TSLA is already there. All five are in the same industry. Data. Data Analytics. Cybersecurity. Doubt any of these can hit $1T market cap.

I look at SBC differently, since it’s not a cash expense. It’s diluting shareholders. So the real questions are:

- Is revenue growing fast enough that dilution is acceptable?

- Are non-GAAP earnings growing fast enough that dilution is acceptable?

Compare SBC to market cap not earnings.

Still have clover ![]() They are doing better each quarter so I’m not worried for now.

They are doing better each quarter so I’m not worried for now.

Didn’t you make most of your money from your AAPL bet back in the dot com days? And you have been saying we are in Dot Com 2.0 now. So are you going to make another fortune now?

.

I want to ride on Web 3.0/ metaverse to billionaire club ![]()

Take note: I have missed the Web 2.0.

That’s not going to happen if you keep holding most of your wealth in Aapl though.

BTW, that list is a joke. Tesla killer and Tesla killer 2… pretty much sums it up. The next 100 bagger won’t be a Tesla killer for sure.

1000 x $1M = $1B ![]()

The businesses they are in can’t scale to 1000x. The key is leadership and corporate governance. Outstanding leadership should be able to expand to related area eg from Mac to iOS devices and wearables.

Only one that matter ![]()

Instead of 100 baggers or 1000x, it is better to focus on 5x or 10x. I noticed some of the known companies are missed simply to grab 10x (from 2020 bottom)

- NIO ($2.63 to $65 (peak) and now $10).

- DVN ($4.58 to $68.54)

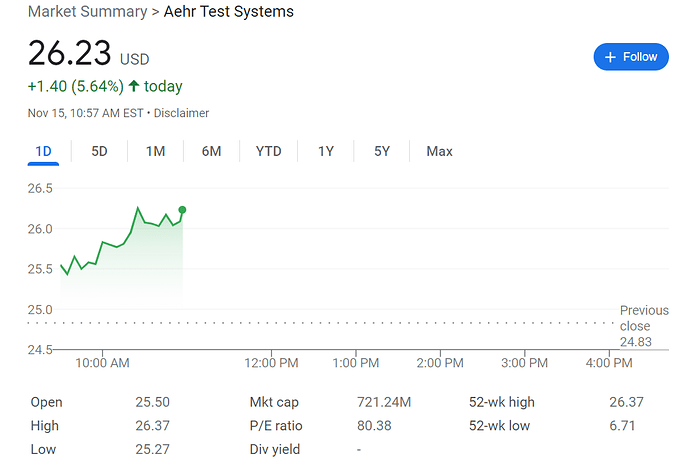

I just hold 1 AEHR to find the bottom (it may not reach the recent 6 months bottom) to get in. Hopefully, not interested in trading with AEHR (but never know what I will do!) I do not own any other.

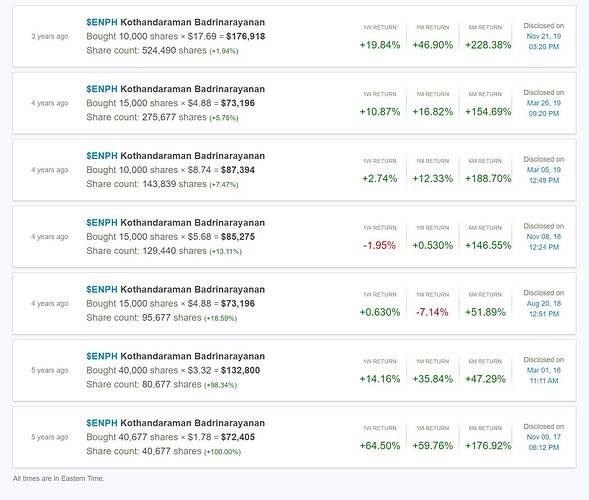

However, another stock I knew already was ENPH. Just publishing here how important CEO buys (ENPH) and sells (FB,TSLA) are for retailers make use of !

I knew this ENPH when I came to know the site ceo-buys, but never expected that to reach $300+ level. See how much this CEO was confident and bought bulk when he knew future is bright.

He seems like a smart guy.

Other than 1 share of AEHR, I hold 1 share of NLY, GSK and UMC. Trying to get dividend shares at low cost ( even though dividends may be cut in future ). When market hits a possible bottom, planning to buy more.Also, this list may change in due course as I have not done and deep research.

I did not do and major fundamental analysis, May do in future, but knew these stocks for more than 2-3 years.

Expecting market comes to bottom in 2-5 months timeframe, I am planning for some dividend & growth stocks.

No more tech. No more QQQ. No more Nasdaq. What now?

BioTech? MRNA, BNTX, CRSP, DNA, …

Tsla, spaceX, and Twtr.

QQQ/TQQQ and SMH/SOXL will survive as usual. When the NDX gets rebalanced with new entries, everything will set it right. This has been happening ever since I know about QQQ. Same way with chip sector (but QQQ/TQQQ better with volume).

Regarding MRNA, BNTX, CRSP, DNA, my take is on MRNA, BNTX as I do not know about CRSP, DNA (they claim, but do not have strong fundamentals except you believe in Cathie wood).

Remember this: Bottom has not come yet. When it comes I will bulk load TQQQ/SOXL !