

• Proposed: Itemized deduction for loans up to $500,000 on new home purchases

The GOP is run by the red states…They don’t give a crap about the coasts…Nevada, here I come…

Ugh. Why all the complexity? They could have turned 70,000 pages of tax code into a few pages.

I don’t want to see 1031 mentioned anywhere in that complexity…

And increasing standard deduction to $24500/Family & Limiting $500k loan means, no high fly bay area people can make use of Mortgage tax deduction !

Property tax deduction limited to $10k!!! Not good…

Aloha!

One key consideration involves a compromise that Brady offered on tax breaks for individuals in high-tax states: allowing individuals to deduct the cost of their state and local property taxes. That benefit would be capped at $10,000, according to the memo. <---------

The bill would cap the mortgage-interest deduction on new home sales at $500,000 – a departure from the current cap of $1 million for couples filing jointly, according to a memo written by the House Ways and Means Committee. The National Association of Realtors, which has been wary of the tax plan, said the memo “appears to confirm many of our biggest concerns.”

SOMEBODY HERE ENACTING THIS TAX REFORM IS HATING RICH PEOPLE IN CALIFORNIA, RIGHT?

DAMN SOCIALISTS!-

S&P down

There are 135M housing units in the US and ~2M are worth over $1M. In other words, limiting the interest deduction to $500K impacts the rich. Over 90% of Americans won’t feel sorry for the rich and won’t be impacted by it.

If you think about it logically, allowing the deduction of state and local taxes off the federal tax bill results in the rest of the country subsidizing high tax states. The entire US doesn’t benefit from a high property tax bill which pays for local services. Why should those people pay less in federal taxes, because they pay more to have superior local services? If democrats had consistent logic, then they’d support eliminating SALT deduction. It’d make high income people pay more into the federal tax system to support the greater good.

There we go! But the democrats!

Who is in charge now? Dumb question.

Not like that. Not only californians (or bay area), but entire US Mortgage tax deduction becomes worthless.

This brings down all primary home seeker/buyers(discourages primary buying).

Current interest rate is 4%. Even if you assume 30 year fixed mortgage to 5%, the mortgage per year comes to $25000 for a home of $625000 (500k loan at 80% LTV).

Standard deduction is raised for a family to $24500. They may hardly have $500 tax deduction ! Why should they shoulder big loan and risk, rather they can continue to rent.

Ultimately, primary home tax deduction will become worthless for entire country.

If I turn my primary home rental, I get full tax deduction and can rent a home elsewhere and get same 24500 standard deduction !

For a family of 4, the personal exemptions would be $16200 as of 2016, plus property tax of over $8000 on a house of $625k. You will have total deduction of $16,200 + $8,000 + $20,000(interest for 1st year) ~= $44,000. Still a lot higher than standard deduction of $24,000.

Excuse me but…most homes nowadays are worth $500K +. That means their PT are going to be on the $500K or up.

Is every homebuyer in CA a millionaire now?

Fake news. Median home price is $318K so by definition most homes are worth less than $318K.

I am going to give you a $318K check and you are going to buy me a $500K in East San Jose. Cash!

Please tell me your bank acct # for the transfer.

SURPRISE…SURPRISE!

Tax brackets were changed in the middle of the night!

Individual tax rates will change

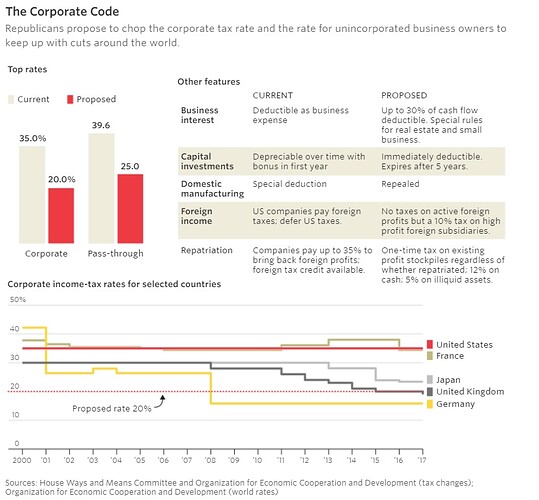

The plan establishes three tax brackets, 12, 25 and 35 percent, and also keeps a top rate of 39.6 percent for the highest-earners, collapsing the total number of brackets from seven. The brackets fall along the following lines:

Those making up to $24,000 will pay no income tax. For married taxpayers filing jointly, those earning up to $90,000 will be in the 12 percent bracket; those earning up to $260,000 will in the 25 percent bracket and those earning up to $1 million would fall in the 35 percent bracket. Those making above $1 million will be in the 39.6 percent bracket, which is currently the top rate for millionaires. For unmarried individuals and those filing separately, the bracket thresholds would be half of these amounts, other than the 35 percent bracket, which would be $200,000 for unmarried individuals.