Databricks is a little harder to use. It’s also a powerful data processing platform that provides variety of SQL/R/python compute options, rich notebook capabilities and data cataloging. So in that sense it caters to a more important engineering centric audience

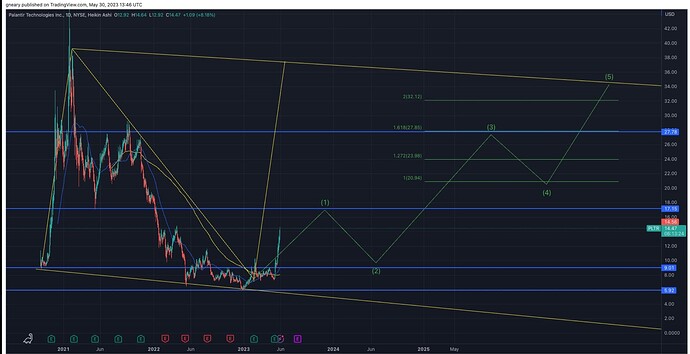

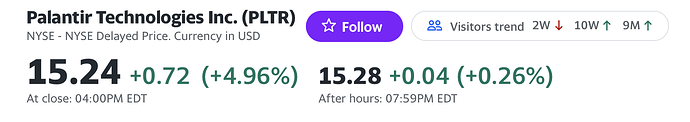

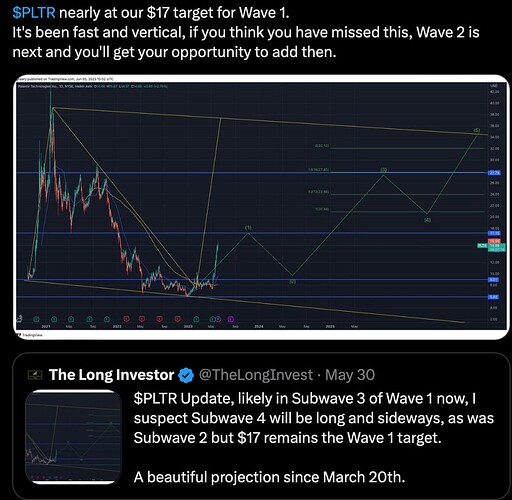

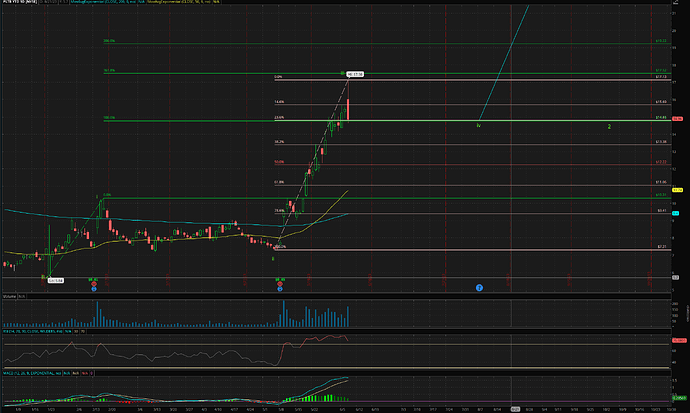

EW count of PLTR by a random Elliottician. Immediate target is $17 (investor: not selling) before pulling to $9 (investor: BTFD opportunity). Trader would plan to sell at $17 and re-buy at $9… LT, return of investor trumps the return of trader… plain truth.

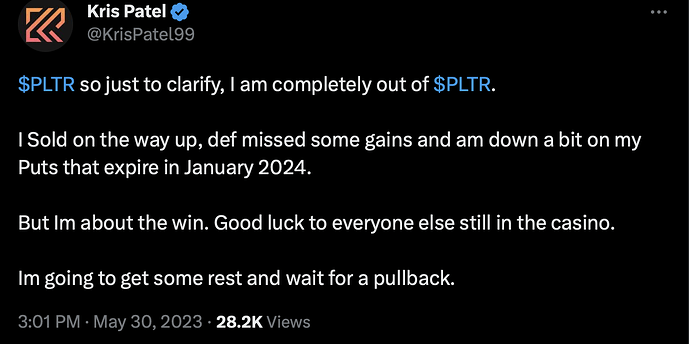

Kris, a true blue trader, sold out of PLTR…

$PLTR is currently one of the most talked about stocks in the market with lots of hype and fear of missing out.

Tom Nash assesses that the value of PLTR should be around $7. However, he won’t be selling any despite the overvaluation at ~$15. He has a LT mindset vs Kris’ trader mindset.

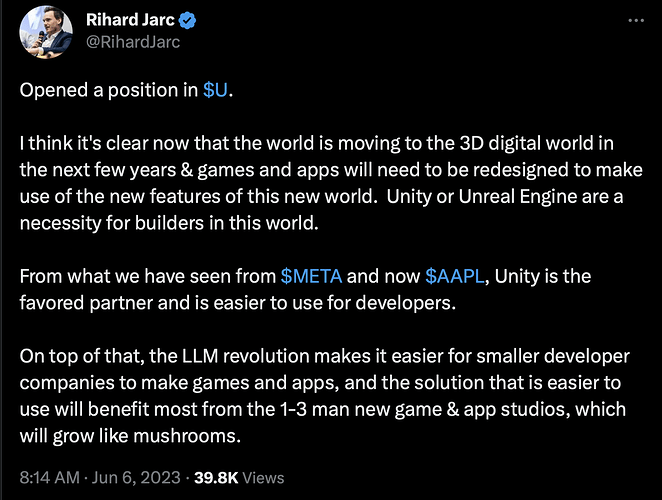

OP on Sep 2021…

ATL of PLTR is around $6. If PLTR becomes $1T market cap stock, is a 100 bagger ![]() from ATL.

from ATL.

