Data stocks are laggards in this new bull market. Bottom late than Fintech stocks.

Data Analytics market started to heat up… first SNOW acquires NEEVA, now DataBricks acquires MosaicML… PLTR has LLM built-in years ago.

Databricks Acquires Generative AI Platform MosaicML for $1.3B

Big companies are risk adverse though. Rule #1 for a CIO is don’t crash. That makes SNOW a much easier sell to them.

.

Crash? I think you mean their career safety ![]() SNOW is safer to implement for sure. Re-inventing the processes are extremely risky. Fine-tuning is far easier and safer.

SNOW is safer to implement for sure. Re-inventing the processes are extremely risky. Fine-tuning is far easier and safer.

Anyhoo, SNOW has two huge advantages over PLTR:

-

Slootman is an experienced CEO who is known for scaling up a company profitably. Karp is a first-time CEO. Slootman is doing what he has been doing previously while Karp has to learn on his job.

-

SNOW has a “nobody has ever been fired for choosing IBM” vibe.

Yes, they will always prioritize career safety. It’s also not as simple as switching systems. There are tons of internal politics around all of it. A new tool might be better, but if it doesn’t support the existing business process then good luck. People see process change as risk. I swear companies could run 25-50% leaner if they’d embrace change and continuous improvement. The issue is that doesn’t allow management to grow their career by managing bigger and bigger teams. There’s zero incentive to do it until budgets are cut so much it is required.

NET is ![]()

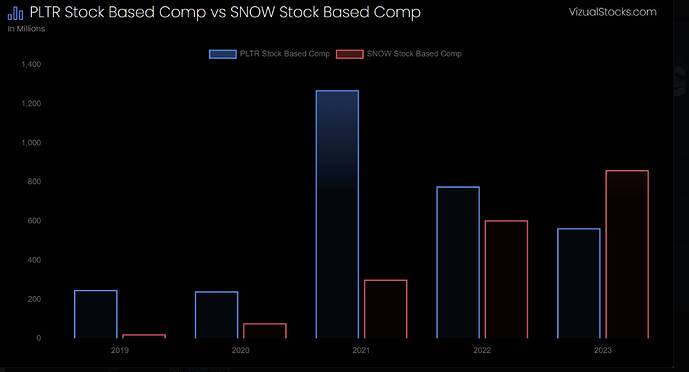

SNOW fundamentals is deteriorating vs PLTR?

SBC is for encouraging SWEs to take action that would improve the company’s performance but excessive is counter-productive.

SNOW has huge potential. Valuation is a bit high ST… though is not high LT.

Undervalued? IMHO, is over valued.

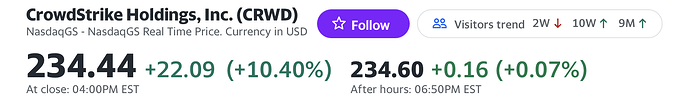

My data portfolio has four stocks: CRWD NET PLTR SNOW. Only PLTR is above avg purchase price. The other three are underwater. YTD return is over 100% ![]() but 1 yr return is till negative

but 1 yr return is till negative ![]() So if you read any influencers/ bloggers in social media boasting about their YTD return, ask for their 1-yr and 2-yr return.

So if you read any influencers/ bloggers in social media boasting about their YTD return, ask for their 1-yr and 2-yr return.

My data stocks are minting coins… ytd return of data stock portfolio +200% ![]()

NET PLTR CRWD SNOW

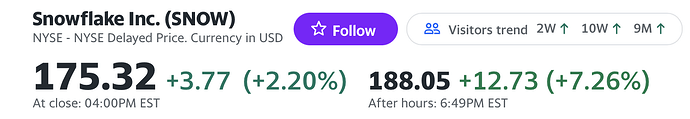

AH SNOW shot up by over 10%

I struggle with how/why their revenue growth is 17%. They should be growing at 40%+ without even trying. They need to improve their implementation process, so they can onboard new customers faster. The onboarding is still a legacy consulting business. If somebody solves onboarding before them, then they’ll eat their lunch.