.

More bearable than import duty at the point of import.

.

More bearable than import duty at the point of import.

If they import parts, they pay duty at parts price $20 for example.

If they sell finish goods say iPhone, they pay duty at $1000.

The FTZ are special locations aimed for FTZ ( free trade zone duty free ) international trade. Any violations will trigger severe punishment. Normally, well known companies won’t cheat as they maintain name and good relationship with government authorities, rules and laws.

When asked during the call on Thursday about Apple’s opportunities within the Metaverse, Cook responded “we see a lot of potential in this space and are investing accordingly.”

In a lot of ways, a future Apple AR headset’s logical flight path should be clear from just studying the pieces already laid out. Apple acquired VR media-streaming company NextVR in 2020 and it bought AR headset lens-maker Akonia Holographics in 2018.

Kuo previously predicted that Apple’s VR-AR headset would arrive in the fourth quarter of 2022 with Wi-Fi 6 and 6E support. While that date looks like it’s slipped to 2023, Kuo has also predicted that Apple smart glasses may arrive in 2025 and maybe AR contact lenses after that.

The company’s “goal is to replace the iPhone with AR in 10 years,” Kuo explains in a note to investors, seen by MacRumors. The device could be relatively lightweight, about 300 to 400 grams (roughly 10.5 to 14 ounces), according to Kuo.

Not many here believe in metaverse/omniverse, but I do ![]() + Web 3.0 + NFT + blockchain

+ Web 3.0 + NFT + blockchain

No more iPhone? Apple Glass + AirPods (if need audio/voice) + Apple Watch (for control?) + Apple Ring?

Apple Watch Ultra ![]()

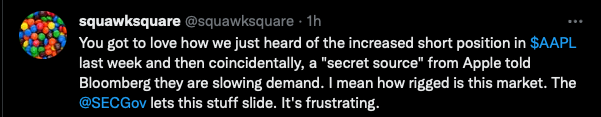

Click bait article from Bloomberg.

Instead, the Cupertino, California-headquartered company will aim to produce 90 million handsets for the period, nearly the same number as a year ago and in line with Apple’s original forecast this summer, the report said.

Demand for the higher-priced iPhone 14 Pro models is stronger than for the entry-level versions and at least one Apple supplier is shifting production capacity from lower-priced iPhones to premium models, Bloomberg reported.

Ceteris paribus. Selling more higher priced model should mean increased ASP of iPhones which should mean increased eps which should mean increased share price.

Past bearish articles…

iPhone 12

https://pocketnow.com/apple-reduce-iphone-12-mini-production-far-lower-demand-than-expected/

iPhone 11

iPhone X

Below is a chart showing past shipments of iPhone per quarter. Wondering where did Bloomberg get the info that Apple plans to have production of nearly 110 units. Given the trend, I would expect the planned production to be 80 million. According to the article, production is expected to be 90 million ![]()

Ahhh! This is very common rumor after every iphone release !

This is the reason for premarket sell off big time, lot of people scared with AAPL news Bloomberg and selling stocks.This is total retail attitude of rumors created by ( truth or false we do not know) Bloomberg!

Those who sold premarket and panic selling regular market will regret later.On any case, it will be fun when market closes way positive today. Hopefully, today is day of reversal.

Let us wait and watch the fun!

.

Happen so often yet work. It means many AAPL investors are new to AAPL. The positive aspect of this is the number of AAPL investors is increasing ![]()

On watch screen, I notice both AAPL and TSLA went red while the market is green. So whoever want to force the market down by shorting (+ spreading FUDs) AAPL and TSLA is not successful.

Because…

big boys exploit…

People sell based on rumors, never mind about it, it is common. As long as fundamentals are good, stocks are good long term.

Yesterday, you asked whether there is a possibility that S&P & Nasdaq can go down while AAPL & TSLA is held up.

However, your question is answered on the opposite side.

Today market answered, S&P & Nasdaq can go up while AAPL & TSLA is held down.

Reverse will also be true sometimes!

Any permutations and combinations possible with US stocks as they are very few restrictions.

As an AAPL permabull, my optimistic bull count is…

Hard not to be a permbull because…

a. Increasing service revenue due to increasing installed base + more category of services offered + increasing ads revenue

b. Impending launch of metaverse (aka omniverse, mixed reality) products such as Apple RealityOne (headset) and Apple Glass.

c. Increasing ASP of iPhones and wearables

d. Huge cash hoards

This is not good, BAC is also shed their some shares(would have completed before downgrade).

Blogosphere is full of needing AAPL and TSLA to crack for retail capitulation and market bottom. This is a message from the Black Hand for other big boys to follow. Is up to retail investors to play along or stand firm. Expect increased volatility from tugs of war.

Retail can not stand with any big players. Market drops, sell off, one by one in phased way to make a bottom. When you were telling AAPL and TSLA not going down, I knew (did not like to confront at that time as you will know the truth some day) that they will go down some time later.

It is pure rotation, when market tanks big players see which is better to take cash and they will sell whatever that did not go down much. This way, they sell least amount of shares at highest return to match the rate hike impact.

Simply state, it is asset allocation 80 stocks 20 bonds to 60 stocks and 40 bonds kind of calculation. Every stock will get hit in this process.

Rotation is not inconsistent, is same event, up to you to put meaning to it.

WS has been trying, finally a good story.

I know you won’t agree, that is perfectly fine. Yes, inconsistent will always be there and it is normal.

When you said “AAPL & TSLA did not go down while other stocks went down”. Exactly similar inconsistency happened too, right. When it is in our favor, we appreciate it, otherwise we hate it.

Simple truth is economic impact affects every company and big holders reallocate their portfolio and every company gets affects.

WS has been trying, finally a good story => It is wall street selling spree, but story is written by news/media to convince readers.

However, if fundamentals are strong, holders like you need not be concerned by this sell off. It is like holding Cupertino home forever, both appreciation and rent continue to flow.

Can you and Wu just liquidate all your positions so we can finally have some good days ahead? Obviously you guys are the problem. Take one for the team!

Adding fuel to fire ! LOL !!