Well, since Jill is pandering or recommending his products, I will do that too. This forum should be to help, recommend, do good deals among posters, let the posters decide which plan the love the most.

If you are a high earner, with a big net worth, you are better putting your money into an IUL.

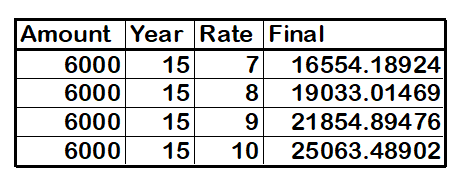

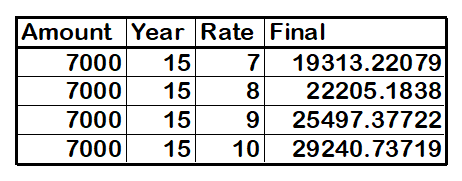

75%-80% of your contributions will be in your hands, while another 75%- 80% will be in the S&P 500 earning at least 7% compounding interests as Jil told us in another topic, S&P500 returns have been 7% in the last 20 years or so.

Contributions are not limited pathetically as of any of the above programs. You can open a policy reflected in 20-23 times your income. $10K a month? Easy! You get $8K in your hands and $8K in the S&P500.

That is called leverage of your money. $10K = $16K in your hands.

The insurance company, contrary to the 401Ks and so forth, invests your money, when they make a profit they will give you a return, if they lose, they lose their money, yours is protected by 0% returns.

If you had put a total of $100K into an IUL for 20 years, you could be scheduling your retirement income right now disregarding if you are 50 or 60, receiving $80K-$120K, tax free, year after year, for the rest of your life, up to age 120.

Don’t let the brokers keep 100% of your money. At the whim of the risky stock market where you lose 10%, you have to make 11% or more just to get even. To be a winner right now, you need the stock market to reach 28,000 points. Just ro recover your losses.

Don’t let these brokers punish you for having an emergency when you make a loan, or get penalized 10% for closing your account. They are charging you up to 24 fees, Google it, or go to YouTube.

There’s no retirement age limitations. You can schedule your income in 15-30+ years if you wish so.

The 5%-10% many Americans in retirement lost recently, wouldn’t happen with owning an IUL.

Why? Because when the market goes under, you get 0%, but as soon as the market recovers, even in the negative territory, the IULs are giving you returns.

Have a nice retirement age, don’t depend on age, contribution limits, minimum distributions where you are forced to withdraw your money even if you don’t need it, otherwise, you get penalized.

It’s your money, right? Why giving somebody else the control over it?