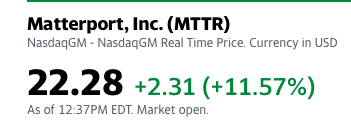

MTTR ABNB rock.

MTTR ABNB rock.

I bought some LCID too.

Yes, LCID rocks too. In momentum too. Not enough $ already  and don’t feel like using margin.

and don’t feel like using margin.

Yes, I do not know how long it will run. But, my friend say it can give serious challange to TSLA in high end market for EV

Another one that had good run is APPS, but seems stalled for now.

I want to focus meta verse stocks. Plan to hold 15-20 years. MTTR will be huge in meta verse.

I blindly bought some APPS, what is your thought on it?

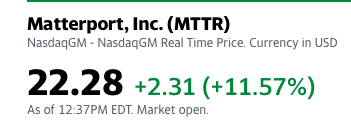

I bought MTTR calls yesterday  . Thanks!

. Thanks!

MTTR Feb 18 2022 25.00 Call

.

No idea. Heard JC mention it. I thought TTD is better.

I started a position last month which I’ve exited due to valuation but keeping it on top of my watchlist and watching for more evidence of them becoming a platform.

Richard,

You are behaving like @manch. By the time it is evident, stock price may be 10x current price. I think he missed out the next step. Taking 3D of buildings for RE industry is like iPod, no big deal. Is the “iPhone” (meta verse) that we are waiting for.

While Matterport has strong value propositions for real estate owners and massive growth potential, a few things prevented me from taking a position in the company.

First, there are many alternatives and competitors out there which means no-to-narrow moat. Secondly, advancements in smartphone technology may eventually make Matterport cameras obsolete, thus, eroding their value proposition. Finally, valuations are too rich at the moment — management even compared themselves to Zoom (ZM), Netflix (NFLX), and PayPal (PYPL), claiming that Matterport has the potential to be a $100 billion company. These are red flags, which is why I’ll sit on the sidelines for now.

There are always competitors. Having competitors doesn’t mean no moat… craps, how did FB trumped the rest? Valuation for promising companies has always been very high. All these have been said about SHOP.

APPS is up today 5+%. Is it one of the potential 100 bagger?

Didn’t study AAPS. Focus on meta verse stocks only.

Unity Software CEO on the metaverse and enabling real-time 3D in retail, sports and other industries

Above interview by JC is worth…

This stock has the best chance to gun for 100 bagger since IPO. IPO: $52 on Sep 17, 2020. Price is already 2.6x of IPO.

Look at mattaport in RE listings. Been around for a few years. Hasn’t really taken off. More like Peleton than Tesla. An unneeded product that is mildly popular. Another meme stock?

I paid to have on a listing, my Nevada realtor insisted on it. Cost $500 for the service. Had limited value. Might have some other applications?

.

Read more and you know why it is a great company and a great stock.

You haven’t sold me and have actually used their product

Refer to meta verse thread and previous posts here (about 1 day ago).

You don’t like it and you still have to pay for it. Sounds bullish to me…

An Article to convince @manch that PLTR is a potential 100 bagger.

CEO: Alex Karp

IPO: Sep 30, 2020

IPO price: $10

Current price: $27.43