Pricing and inflation are two different things and impact consumers and producers differently.

According to Merriam Webster, inflation is a continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services

On the other hand, price is what a consumer pays for a good or service at the point of sale.

Inflation is generally a fixed number. But, Pricing varies under different sale conditions.

For example, the same room in the same hotel in the same week of the year may have different rates on different nights depending upon the demand variations. And even if a hotel room is priced right, it earns 0 to the owner if it remains vacant on a night, the cost of real estate does not matter.

Similarly, perishable goods (most food items) loose value fast as they come closer to sell before date. You might be able to buy them for near scrap value if you know how to time your shopping. I see a lot of elders with coupons looking for a deal. Clothing loose values as they run out of season, or fashion. You can look for coupons from Kohls or Penny’s for clearance items. Go for a vacation and cruising offseason.

Most garage sales and yard sales hardly earn any money. It might be cheaper to just call hauling service and get the trash picked up.

Regardless of the price to consumers, the cost to produce goods and services is generally a fixed number. Producers generally do not have the luxury of buying raw material below market price, or they cannot always time it perfectly with the sale, or get a Groupon deal. The produces must make a profit on average even if they sell a few units at loss. It means they sell some units at higher than average profit.

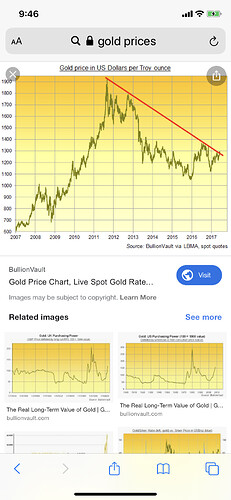

A fairway to see the impact of inflation would be to study the prices of goods and services in the same condition over a period of time.

Economic analysis is incomplete without the assumption of Ceteris paribus: all things being equal.

The cheapest restaurant food I have ever know is McChicken sandwich at McDonald’s. Used to sell for $0.99. These days it sells for about $1.50.

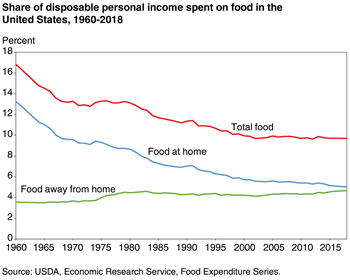

Do you know how much the Safeway Turkey for $.33/pound in similar conditions would have cost you in 2010?

or food price decreases

or food price decreases