Yes, yes, yes…+one

Are you sure? Besides, there aren’t currently any means there will never be?

As I explained before, smaller headcount in newer generations of tech companies is actually bearish for towns whose only purpose in life is to serve as overflow rooms for Bay Area. You know, towns like Austin.

Your like to look at issue from one perspective ![]()

Austin is a wrong choice for your illustration. Austin economy is diversified and doesn’t depend on tech, doesn’t depend on tech, doesn’t depend on tech,… should I repeat more ![]()

Austin has:

- Capital of Texas

- UoT

- Some military research centers

- Music

- Medical

- Tech, yes tech too (not that many startups as you like but many companies have expanded their ops & sp and css functions there + semis + Dell

+ manufacturing facilities)

+ manufacturing facilities)

Jobs are not the high paying ones like SWEs on R&D (actually ML/AI community is fairly sizable there) in SV but the steady stream of jobs coming in keep RE prices increasing but not the fits and starts style in SV. Tortoise vs hare.

Then why bother?

Isn’t your whole bull case for Austin based on that Apple campus? They are not paying well?

Who say that? I don’t rent to Apple employees. So far, I think only one tenant is from tech, rest from other industries. Apple employees are my competitors, they compete with me to buy rental and then flood the market with rentals. Thought I mention this a few times. Actually after the new campus announcement, my yield/cap rate drops significantly, now I have to either pause or move further away.

My bull case is steady growth from a diversified economy. Announcement by AAPL, FB and GOOG expanding there cause sudden spurts in prices, not good for yield.

So any experts have a short term forecast?

In the long term obviously we all are dead I.e. we all know the outcome as far as RE is concerned ,i.e. it will go up at inflation rate.

Still no match to SFBA. We, my friend and I, were two landed SFBA 25 years before, both are IT and he moved to Dallas within 12 months and I stayed here. His main concern, at that time mid 1990s, was high cost of living bay area !

Now, he can not match me and it is (mainly) SFBA real estate investments and opportunities to grow (can be done in Texas too).

Even though I do not like high CA taxes and other rules/regulations, I like this location being lived more than 2 decades.

I hope there are many like me, settled here, not moving out even though this is expensive place. It is not easy to move out.

Short-term is rounding error. It’s more important to focus on long-term trends.

The best way to understand how SFBA real estate is doing is to do this. This is my personal method and based upon my assumptions to which many will not agree with. That is not the point.

Use 1.5 as GDP deflator. This is how I come to this number. A lunch buffet that used to cost me $10 in 2010 costs $15 these days. You can use some other deflator, like ratio of the minimum wage in your city in 2010 and 2019. Or the price of a sandwich.Or use the government-provided number if you trust.

A home that is priced 1.5 M in today’s Dollars can be assumed to be priced $1 M in 2010 Dollars.

The homes that are selling at 1.5 M today cost about 700k in 2006, the year of peak price before the crash of 2008. In terms of 2010 dollars, the prices have risen from approx 700k to 1 M in about 10 years. If you calculate the rate of return in over 10 years, it is 3.63%.

However, these things can be said in favor of SFBA real estate and primary homes:

-

If financed with 20% down, a leverage of 5 provides an actual rate of return of 18.5% (3.63 x 5).

-

Primary home shelters taxes, which may not be much valuable anymore with SALT caps.

-

Home has a utility. You live there. You enjoy the bay area’s Mediterranean weather. You raise a family. It is your castle. It is your pride. These things are priceless. Aren’t they?

-

If purchased for investment, you are betting (or speculating) that prices will keep rising. So, if you are an income investor with minimum downpayment, it may not even make sense.

-

My rough calculation from REAL ESTATE is that you can expect a yield + appreciation of 10% per year.

-

Think of Bay Area real estate as a growth stock, and real estate in other inland areas as divided stock.

Omg ![]() . Austin not Dallas. Also, we are talking about future not the past

. Austin not Dallas. Also, we are talking about future not the past ![]()

Anyhoo, @BAGB has posted a chart showing over 50 years, BARE and Austin doesn’t have much difference in return. Hard to search this forum for past post, @manch needs to upgrade its search capability. The reason is prices in BARE has high volatility but prices in Austin increases steadily. For example, prices in BARE drop significantly during financial crisis while Austin prices are still increasing but slowly. Similar behavior since 2018 to now.

If the price appreciation rates don’t differ much, how come Bay Area houses are that much more expensive than Austin? There must be long periods in the past when SF prices pulled ahead of Austin. Keep in mind Austin was founded earlier than SF.

By being more volatile SFBA gives people lots of entry points. And arguably "right now is a great time to buy"™.

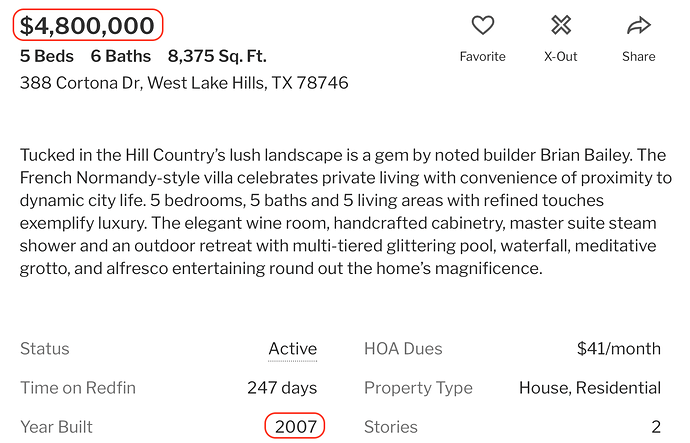

Houses where I buy is all newer than SV. There are many multi-million dollar houses in Austin. Obviously we are not talking about the same thing.

This house has been sitting on the market for 8 months. Are you saying the median price of Austin is higher than Bay Area?

No. I have been talking about median prices. My reasoning is pretty simple. House prices all started with pretty much just labor and material costs, because land is almost free in a newly established town. I don’t think labor and material costs would differ a lot say 150 years ago between Austin and SF. Fast forward to today house prices in SF is 3x that of Austin. So obviously during some long period of time within that 150 years SF houses were able to appreciate much faster than Austin. When was that period? You claimed price action in the last 50 years were similar. So sometime before 1970 SF was appreciating much faster than Austin but not anymore?

I didn’t ![]() @BAGB’s chart

@BAGB’s chart ![]() His chart is also about median prices. Told you don’t believe, so be it. Where is @BAGB? Post chart again.

His chart is also about median prices. Told you don’t believe, so be it. Where is @BAGB? Post chart again.

You make some valid points but focus on price too much. I would rather compare returns on % basis. Here is what I am getting:

Approx ROR for Bay Area = yield (3%) + appreciation (7%) = 10%

Approx ROR for Austin area = yield (8%) + apprecation (2%) = 10%

Price alone does not mean anything. I have a feeling Amazon must be selling like a penny stock to early investors.

Added Later: Real Estate in Bay Area sounds atrocious because of higher entry prices. Higher base price make the appreciation look bigger.

Startup to the rescue

A startup's bid to pay workers to leave San Francisco is catching on in a big way