Don’t know what you are talking about. Already got the loans.

Interest rate staying lower may be helpful for home buyer, but that leads to inversion ultimately downturn.

5. Expect delays in IRS transcript and Social Security reporting

Lenders generally have borrowers sign an IRS request for transcript of tax return (Form 4506-T) at or before closing. The IRS will not process new requests for transcripts during the shutdown. Lenders aren’t required to have the transcripts at closing and, in many cases, can add the transcripts to your loan file after closing.

To process a mortgage application, lenders verify that your Social Security number is valid with the Social Security Administration. With significant delays expected in processing these requests, government-sponsored agencies have relaxed their rules to allow lenders to submit these reports prior to loan delivery rather than earlier in the loan process. If your Social Security number cannot be validated prior to this time, however, your loan could be denied.

Got the loans means got the CASH.

There is some workaround. Two parties can access IRS transcripts online.

- Lender representative.

Or

- Owner of the SSN.

Last time, my lender, for some security reason, could not pull the IRS transcripts online. Manual dispatch takes longer time, say 10-14 days.

My lender representative asked me to pull the records online. I registered with IRS site (tightly secured, two factor authentication and additional checks to hard to get in) and got the transcripts, then lender accepted closing documents.

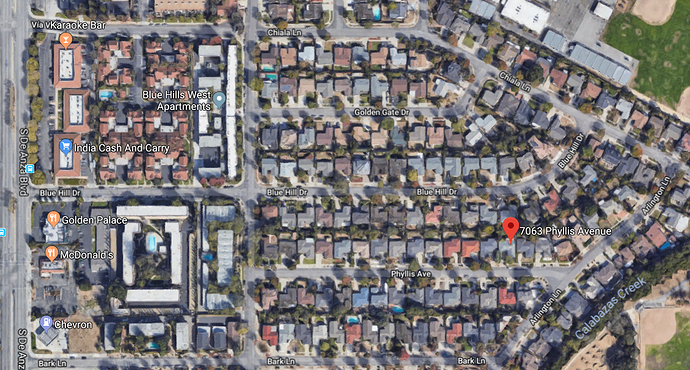

This is Lynbrook-Cupertino Schools area, looks to me good deal even at this price 1.98M.

There is only one SFH listed in whole Lynbrook High area now.

That house is facing bunch of apartment complex and in very undesirable location.

I guess this area is holding up the price well given the sentiment of the market.

Like this one.

https://www.redfin.com/CA/San-Jose/1022-Windsor-St-95129/home/1258726

The apartment complexes like Villa Colina Apartments (nearest) are 13 homes away - end of the street, not near by.

Getting this 3/2 in quiet location is desirable for those who prefer Lynbrook schools.

@Jil, I guess I confused you.

What I meant was below house which is the only listed SFH in Lynbrook High area now.

https://www.redfin.com/CA/San-Jose/1196-Weyburn-Ln-95129/home/1141061

I see lot of homes, which were not sold last quarter, went pending suddenly this week. Since Oct-Dec was stock low, it was hanging and all of these changed to pending now. It may be below list price.

This is one of them

https://www.redfin.com/CA/San-Jose/1733-Dry-Creek-Rd-95125/home/1582850

This is another

https://www.redfin.com/CA/San-Jose/2241-Dry-Creek-Rd-95124/home/733628

That second stairwell is gratuitious

So what it comes down to is if it’s a good time to buy as of Feb 2019. I don’t see a crash coming to the bay. When I say crash I would say 15% dip. That would be pretty drastic. My personal gut feeling is that today is not the best time to buy as we will slide down a little bit further. I’m personally waiting until end of 2019 to check out the market. Spent 35 years in the Bay and never bought a house. A bit bummed out about that. I did a write up in depth on answer this question. Check out my article and let me know if you agree.

Bay Area Guy

Did you grow up in Bay Area or just came here to work?

Instead of focusing on boom and busts focus on growth. Soon the BA will be part of a mega city of 12m. Watch employment and growth.

Note we have the highest GRP of any region in the country. Explains why housing is so expensive. People here make a lot of money and are competing for limited housing supply.

http://www.bayareaeconomy.org/report/the-northern-california-megaregion/

Elt1’s advice is good advice - focus on long term fundamentals and growth prospects vs short term momentum…

You can try and time the market, but you will miss some good opportunities while trying to do so. Try and look at housing as a tool for living, and a little less like an investment product.

Fundamentals - here is an example. In 2019, there are 73 Million millenials in the US. 72 Million Boomers. 65 Million Gen X.

Millenials range from age 23-38 … just starting to hit prime house buying years. And, there are SO MANY OF THEM. You might be one of them too, @BayAreaGuy.Com. Where are all these millenials going to find housing to buy? Lots of demand, low supply.

This guy has been timing the market for 35 years. But he forgot the most important rule for BA RE. Don’t wait to buy, buy then wait.

Not a big deal, though. He is only 37. Still has plenty of time to buy and wait.

I bought in 1976 at 22. Still buying.

Indeed, he does have time. In SF, I bought for the first time at 32. Bought two more at 37. Bought two more at 43. Yet still more at 44. I still hold them all. Every single one of my tenants are high-achieving tech-oriented millennials. They all pull in tons of income.

I might buy yet still more soon. But for a first time buyer in SF, it sucks. They have to compete against not only their peers, but also people in my age group, looking to add to their portfolio. People in my position can probably easily eliminate any “first time buyer competition.” So much demand and not enough supply.

BAGuy suffers from analysis paralysis.

He knows a lot about past pricing. He is overly concerned about the three corrections since 1990. As long as you don’t sell downturns are irrelevant.

I wonder what his feelings are about investing in general. Stocks are even more risky. Can easily drop below the purchase price the next day. At least RE prices are sticky and allow one to sleep at night.

I have bought several stocks in the last year. The prices jump all over the place. But I plan to keep them till I die. Same with most of my RE. Price fluctuation is not that significant.