That bust is obvious in Nvidia’s revenues this year: they are essentially flat for three quarters now, hovering between $3.1 and $3.2 billion.

Almost 20% of Nvidia’s $9.7 billion in revenue last year came from China. Many of its chips are used there for assembly into other products, and it has invested heavily to tap China’s burgeoning AI industries.

When it comes to owning next-generation application workflows, Nvidia is facing robust competition from startups and established players who want access to this potentially gigantic market. Even its potential customers are competing with it. Facebook is reportedly designing its own chips, Apple has been doing so for years, Google has been in the game a while and Amazon is getting into the game fast. Nvidia has the know-how to compete, but these companies also understand the nuances of their applications really, really well. It’s a tough market position to be in.

CAN’T MAKE CONSECUTIVE 3 POSTS. So have to edit this post.

Time to buy MU on an auspicious day 1228?

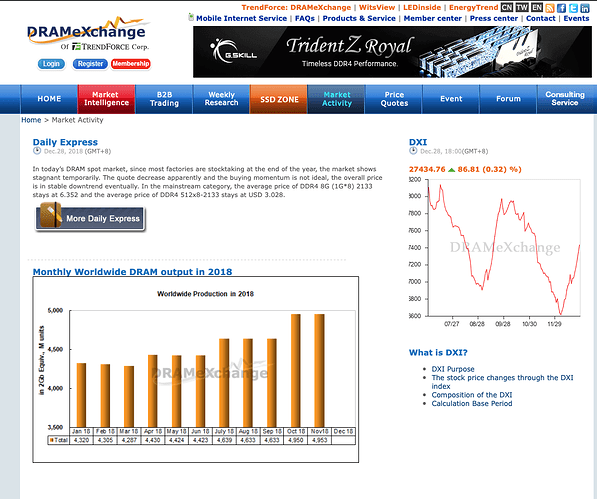

Dram prices are increasing AGAIN.