Nice discussion. I wish the subject of the thread described the discussion better. Something like post retirement asset allocation and drawing strategies.

As I explained to @Jil, no, you don’t worry paying for the margin. Just let the debt accumulates. The bet is that the long term 10% appreciation of S&P will make the debt look smaller and smaller over time.

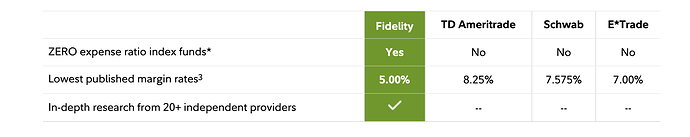

Where did you get the 6.75% number? Time to switch brokerage.

Feel free to plug the numbers into excel.

Same f… strategy for RE, appreciation play. Meanwhile cashflow negative. Doesn’t sound wise.

Better pray no recession or something geopolitical that crashes S&P. You need to pay 6.75% regardless of the worth of your portfolio. For a period of 10 years, dividends need to grow at an annual rate of 13% just to breakeven with cost of margin. Meanwhile need cash for paying margin for 10 years.

Still higher than 1.95%. At 5%, need 9.9% average annualized return over 10 years to breakeven.

It’s factored in. How low do you think s&p will go in your “crash” scenario? 50%? 75%? 90%? How will your options strategy fare in these scenarios?

Keep in mind some of the most violent upswings happen in bear markets.

can you borrow and buy more in a crash scenario? Assuming it takes a year or so to recover from crash. What is a duration of a typical downturn? Looks like the one in 2008 took about 2 and half years.

Cashflow positive ![]() Always cashflow positive. It works in all cycles and doesn’t matter what price you start with. Read below:

Always cashflow positive. It works in all cycles and doesn’t matter what price you start with. Read below:

Your approach can’t withstand one because it is cashflow negative for 10 years. Any recession during the 10 years can destroy your portfolio. Cost of margin stays the same and dividends received in absolute dollars are likely to decrease during the recession i.e. more cash injection needed. Beware that brokerage may want you to top up with cash or forced sell your stock/ETF after a decline of x% in value.

Recession is not as damaging after 10 years since it becomes cashflow positive, assuming margin rate isn’t float and stay fixed.

Btw, hope you are not comparing the two approaches, one is with margin, one is no margin. Chicken and duck. Btw, miss your “with margin” in the original post, otherwise won’t bring up the alternative approach.

What if every time you sell covered calls, your stocks got called away? Then your strategy is nothing more than selling your holding to take cash out. Overtime your principle will dwindle toward zero. It’s not sustainable.

Don’t get too hung up on debt vs no debt. It’s just a financial instrument not unlike equity. Like a house there is a certain range of earthquake it can withstand. Similarly taking on debt can be dangerous over a certain range. No house can withstand a scale 10 quake. No retirement position can withstand a 90% fall.

What talk you? Called away means appreciating, I make ton of $.

Buy $267, called away at $320.

Buy $325, called away at $360.

…

Principal is increasing, not decreasing.

You can’t compare debt vs no debt strategy.

BS. I withstand over 90% drop in AAPL a few times. No debt of course. So no margin call and forced selling. I was retired as in unemployed! with no unemployment benefits, no help from USG, nada.

.

@caiguycaiguy Quite often you delete what you have typed few seconds later but we all read it ![]()

That is the biggest risk with single stock whether it is AAPL or OXY. S&P 500 means spreading the risk across 500 companies.

Quick question: Whether margin payment is tax deductible?

That’s why I added to my comments that the biggest upswings happened in bear markets. Long term trajectory can be down and yet short term upswings can call your shares away.

Note that I said “retirement position”, meaning you need to take cash out, somehow, for living expenses. If you don’t have to take money out, then my strategy is rock solid too because I will just not do anything.

One reason why I explicitly used VOO as example is that if VOO crashes 90% we are in the most serious depression this country has ever seen and we should all load up on guns and ammunition. Forget about stocks.

As WB said, don’t mixed up volatility with risk ![]() Buy n hold broken stock of a rock solid company is not a risky move. Buying stock of a broken company, regardless of price is a risky move.

Buy n hold broken stock of a rock solid company is not a risky move. Buying stock of a broken company, regardless of price is a risky move.

I was already retired then ![]() Your margin approach need cash injection! cash injection!

Your margin approach need cash injection! cash injection!

You don’t take from one, can take from the other ![]() Btw, AAPL starts paying dividends in late 2012, no over 90% decline since then, nearly 60% in 2018

Btw, AAPL starts paying dividends in late 2012, no over 90% decline since then, nearly 60% in 2018 ![]() How many investors did this,

How many investors did this,

" Buy when there’s blood in the streets , even if the blood is your own."

I think @caiguycaiguy did.

We are not talking about GTAT ![]() You always conveniently forget about the important caveat: Rock solid fundamentals, broken stock not broken company, due diligence.

You always conveniently forget about the important caveat: Rock solid fundamentals, broken stock not broken company, due diligence.

By making your wife work? ![]()