My guess would be most of those jobs would be paid a little over CA minimum wage(the ones with no college degree requirement)

.

Sale of houses closed in Jun is 60-80% above 2020 tax assessed value.

in CA? for houses which sold in 2020? asking because in CA tax assessed value comparison is kinda not useful ![]() due to prop 13. Only works for recently sold houses.

due to prop 13. Only works for recently sold houses.

When will Texas govt allow Tesla to sell cars directly in Texas? ![]()

Austin. This is Austin thread.

Had these jobs stayed in the California, they would still have paid minimum+ wages. A good comparison is amount of high paying jobs created in Austin that could have been created in SV.

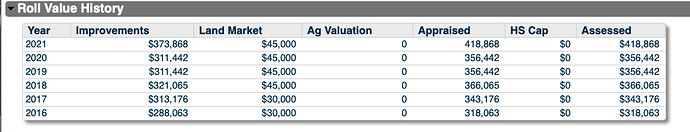

Do the Prop taxes levied reflect actual market value(let’s say redfin or zillow estimates)? When I checked online it didn’t seem so and the taxes are lower than market/estimates. Hence the comparisons 2020 to 2021 are higher.

He just couldn’t find many workers who would bust their behinds for those wages in CA.

.

AFAIK, assessed market made for first quarter, payable in last quarter, so the assessed value on the county’s website is 6 months behind. So assessed value for 2020 would be early 2020 market price.

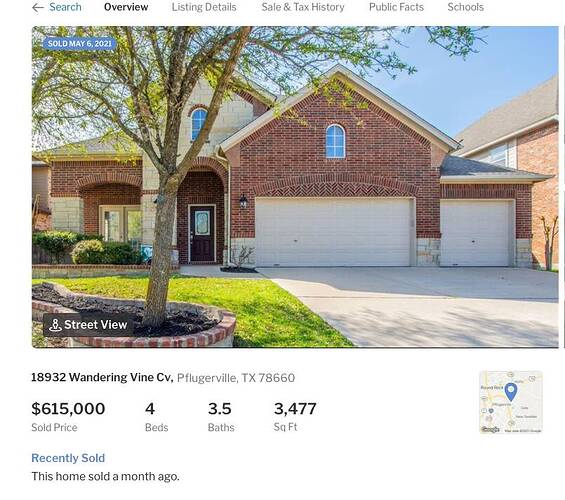

For example,

615/356 = +73%

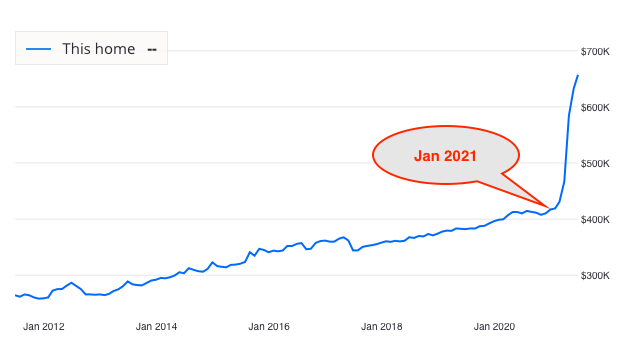

$419k is assessed market value for first quarter of 2021… Feb to now, prices shot up ![]() very fast.

very fast.

Is this number by government accurate as compared to zillow/comparable sales values? I was also checking Idaho/Boise and also Seattle area/Kirkland, the numbers assessed by local government seem to be lower than market value.

.

Usually lower.

Yeah so that + the early or late year assessment is the reason for the 60-80% number.

I have an advanced degree. Of course I won’t apply.

Go to Tesla’s jobs page. Bay Area is full of AI/ML engineer roles and Austin is people banging hammers.

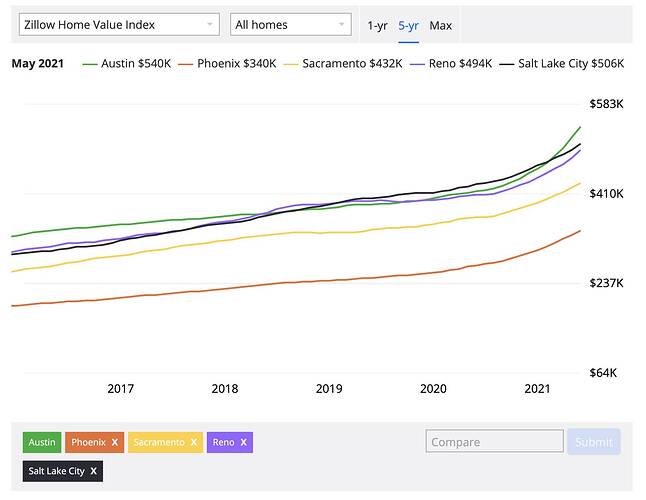

Austin’s boom has little to do with it being so-called a “tech hub”. Pretty much all the inland cities west of Mississippi are booming. Their magic power? Cheapness.

You can play with the data here:

https://www.zillow.com/austin-tx/home-values/

Comparing the 2015 Zillow home price index with the latest 2021 May data:

| 2015 | 2021 | ||

|---|---|---|---|

| Austin | 330 | 540 | 1.64 |

| Reno | 299 | 494 | 1.65 |

| Sac | 262 | 432 | 1.65 |

| Salt Lake City | 295 | 506 | 1.72 |

| Phoenix | 195 | 340 | 1.74 |

Austin’s appreciation is about the same as Reno and Sac, but slower than SLC and Phoenix.

Sacramento and Reno are better bets than typical valley towns with nothing but agricultural jobs.

Sacramento and Reno are good towns to invest, but for someone living in South Bay, 99 Corridor is less distance to drive for property upkeep and related issues

“At this point, Austin does not have a lot of land to build single-family homes in the core, …,” said Susan Horton, president of the Austin Board of Realtors.

Yay! ![]() Contrary to popular beliefs of Californians, there is not enough land to build. Price to the moon

Contrary to popular beliefs of Californians, there is not enough land to build. Price to the moon ![]()

SF market is hotter. Just sold for over $2.4, ask $1.6m. 13 offers.

https://www.zillow.com/homedetails/1972-10th-Ave-San-Francisco-CA-94116/15115235_zpid/

Pending… Zillow estimate is $1.94M.