say what?

You don’t need to build any cash reserve, hanera. You should buy a couple more homes in Cupertino. I don’t understand why you would even waste money on Austin.

Own AAPL and buy in Cupertino? Don’t you think is over-exposed? Diversification! Of course it means lower return but also lower risk as in not putting all eggs in one basket… Texas is a Republican state, you should, by now, know that I don’t like Democrats. Cash flow (7-9% yield) and capital appreciation of Austin SFHs (8-10% p.a.) are pretty good, whatever conception you have that rooted a decade ago no longer hold true. A decade ago, cashflow 10-12%, appreciation 3-5%.

The way to build wealth is through concentration, not diversification. I thought you should have known this by now. Look at Bill Gates, he has owned nothing but MSFT and lives in Seattle. How diversified is he?

Anyhow, good luck with those Austin houses…

After concentration is diversification. That is what he is doing. He doesn’t hold much MSFT.

The only way for me to make a quantum leap in wealth is to take huge risk such as investing in startups!

Me, not a big spender, so no need to build wealth. Preservation is good enough.

Investing in startups is a good way to lose 100%. Good deals are only for top tier money and well connected money.

Always won on concentration and lost of diversification. .I think the whole diversification thing was BS thought up by stock brokers to churn your account. .So 60s…

As far as investing in startups…only for insiders with tons of wealth…Dont put more than 1 percent of your net worth in any one…100 to one shots

I’ve said it before and I will say it again, how hard is it to make money when you have money? For the folks that don’t have a lot of cash, there is no choice but to start in the rougher areas and make a go of it. There is a reason why the saying is buy low, sell high right? It ain’t buy high, sell higher (not that that can’t work of course). Personally, I am more impressed with folks who make a nice nest egg out of nothing vs some primadonna techie punk who oh by the way buys a place in SV. People with nothing have a lot more skin in the game and when they win, it actually does transform their financial status dramatically and those are the stories that interest me.

500K can buy you a Class A condo in some parts of Bay Area. I have a SFH in the fancy Brookside area of Stockton, and houses there sell for 350K. Only if you limit yourself to 1) SFH and 2) prime Bay Area do you have to make these compromises.

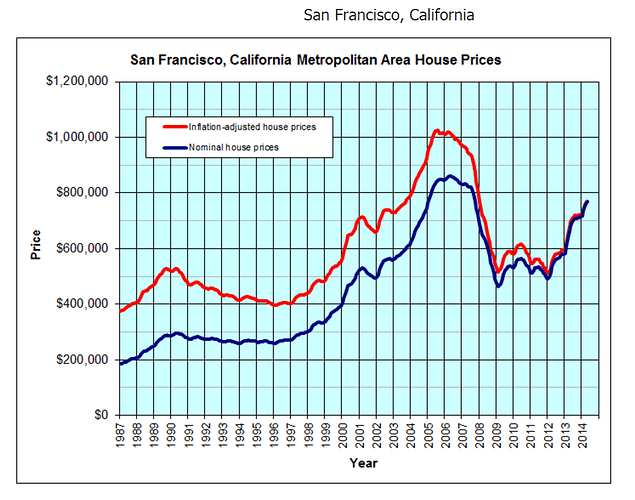

In all these years of boom and bust, what happened? Centers of Excellence like the Fab 7x7 survived and came back even stronger. What happened to the real Outside Lands like Sacramento? Like Antioch? Like Stockton? Oh, oh, its different now… Yeah right… Garbage is garbage

Appreciate all the feedback and perspectives - thank you so much!

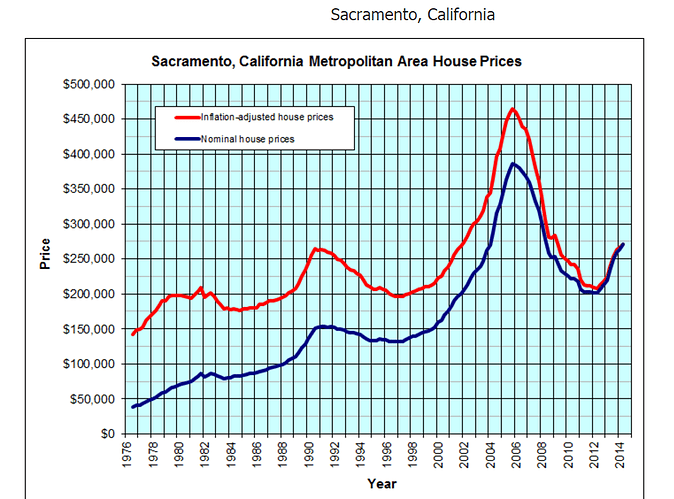

I was semi-interested in Sacramento region. It seems a nice place to live. How was the historical appreciation in last 30 years? Is it comparable to SF?

I will try to find some comparison numbers between cities but honestly I have a real feeling that SF blew away Sacramento over the last 30 years. You can almost tell by the current status of Sacto pricing right? It is only now or fairly recently that it is going up (again). In the past, it fell a lot while SF did not hardly.

Sac is a big market…Even South Lake Tahoe is part of the Sac MSA. …The highest return I ever made was in south Sac…the worst part of town…Pulled out 6 times my investment in 2 years.And still have 3 times my investment in equity…Big returns, mean big risk though…I still think Tahoe has bargains…No vacancies, high job growth and lots of millennials coming for the lifestyle. Downtown metro Sac has high rents now…Follow the trend outwards…Starting to hit south Sac…The increase in min wage is guareenteed 50% by 2022…That means huge rent increase for B and C apartments. .nobody builds those…

BTW, our rents never dropped since 1999…But they didnt go up much either…They will soon though…Rents are going up across the country…it is a nationwide trend…Not enough construction, millennials are holding off buying…and apartments near urban areas have high walkablity…If you can find a rehab potential in downtown, should be a winner…Also government never shrinks…they will always be hiring…All that Silicon Valley income tax money ends up in Sac…

The question is are you looking for rentals or a home…Different issues…If I was buying a house it would be in Eldorado Hills…Or Granite Bay.

Apartments —downtown or South Sac…the new EPA…

https://www.rentjungle.com/average-rent-in-sacramento-rent-trends/

In Sac

SInce construction is limited in the near future, occupancy is expected to reach 96.6 percent and rent is forecasted to rise another 9.6 percent in 2017.

Finally some interest in my current home city… how lovely.

The rising tides are finally coming to my area