Note: Since Fed started hiking rates, is an epic bear market for growth stocks.

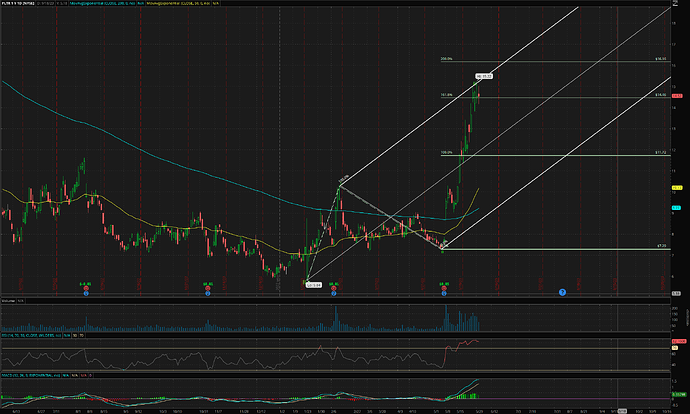

PLTR: Price target: Uber $500, base $118.

Stage Analysis: Clearly in stage 2

EWT: Cycle degree wave III Primary degree wave 1 Intermediary degree wave iii: Wave III.1.iii (completed or almost completed)… wave iv is mild pull back ~$2-$3.

Social Media Influencers: Tom Nash (hustler), CodeStrap (technologist), Amit Kukreja (cultist)

Disclosure: Holding 4000 shares @~14 finally green ![]()

Interview with Alex Karp on AIP…

Waiting for the inevitable wave 2 (currently is at wave 1.iii) pull back to add.

Note: The count by a random Elliottician is differed slightly from mine.

SMH.

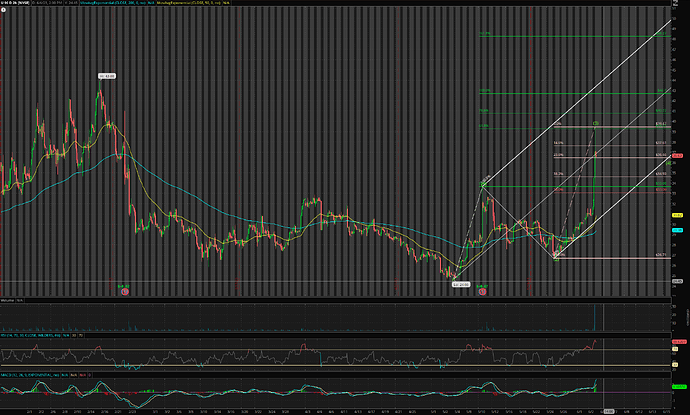

Another potential 10 bagger from ATL $$21.65. Current ATH $141.60.

Definition of a 10 bagger = 10x over 10 years. CAGR = 25.89%. First confirmation is double over 3 years.

Btw, CAGR of AAPL since 1997 is ~29% ![]()

.

![]()

I believe PLTR is in intermediary degree wave iv of primary degree wave 1… wave 1.iv. Given the nosedive, I suspect wave iv is a flat… ofc, could also be a triangle… we’ll see what is the price action for the next few trading days.

Note:

The random Elliottician counts $17.16 as completion of wave 1.v, I count as 1.iii.

…

Did you add to NET today? Just added ![]()

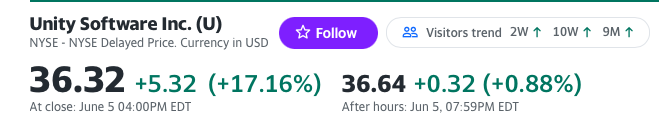

SOFI is poised to break above $8… if it happens… some1 is going to miss the inevitable 10x return.

.

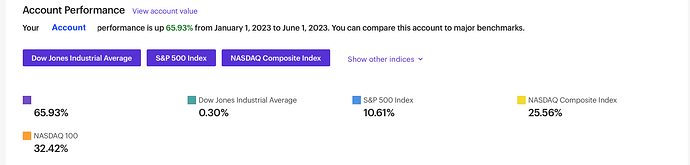

Almost 50% gain within 24 hrs… bragging rights…

Ok… ok… I know… not enough to buy an Vision Pro… nevertheless bragging rights… is how social media influencers like to do… post %gain without the absolute dollar gain.

Bear in mind: SOFI is the go-to-bank for gen-z, the current hot-headed youth.

The need for consulting to setup the software will limit how quickly they can scale adding more customers. Most companies data is a complete mess though. It takes a lot of work to get all the data into one place for data science, ML, and AI can work.

Criteria for choosing 100 baggers.

https://twitter.com/QCompounding/status/1667877411147468801

I’m surprised the revenue growth is only 5%. That’s barely faster than average GDP growth. Profits growing faster than revenue means a company is gaining operating leverage as it grows. It’s why I’ve been against a lot of “tech” startups which are really operations companies. They don’t get leverage the way a software company does when scaling.