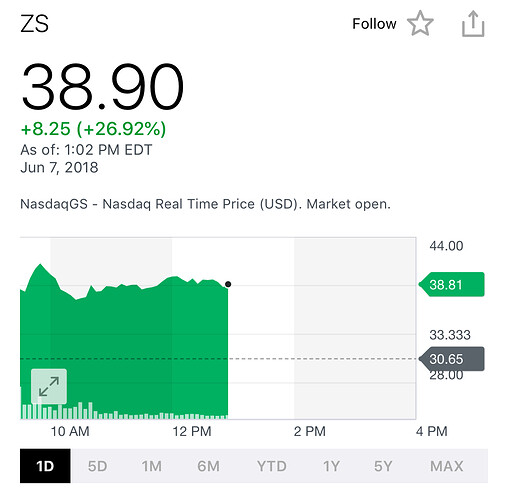

Is this why PANW and SPLK drop today? Sell’em to buy Zscaler?

That’s probably a short-tern drop then.

Zscaler Inc. (ZS) sells cloud security software that lets IT departments monitor all the traffic on your corporate network while protecting it and (hopefully) the workers. Zscaler’s (ZS) pitch focuses on it being a cloud native, while established rivals have had to adapt to “networks” becoming distributed global data centers supporting employees who log on from a variety of devices to a multitude of apps.

Zscaler (ZS) shares surged in their trading debut Friday, after the company priced its IPO late Thursday at $16, above an already elevated range. The $16-per-share price values the company at $1.88 billion. The stock jumped 70% in early trade on the Nasdaq exchange under the ticker symbol ZS.

Morgan Stanley and Goldman Sachs were the lead underwriters and, with the company, had originally planned to sell 10 million shares for $10 to $12, but bumped the price range to 12 million shares at $13 to $15.

Here’s what you need to know:

A hot offering ahead of bigger names

Zscaler (ZS) was privately valued at more than $1 billion in its last round of private funding, according to VentureSource, and is headed for a valuation of more than $1.5 billion at its initial public offering price this week. After planning to sell 10 million shares for $10 to $12 originally, the San Jose, Calif., company moved all those numbers up days ahead of the sale to 12 million shares and a $13-to-$15 range. At the midpoint, Zscaler (ZS) would pull in $168 million at an initial market cap of $1.64 billion, though valuations that count unvested shares would be higher

Despite the size of its IPO, Zscaler (ZS) has largely slipped under the radar ahead of debuts from two larger unicorn startups with names that more consumers recognize. Music-streaming app Spotify Inc and cloud-storage offering Dropbox Inc. are expected to enter the public markets within weeks, and the reaction to Zscaler (ZS) could indicate appetite for venture-backed startups.

In aiming for larger customers and its specific niche of software, Zscaler (ZS) is facing two formidable challengers in Cisco Systems Inc. (CSCO) and Symantec Corp. (SYMC) Cisco bought a similar company, OpenDNS, for more than $600 million in 2015, and it has added other startups to an offering it calls Umbrella.

Ulevitch was complimentary of his adversaries, calling Zscaler (ZS) “a really impressive business” and saying Symantec made a “brilliant move” in acquiring Blue Coat, but the relationship between Symantec and Zscaler (ZS) does not appear to be as chummy. Symantec has filed two lawsuits against Zscaler (ZS) claiming that the startup is infringing on its patents, leading to a lot of disclosure in SEC filings–Zscaler (ZS) mentioned Symantec 58 times in its prospectus, while Cisco was mentioned nine times and other rivals received no more than three mentions.

Growing revenue, growing losses

Zscaler (ZS) has managed to increase revenue at a solid rate, but its losses are growing as well. Sales grew from $53.7 million to $80.3 million to $125.7 million in the last three full fiscal years, with the most recent ending July 31, 2017. In the first six months of the current fiscal year, Zscaler (ZS) has accumulated $84.8 million in revenue, compared with $56.2 million in the same period the year before.

In the same three full fiscal years, Zscaler (ZS) has recorded net losses of $12.8 million, $27.4 million and $35.5 million, and it warns that it expects to continue incurring losses for the foreseeable future. In the first six months of the current fiscal year, the company lost $17.9 million, after losing $14.6 million in the same period the year before.

Strong overseas presence

Many American startups go public with a mature business in the U.S. and plans to expand overseas, but Zscaler (ZS) already gets more than half its business from outside the U.S. In fact, the U.S. has been its second-largest geographic segment in two of the past three years, behind a combination of Europe, the Middle East and Africa.

Zscaler’s (ZS) workforce is similarly constructed, with about 52% of workers stationed overseas, according to its prospectus. Zscaler (ZS) had 950 employees as of Jan. 31, more than double the number it had in 2015.

The company’s growth plans are more targeted than a general expansion of its overseas presence. It wants to specifically target Japan in seeking to boost its presence in its Asia Pacific segment, which is currently about 8% of its revenue, while looking to land federal government contracts in the United States.

More than 60% insider ownership

Zscaler (ZS) will offer a single class of stock with common voting rights, a rarity for a venture-backed startup of late (http://www.marketwatch.com/story/snap-backlash-facebook-capitulation-wont-stop-multi-class-stock-structures-2017-09- 22), but insiders will own more than 60% of the company after the offering. Chief Executive and co-founder Jay Chaudhry will own about 23% of the company, though an even larger percentage will go into trusts for his family managed by a trustee. Venture investor TPG has the next largest stake, at about 8%.

Four directors have collectively offered to buy up to $5 million in IPO shares, according to Zscaler’s (ZS) filing, including former Palo Alto Networks CEO Lane Bess and former Guidewire Software Inc. (GWRE) Chief Financial Officer Karen Blasing.

It’s interesting to see that two of the main competitors in the space are buying $5 million each of stock at IPO.

What do you guys think is a good entry point in this stock?

I don’t like to buy until after employee lockup expires. If you’re buying the next google or amazon, a few months won’t matter. It also helps you avoid buying the next stock that tanks.

This is the financials section of the S1. Losses have not increased that much YOY vs revenues.

The gross margin is amazing. I’m curious why the R&D spend is growing so much. If it’s developing new products, that’s great. I’ve seen where a growing customer base resulted in more issues that R&D had to fix with patches/updates to existing software. That’s bad R&D growth and means the business isn’t as scalable as thought. It was a result of a sales team that’d never turned down a sale and would sell software that wasn’t property designed for the use case.

My understanding is that ZScaler sells cloud security as a service solutions. Doesn’t SaaS typically have low cost of revenue and more OpEx?

Yes, it’s usually the sales and R&D expenses that are high. Those expenses hit a point where they increase much slower than revenue if a company scales correctly. That’s when they become highly profitable companies. That’s why I’m willing to invest in companies with a high gross margin that aren’t profitable yet as long as the growth is there.

How high? At least 35%?

My initial screen is 40% gross margin and 30% revenue growth. Then I start doing more research. That’s how I created the initial list in the 10x thread.

Lock up will expire in September. How many of its employees will be buying houses, and where?