Buffet strategy has lagged the market for several years, primarily because he has huge amounts of cash on the sidelines waiting for a dip.

Cash provide stability to your portfolio. I wish we return to gold standards or some other way to keep cash stable (as opposed to depreciating asset that it has become)

.

That’s is only one of the reason. He doesn’t understand technology and market has been moving towards tech for 2+ decades. Anyhoo, he corrected himself, he got two successor-potential lieutenants, they are tech savvy. They are the ones who bought into AAPL first. WB then examines the buy and think is f… good and put tons more $$$ into AAPL. Notice WB is into tech now, other than AAPL, BRK is into AMZN, SNOW and BYD.

Aapl is only for old men now. Warren is still 20 years out of date. I doubt he buys Tesla. And I know he regretted not buying Amazon 20 years ago. BTW I own both. And trade in and out of Tesla.

.

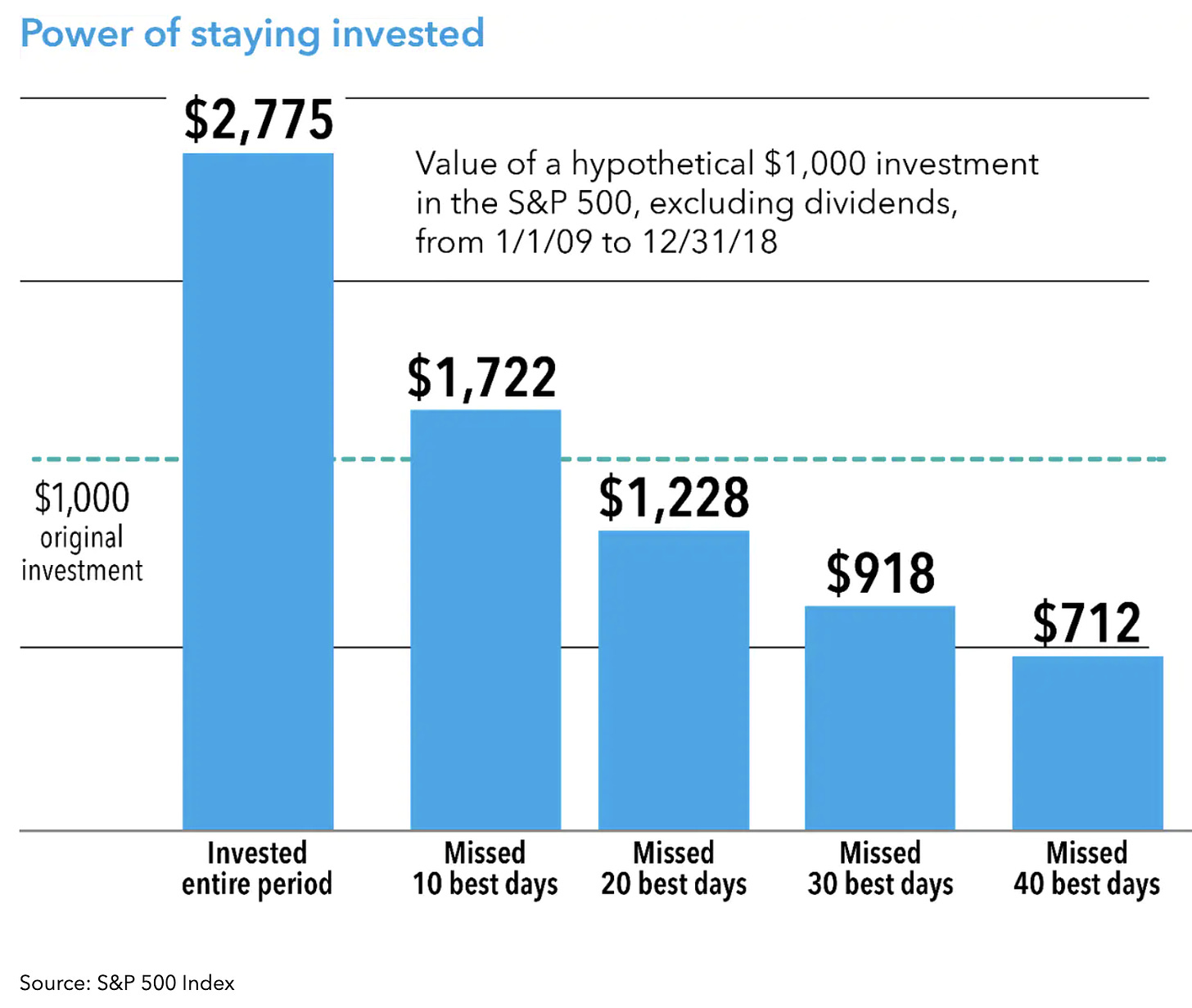

These type of analysis you dare to post? How about you are in the best 40 days and out the rest of the time.

Are you God?

Title of the thread is “Does Market Timing Work?”

The analysis intentionally missed the best days i.e. loaded to portray market timing doesn’t work. This type of analysis is

The difference between market timing and excessive trading must be clearly stated. The two are not the same.

Peter Lynch thinks everybody has a CS degree from Minnesota?

Over 30 years,

Investor 1 gets a total of 1.106 to the power of 30 = 20.5x

Investor 2 gets a total of 1.117 to the power of 30 = 27.6x

Investor 3 gets a total of 1.110 to the power of 30 = 22.9x

Investor 2 / Investor 1 = 1.35. So if you can consistently pick the best day every year for 30 years, your total is 35% more than the guy who consistently picks the worst day every year for 30 years.

That’s over 30 years, practically the entire investing career.

Investor 2 / Investor 3 = 1.21. The luckiest guy is only 21% richer than someone who just buys on the first day of the year, after 30 years.

You understand this calculation right?

Since 21% is nothing burger to you, please give me 21% of your NW.

You first have to show me you can pick the best day every year for 30 years.