Baidu Stock Is Ripe for a Bullish Trade Right Now

30 BIDU

42 BABA

600 TCEHY  Betting the farm on 腾讯 to build a successful entertainment empire

Betting the farm on 腾讯 to build a successful entertainment empire

Baidu Stock Is Ripe for a Bullish Trade Right Now

30 BIDU

42 BABA

600 TCEHY  Betting the farm on 腾讯 to build a successful entertainment empire

Betting the farm on 腾讯 to build a successful entertainment empire

Your farm is only worth 30k? How sad…

I’m the poorest old man in this forum.

Folks in CNBC loves IQ

At today’s low price, bigger boys (not hedge funds) seem interested.

For easy understanding,

IQ = Netflix of China

BIDU = Google of China

BABA = not AMZN of China

JD = AMZN of China

TCEHY = FB of China? Too different

HUYA = Twitch of China

WB = Twitter of China

Perfect! So when I own Bidu I actually have Nflx and googl all rolled into one!

Piyush Mubayi of GS loves to hammer China stocks, in this article, Goldman Sachs: China’s Huya Well-Positioned In E-Sports, But Fully Valued, he claims that the stock is fully priced even though…

Huya is well-positioned to benefit from the growing online game community and live streaming updraft based on the company’s No. 1 spot in monthly active users and user time spent.

“Game livestreaming is an attractive segment as the streaming content taps into the gamer cohort, one of the fastest-growing user bases in China,”

Huya’s overall growth will be driven by an expanding user base and improved monetization. E-sports are strongly gaining more viewership than traditional sports in some cases, placing Huya in a favorable position.

Strategic relationships with companies such as Tencent will likely help Huya in the marketing of new and existing games while developing more exposure to other entertainment spaces.

Guess it means HOLD. Add if decline.

Huya: The ‘Twitch Of China’ Is A Bet On Gaming And E-Sports

Huya is in a great position to benefit from usage and penetration of mobile internet, eSports, and gaming video content growth in the biggest video game market in the world.

It is a Chinese emerging small cap growth, and therefore inherently, a risky and very volatile investment.

Would you be okay with seeing one of your investments drop 10% or more in one day on a regular basis? Such volatility is the price to pay to be part of this growth story.

Huya is a fantastic bet on the future of eSports and entertainment in China - as long as you invest wisely, and you have what it takes to hold it long term.

Chinese tech stocks tumble from more than just trade tensions

Government crackdowns

Rumored competition

Insiders’ sale

Fear of saturation

Bilibili: A Hidden Potential In China’s Most Lucrative Market - Gen Z by Simple Investor.

Solid analysis of BILI. Biz Model. Competitive Forces. Financials.

Did you look at WB, China’s twitter?

No but I’m aware it is hot. Very popular. Backed by BABA. I have skipped the middle tier, owned the top dogs (BAT) and the recent wild cats (BISH).

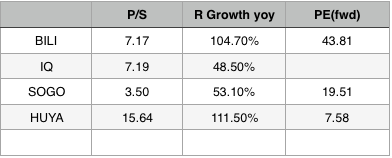

Bili, IQ, Sogo, Huya

WB has crashed down to earth. ROE is strong and PEG very low. I need to look into it more to see if it’s a good business.

Seems to be bigger in China:

Since 2015, China has outspent the U.S. by $24B in 5G infrastructure, potentially creating a “tsunami” that will be difficult to catch up with, according to a new study by Deloitte.

Wondering whether it is commercially feasible to have drones hovering over sport games to provide live streaming of the game from many angles

Yes, it is. Drones are cheap. Sports in usa make a lot of money.

Feasibility of the service is more than the cost of the drones. What is the bandwidth of the drone? Can one drone stream to 1 million paid subscribers? How many drones could be allowed without disturbing the game play or annoying the spectators?

Drone can of course livestream to billions. You just need some sort of wan/wifi networj that is reliable - ubiquiti would probably do. Then you can even use yt to livestream large scale.

As for how many drones, i dont mnow.they also have to have a high enough altitude, to not dosrupt the game.

Will Sogou’s Costly War Against Baidu and Alibaba Pay Off?

Sogou’s stock looks cheap at about 19 times next year’s earnings, moreover, it’s trading at a near-30% discount to its IPO price. However, investors are shunning this stock for two clear reasons: It faces a costly uphill battle against Baidu and Alibaba, and Tencent seems to be a safer way to invest in Sogou. Therefore I’d buy those three stocks instead of Sogou, which simply faces too many headwinds as a stand-alone investment.