I actually wouldn’t mind having more dividends because I can use that to offset margin interest so there’d be no tax I’d need to pay.

Share buyback increased your concentration in the company forced upon by the leadership.

Dividends (double taxed, so what?) let you decide what to do with the cash, ofc you can choose to invest in AAPLs, or buy more rentals or buy index funds.

Goal of share buyback should only be to compensate for RSUs/ ESPPs dilution, nothing more, company should not make stock investment decision! Is obvious that the hidden goal of share buyback is to push up eps which push up share price which benefit… yes, those who have tons of RSUs… who have those? Correct, the leadership.

Any1 who vote for share buyback to increase share price plan to sell shortly, by definition, not long term investors. Leadership want to sell shortly (they are given tons of RSUs every year so they sell whenever RSUs vest), vote for share buyback. Institutions want to sell shortly, vote for share buyback. @wuqijun wants to hold for a long time, like decades, didn’t want share buyback.

You and hanera prefers dividends as your purchase price was $10 and $3 respectively, but that is not the case for institutional investors. They want growth of their stock value, and vote for buy backs.

If they want to buy Netflix they wouldn’t be rolling out their own streaming service.

Mostly, you and WQJ, talk aapl buybacks from your point of view.

But, you are minority considering big institutions and hedge funds, they want to show the clients big growth( than dividends) to be attractive. They vote for buybacks, moving company cash position to investment position without adding double taxation.

Buybacks not only used for espp and rsu, they will use it for take over/merger. They use it in any forms transactions to substitute cash.

Buybacks and dividends just show the lack of ideas on Apple’s part. Apple will always be a heavy user of silicon no matter what it does. Why not use the cash to buy micron or better yet TSMC? If it didn’t waste money on dividend Apple can buy a couple Intel’s with cash to spare.

My preference is SJ’s practice and philosophy. Leave as cash, and buy core technologies. Also to fund the dream of selling products at 10% above white box (that is SJ’s dream). I actually don’t like share buyback and dividends.

Steve Jobs took the long bet to buy chip making startups and now it’s the absolute core strength of Apple. I don’t think TC would have made the same bet. How many semiconductors startups has Apple bought since Jobs passed away? I can’t think of any.

He knew it was a key to future differentiation. Everyone using Intel always limits PC differentiation. Yeah, there’s AMD, but how tiny is their market share?

near the counter-trend target of $176.57. Will AAPL break above it thereby robbing @manch’s chance of ever buying at dreamy price of $100! ?

near the counter-trend target of $176.57. Will AAPL break above it thereby robbing @manch’s chance of ever buying at dreamy price of $100! ?

Can we learn the lesson that revised guidance is a BTFD lifetime buying opportunity and not a time to sell! Apparently the blogger and commentator who took the opportunity to bash AAPL had went into hiding.

Apple To Release New Video Streaming Service This Spring

Traders are betting on Apple Video Streaming Service! Beware of sell the news!

Apple’s service revenue growth is still highly correlated to iPhone sales. The biggest is the App Store tax and second is probably apple care. So to grow service without increasing iPhone sales they have to find ways to get more money from existing users. If you’ve used apple’s service software like maps or Siri you should be worried. They’re POS.

Are you going to write a FUD article like Molly Wood, APPLE, THE IPHONE, AND THE INNOVATOR’S DILEMMA

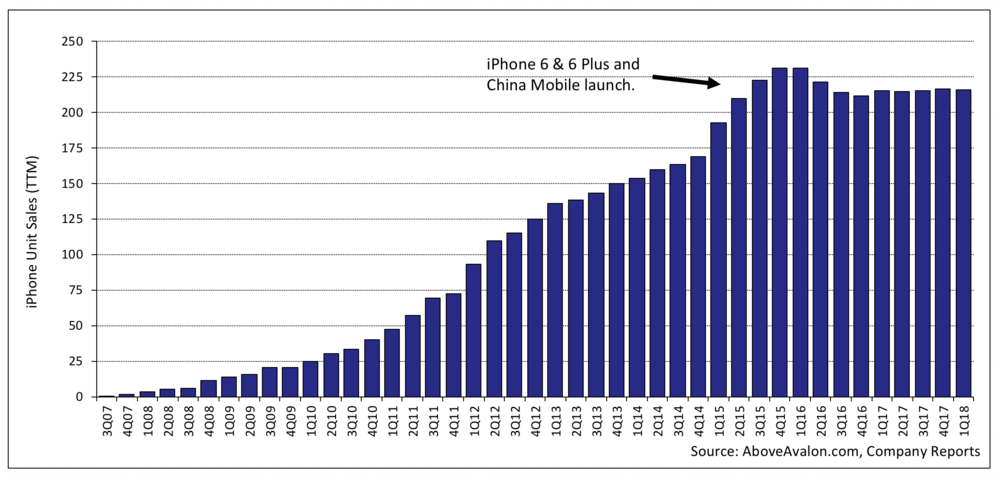

iPhone sales have declined from the peak. That’s what all the bears keep saying. Yet, services revenue keeps growing. I’m guessing the two graphs would have a terrible correlation coefficient.

Services (including AppleCare) correlate closer to installed base (~1 billion) than unit sales (~200 million). Regardless of the age of iPhones, can still use services (may be not AppleCare), so installed base is more relevant when evaluating services. Don’t forget one of the reason for plateau-ing sale is consumers are taking longer to upgrade, still using the iPhone

iPhone sales compared with service revenue growth.

Assuming most new users (as in didn’t own an iPhone before) behave like me, sales to new users would correlate to growth of service revenue. Apple used to provide this info, didn’t read their reports in detail nowadays, so not sure whether they still provide this number. From memory, should be between 10-15%.

Just checked last quarter results, Apple said 19% growth yoy. Assuming 15% are new users, the other 4% could be due to more people using AppleMusic (launched in 2015) and more expensive services (did AppleCare costs more for iPhone X series)? Too lazy to analyze any deeper ![]()

Uh oh. Retail chief leaving.

She’s a career “gold digger”. Always looking for greener pastures. Good riddance.

The fact that the stock didn’t move on her departure news shows the kind of significance she has.

Good news.

Exactly.

After five transformative years leading the company’s retail and online stores, Angela Ahrendts plans to depart Apple in April for new personal and professional pursuits.

Her major achievement is to be blindsided by China accelerated slowdown, causing Apple to have 7 millions (assuming unit cost is about $1k, miss guidance of $7B) of unsold iPhone X series.