Is like asking me what do I expect the return of AAPL in 1997-2000, awful just like Prime ![]() initiative. I am expecting an inflection point sometime in the future.

initiative. I am expecting an inflection point sometime in the future.

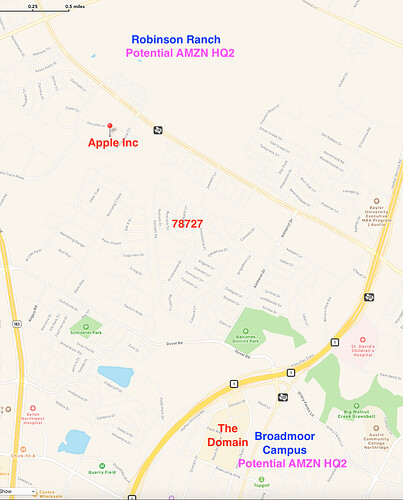

Inflection depends whether bezos chooses austin for HQ2. If not that inflection point may go to another region.

You may well be correct. You don’t think the other FANG might increase their presence there?

Not many places to choose from, Austin, Atlanta, RTP (Raleigh mostly), Denver. Rest not so good.

More FANG may well move into Austin. But we are talking about amazon creating a Seattle 2.0. That can dwarfs any organic growth in Austin.

In short I am saying Austin is good but there may be better choices. Will see in 3 months.

In any case, wasn’t banking on AMZN HQ 2. Might create a sudden jump in prices causing a huge jump in property tax thus killing my cash flow (hate to use cap rate, talk to many realtors/ PMs, nobody seem to understand that, guess is mom&pop guys’ lingo?). Rents can’t be increased drastically as pay doesn’t jump up suddenly because of HQ2 announcement, hence can pay higher rent. The announcement likely to force me to unload my rentals.

No don’t unload. People don’t react all at the same time. For every investor tuned into amazon and HQ2, there are 2 more who will say amazon is in a bubble waiting to burst.

Amazon is going to a DC suburb

I think AMZN is going to DC too, or Toronto.

That area is still extremely tempting for me. How easy or difficult has it been for you to rent out your place? Do you handle finding, screening, and selecting the tenants yourself? We always have, but we have not had any tenant turnover in over almost 15 years here.

Are you talking about DC suburb, Toronto or Near The Domain?

If you’re referring to The Domain, from my experience, varies according to the month and condition of the house. Well maintained or re-modeled rents out very fast, can be shorter than 2 weeks upon listing (signed lease within 1 week and move in 1 week later). Bad months (late fall to winter) and original condition has to offer high agent fees and as long as 1 month after listing. So far, no turnover yet ![]() Probably because were rented to single, one man/ woman occur the entire house. Have 3 SFHs there, one bought recently and rented out in less than 10 days (listing to occupation). The other 2 SFHs were bought 3-4 years ago - no turnover yet

Probably because were rented to single, one man/ woman occur the entire house. Have 3 SFHs there, one bought recently and rented out in less than 10 days (listing to occupation). The other 2 SFHs were bought 3-4 years ago - no turnover yet ![]()

I use property manager. Kind of turnkey service, no inputs from me ![]() except for repairs over $500 (most of the times is replacement of very old appliance). I didn’t really bother with renewal increment… based on my assessment of property tax and income of tenants, so far I have no reason to disagree.

except for repairs over $500 (most of the times is replacement of very old appliance). I didn’t really bother with renewal increment… based on my assessment of property tax and income of tenants, so far I have no reason to disagree.

If you want fast renting out and high cash flow, best to buy re-model, at least with kitchen and bath updated (the house there are fairly old, 1970s-1980s). The first two I bought are fairly old house with large lot > 10,000 sqft, betting on inflection point sometime in the future. Large lot means higher appreciation, hopefully ![]() from bay area’s experience. Also mean I can rebuild to a big house later if my assessment is correct. That is, I am betting on a big killing sometime in the future, meanwhile positive cash flow and moderate annual appreciation is good enough.

from bay area’s experience. Also mean I can rebuild to a big house later if my assessment is correct. That is, I am betting on a big killing sometime in the future, meanwhile positive cash flow and moderate annual appreciation is good enough.

Last time, price of houses varies from $220k-$400k (original to very well-remodeled)

Why not buy an apartment building like 8 or 20 units?

I answer that already many times. My PM prefers SFHs and condos, no MFs and apartments. Apartments are more complicated, talk over haidilao so as not to invite unnecessary comments. Thought you should know, I watch many HK movies/ TV series where big landlords own apartments ![]() You think those problems are not true? Haidilao idea is spawned from you saying you didn’t visit haidilao yet… so trying hard to find reason to go to haidilao. Haidilao meal worth less than 1 FB

You think those problems are not true? Haidilao idea is spawned from you saying you didn’t visit haidilao yet… so trying hard to find reason to go to haidilao. Haidilao meal worth less than 1 FB ![]()

Can’t afford haidilao until FB hits $200.

You don’t have to pay. At least two guys (wuqijun and me) can pay for your meal, we need a good reason ![]() to meet up.

to meet up.

You feeling okay?? This doesn’t sound like your typical self ![]()

Thank you very much for this info Hanera. Yes, I am interested in Domain area. If we buy there, we can most likely go for 2-3 homes in $350K range. We want to do a 1031 exchange from our Svl home and cash out some from the sale and pay tax on boot so we can buy a small apt in Tokyo as a place we can use when we visit. Another area we are interested in is Phoenix. We are at the age when we need to start using some of the money to enjoy life. But, at the same time, I do want the cash flow from rentals coming to us.

If Austin is chosen, the two possible sites are near 78727.

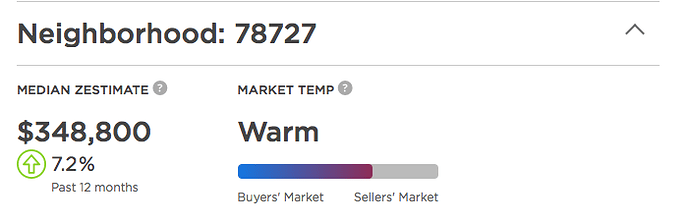

Inlined with national trend, cool down from very hot to warm.

A googler today sent his farewell email, saying in 2015 he started with 5 homes. Now he owns 100doors, and he is moving to houston to grow the business.